Australian winemaker doubles its profits as Asia’s middle-class millennials raise their glasses

Melbourne-based Treasury Wine Estates has profited from a shift away from beer and spirits, with a surge in wine sales in China, South Korea and Japan

The world’s largest standalone winemaker, Australia’s Treasury Wine Estates, on Thursday said annual profit more than doubled thanks to growing consumption of mid-market wine by Asia’s young middle-class.

As the froth drains out of Asian economies like China, Treasury has found a lucrative market in selling US$10-plus bottles of wine to millennial drinkers instead of relying on prestige sales to older, wealthy customers.

“The millennial consumer tends to be a very good target for us,” Treasury Chief Executive Michael Clarke said. “What we are finding is that a lot of those consumers are moving away from other beverages like beer, spirits and baijiu in China and moving to wine.”

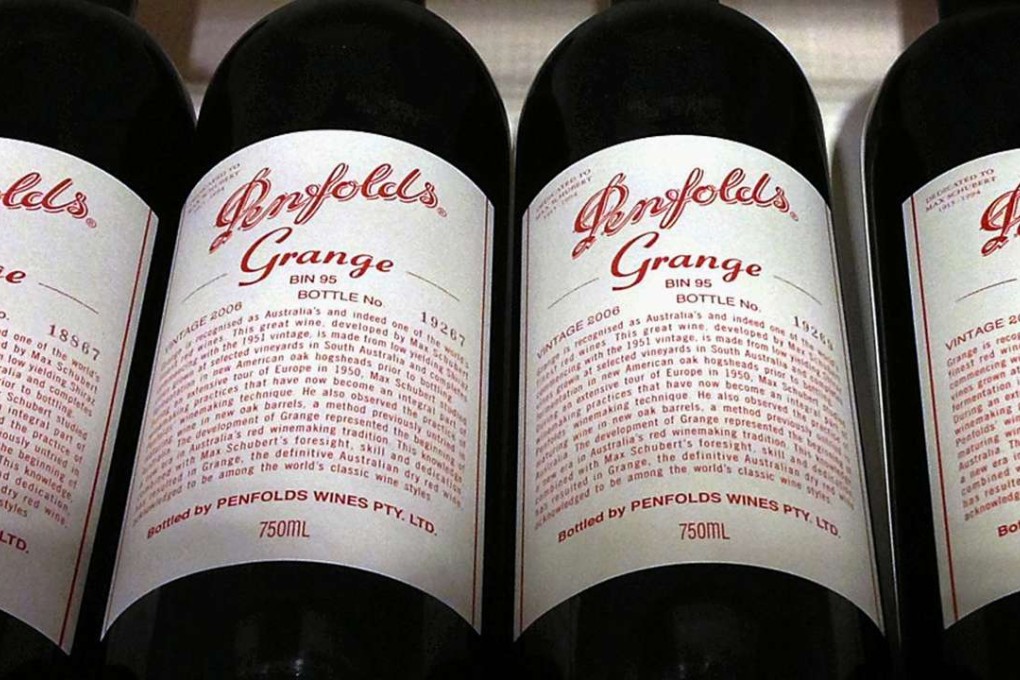

The Melbourne-based company, owner of brands such as Penfolds and Wolf Blass, posted annual net profit growth of 131.2 per cent to A$179.4 million (US$138 million), underpinned by a 76 per cent surge in sales by volume to China, South Korea and Japan.

A lot of those consumers are moving away from other beverages like beer, spirits and baijiu in China and moving to wine

Revenue from Asia as a whole, where volume sales rose 40 per cent, comprised 14 per cent of Treasury’s total revenue in 2015-16. Outside Asia, volume sales jumped in Europe by 26.4 per cent, but volume growth was more subdued in Australia, New Zealand and the Americas.