Harassment cases in Singapore by loansharks rise as they go digital

Telecommunications authorities are now working with police after loan sharks send messages with clips showing damage and harassment

By Victor Loh

For Madam Tan (not her real name), the sole breadwinner juggling three jobs to feed her family, her troubles with unlicensed moneylenders began with a bank loan of S$10,000 (US$7,491) in 2002 which eventually snowballed into S$400,000 (US$299,654) after she turned to loan sharks.

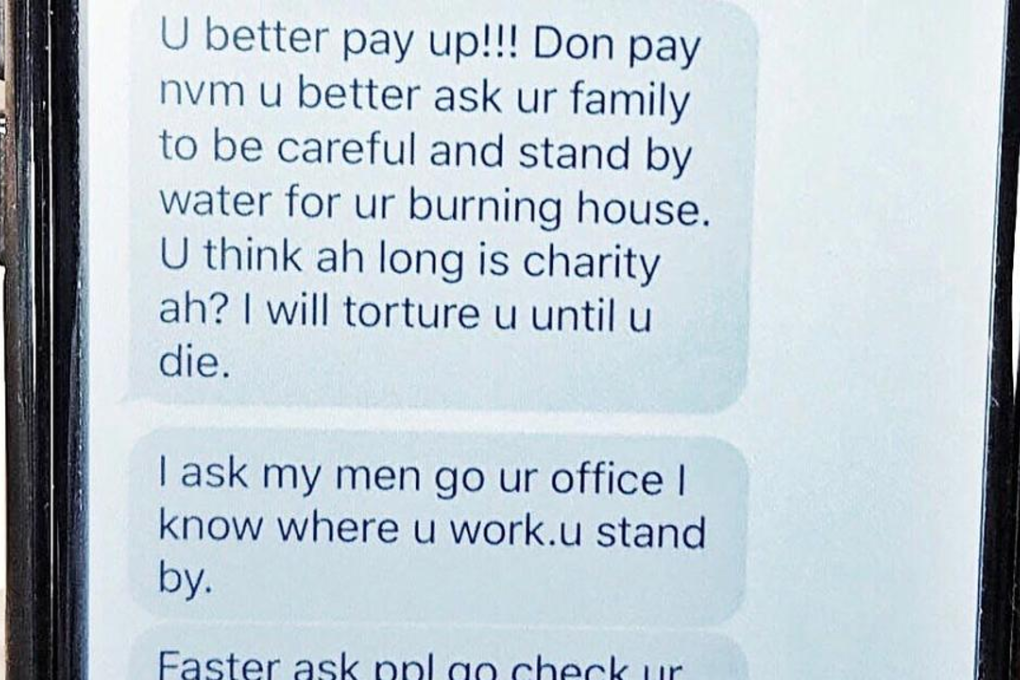

The harassment began in the form of SMS messages, followed by WhatsApp messages threatening to burn down her Housing and Development Board (HDB) flat, and kidnap her three children.

Tan’s case is just one of the increasing number of such harassment cases that the Singapore police deal with. Between January and April 2018, such cases without damage to property increased 17.5 per cent to 942, as compared with the same period in 2017. The trend mirrors a 33.8 per cent rise in such cases last year compared with 2016.

The loan sharks have also adapted to the digital landscape by using new tricks to harass victims via mobile messaging and social media platforms. The new modus operandi allows them to target larger groups of people, said Superintendent Han Teck Kwong, Head of the Police’s Unlicensed Moneylending Strikeforce.

Madam Tan had borrowed S$20,000 (US$14,981) to S$30,000 (US$22,472) from a loan shark in 2013 to repay her initial bank loan. Her husband has been unemployed since 2013.