Goldman Sachs offered Malaysia US$241 million compensation for its role in 1MDB scandal, PM Mahathir Mohamad says

- A reasonable sum would amount to the commission that Goldman received in raising bonds for 1MDB, Malaysian PM says

- Goldman earned about US$593 million for its work on the 1MDB debt sales

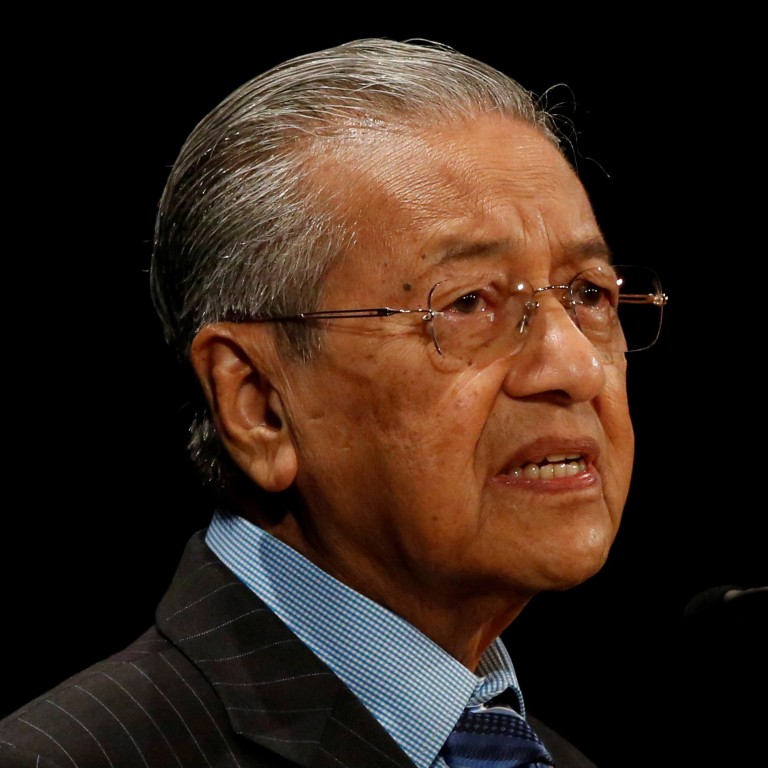

Goldman Sachs offered Malaysia 1 billion ringgit (US$241 million) as compensation for the role it played in raising funds for 1MDB that were later allegedly misappropriated, Prime Minister Mahathir Mohamad said, calling the amount “little” compared with the “huge killing” that the bank made.

A reasonable sum would amount to the commission that the Goldman received in raising US$6.5 billion of bonds for 1MDB, Mahathir said at the Bloomberg Asean Business Summit in Bangkok on Friday. Goldman earned about US$593 million for its work on the 1MDB debt sales, which exceeded what banks typically make from government deals.

“They did offer some little compensation, it’s not enough,” Mahathir said in the interview with Bloomberg Television’s Haslinda Amin. “We wanted to settle in-house if possible, but it seems that they are not willing to offer a reasonable sum of money.”

Goldman arranged the sales for 1MDB in 2012 and 2013. The bank’s revenue from the deals amounted to about 7.7 per cent of the face value of the securities. Underwriters collected average fees of 1.32 per cent in 2013 on comparable deals, according to Bloomberg data.

Stolen 1MDB funds followed ‘clear trajectory’ from Najib, authorities say

A Goldman representative said it “will not be commenting on any negotiations with authorities”.

Goldman officials have said for years that the bank raised money for 1MDB without knowing that it would be diverted from the development projects. As for the fees and commissions, Goldman said in 2015 that they “reflected the underwriting risks” it had assumed.

Goldman is facing scrutiny in the US, Malaysia and Singapore over its role helping 1MDB raise money. Malaysia has filed criminal charges against three Goldman entities, while US prosecutors have charged two former bankers at the firm.

Singapore is planning to seek a deferred-prosecution agreement with Goldman, according to a person with knowledge of the matter said.

In May, Mahathir said he was awaiting a response from Goldman before deciding whether to take legal action against the bank over “too high” fees on 1MDB bond sales.

Malaysia had already announced criminal charges against Goldman in December, accusing the lender of misleading investors when it knew that funds raised from the bond offerings it arranged would be misappropriated.

1MDB scandal fallout drives up Asean regulatory costs

The bank has said it will defend against allegations. It has sought to depict two of its former top bankers as rogue employees who kept the firm in the dark about their 1MDB dealings.

Malaysia has focused its efforts on recouping funds believed to have been lost through 1MDB, whose full name is 1Malaysia Development Bhd.

The fund, set up to raise funds for investments in the Southeast Asian country, instead saw US$4.5 billion diverted with some of the money used to pay kickbacks to Malaysian officials, according to US prosecutors.