East Timor gas company denies US$16 billion loan from Chinese bank but reports are enough to unsettle Australia

- Reports raised concerns in Australia that Chinese military could establish a presence just 500km from Darwin

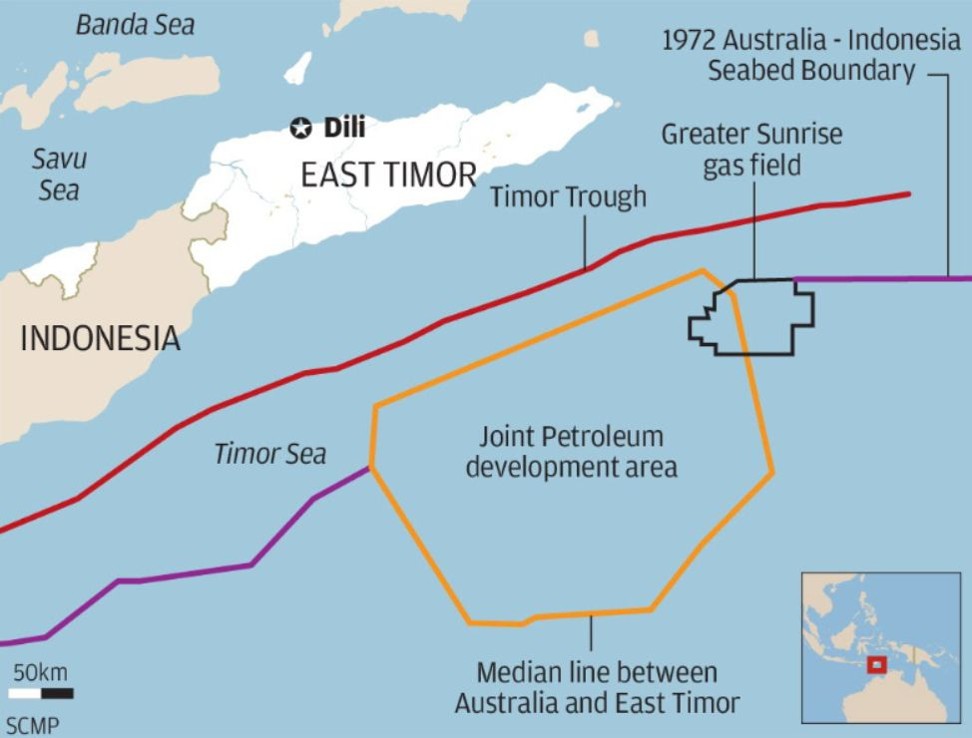

- Australia and East Timor disagree over where offshore gas resources are processed, and both nations wanted it piped to their own domestic facility

The East Timor government recently took majority ownership of the its Greater Sunrise project after buying out its former partners – ConocoPhillips and Shell – with the aim of ensuring the gas is piped to its shores instead of Australia’s. It is now seeking finance partners to develop the untapped reserves in the Timor Sea.

Chinese firm to revitalise stalled LNG project in East Timor

Timor Gap said it was talking to China but also canvassing investors and financial institutions in the US, Australia and other countries about financing the Tasi Mane onshore energy processing project.

“The statements that Timor Gap is about to sign a finance deal with China Exim Bank is incorrect as much as the suggestion that we rejected a competitive offer from US pension funds,” a spokesman said.

Jose Ramos Horta, a former president and prime minister of East Timor, said East Timor was “still actively searching for multiple partners and investors”.

“Xanana [Gusmao’s] strong preference is for several different investors including Australia, US, Korean, Indonesian, French, etc,” said Horta, who is currently travelling with the former president Gusmao.

Dr Ryan Manuel, a Hong Kong-based China academic, said there had been no mention of the reported loan in Chinese media – which was unusual for such an “extraordinarily large” amount.

“This to me sounds much more like the East Timorese saying … we run the show now, and if you don’t like us we’ll go to China,” he said.

This to me sounds much more like the East Timorese saying … we run the show now, and if you don’t like us we’ll go to China

Manuel said the prospect of a large Chinese investment in Greater Sunrise should be of interest to the Australian government because it suggested the country was being pushed diplomatically by China.

“This is our turf and traditionally this is not an investment China would make because from an investment perspective it’s a risk,” he said. “[Exim] is a Chinese policy bank, so if you’re giving US$11 billion from the policy bank you’d expect some policy outcomes.”

Manuel said the fact East Timor was now the majority owner of the project made a large-scale investment by China even more unlikely from a commercial standpoint, “because you don’t have foreign participation that’s done the risk management and assessment for you”.

A sticking point remained over where the gas would be processed, as both nations wanted it piped to a domestic facility and were willing to give up a portion of the revenue in return.

Private operators and energy experts supported piping the gas to Darwin, but East Timor – led by Gusmao at the negotiation table – was adamant it go to their already constructed Tasi Mane facility on the remote south coast.

China defends belt and road strategy against debt trap claims

In recent years the country has spent big on infrastructure projects, including sea and air ports in the region in anticipation of such an outcome, some with Chinese involvement.

Dili-based human rights organisation L’ao Hamutuk has warned the cost of these projects, the required pipeline, and the ConocoPhillips and Shell buyouts could total as much as is left in the country’s sovereign wealth fund.

China’s influence rising in East Timor? ‘Nonsense’: ex-leader

A leaked 2008 US diplomatic cable described China’s approach to East Timor as “distribut[ing] goodies with few strings attached” and little encouragement for good governance, but said the country was – at that time – “strategically unimportant to Beijing”.