Singapore to invite firms to apply for digital bank licences

- The Monetary Authority of Singapore will in August invite firms to apply for digital bank licences, ‘even if they have not yet established a track record in banking’

- It is looking to issue two full licences to Singapore-based firms and up to three wholesale licences which will be open to both local and foreign players

Singapore’s central bank on Friday said it would offer up to five digital bank licences to suitable applicants, in a move that could deliver the biggest shake-up in two decades in a market dominated by local banks.

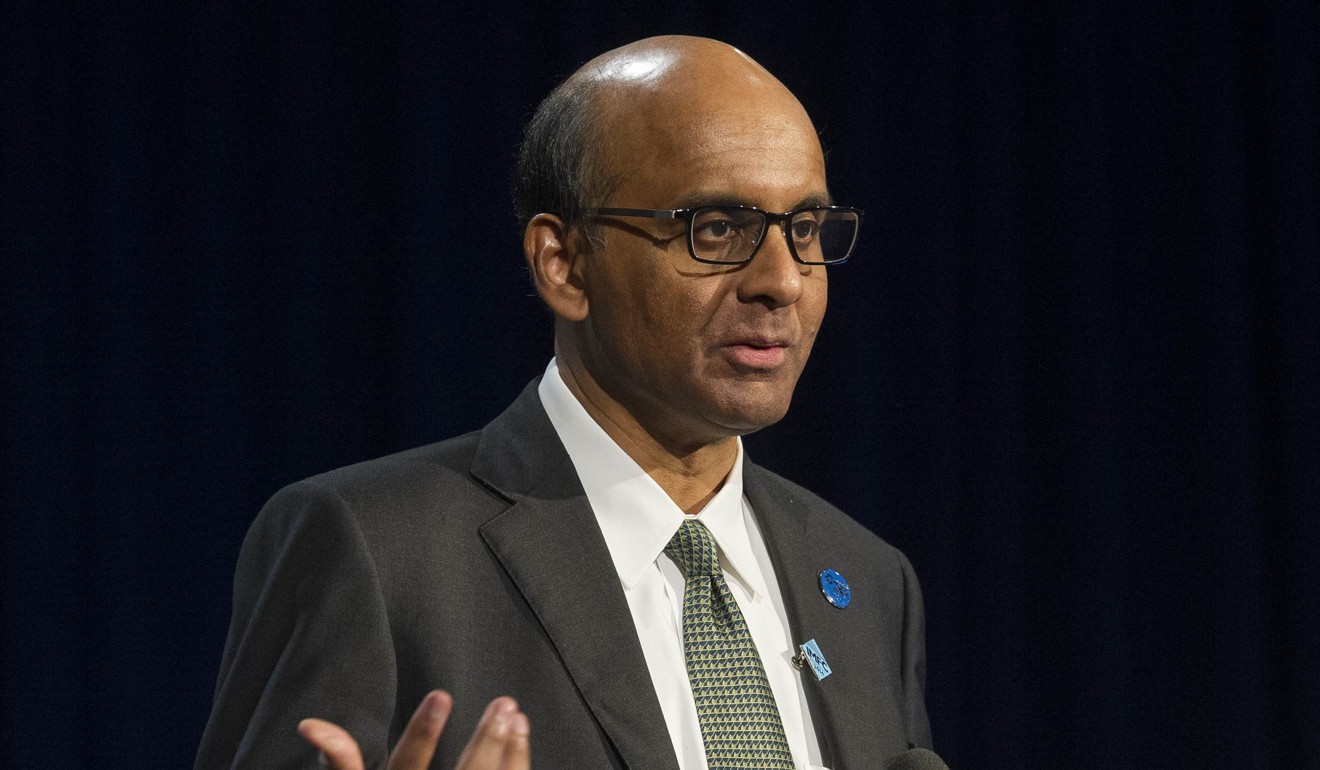

“We welcome firms with innovative value propositions to apply for the digital bank licences, even if they have not yet established a track record in banking,” Tharman said at an annual event of the Association of Banks in Singapore.

The MAS said in a statement it will issue up to two full digital bank licences to companies headquartered in Singapore and controlled by Singaporeans.

Foreign firms are eligible for these licences if they form a joint venture with a Singapore company, and the venture meets the headquarter and control requirements.

Hong Kong issues virtual bank licences as city catches up with China, Japan in disrupting traditional banking

It expects to invite applications in August.

The MAS said it will also issue up to three digital wholesale bank licences which will be open to both local and foreign players.