Philippine bank clients complain of missing funds, unauthorised withdrawals as officials report ‘internal error’

Customers of Bank of the Philippine Islands (BPI) were shocked on Wednesday morning to see unauthorised withdrawals and deposits from their accounts

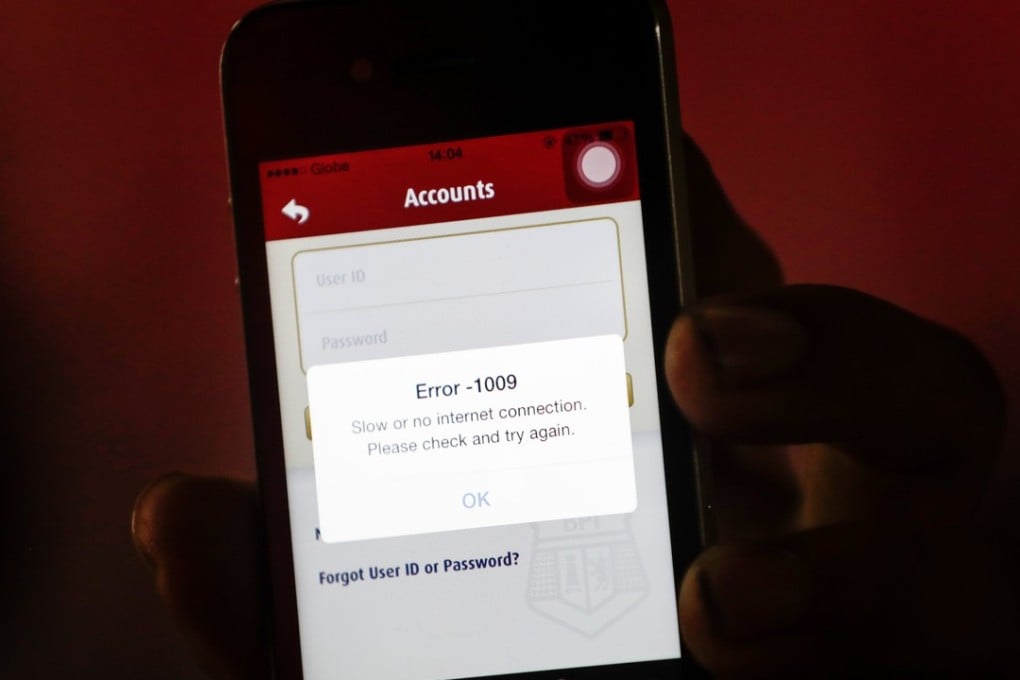

A major Philippine bank shut down online transactions and cash machines on Wednesday after money went missing from accounts, triggering fears it had been hacked even as company officials said it was an internal computer error.

Customers of Bank of the Philippine Islands (BPI) were shocked on Wednesday morning to see unauthorised withdrawals and deposits from their accounts.

BPI said in a statement the problem was caused by an “internal data processing error” that had been identified.

But it had to close its automatic teller machines (ATMs) and told its eight million customers they could not do online transactions on Wednesday as the bank scrambled to fix the problem.

“Please do not panic... we will make sure that your money is there,” BPI senior vice president Cathy Santamaria said at a news conference as social media lit up with complaints from customers about missing money and inconvenience.

Efforts to fix the problem were “progressing well” and the glitch was expected to be resolved within the day, the bank added in a statement, although it did not explain why the glitch occurred.

There has been global concern about hacking following the world’s biggest ransomware attack last month that struck hundreds of thousands of computers worldwide.