Singapore investments topped US$8.8 billion in 2021, led by chips and biotech

- Electronics saw the largest investments, while biomedical manufacturing overtook the chemicals sector as the second biggest draw for investors

- More than 17,000 new jobs are expected to be created according to the Economic Development Board

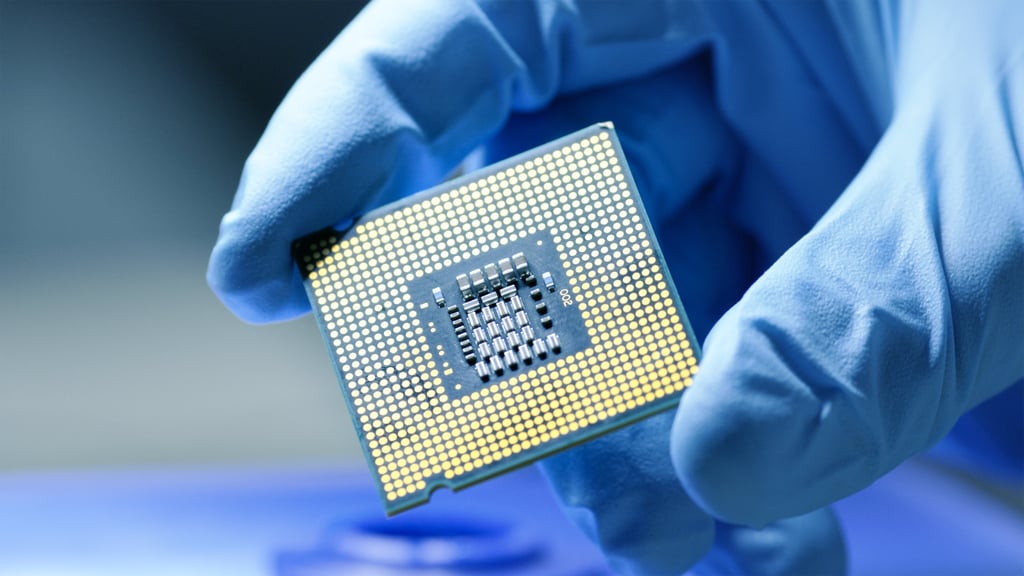

Singapore attracted S$11.8 billion (US$8.8 billion) in investment commitments last year, led by semiconductor manufacturers ramping up production to meet a global chip shortage and biotechnology firms chasing pandemic demand.

Investments saw a 31 per cent drop from the previous year, according to data Wednesday from the Economic Development Board, which it said was expected after posting an “exceptional” S$17.2 billion (US$12.8 billion) in 2020 and beats the medium- to long-term target of S$8 billion (US$5.9 billion) to S$10 billion (US$7.4 billion). More than 17,000 new jobs are expected to be created, according to the EDB.

Electronics continued to be the largest source of investments amid heightened demand for semiconductors, and should continue to drive growth as the supply shortage is seen to persist until at least 2023, EDB Chairman Beh Swan Gin said in a briefing.

Biomedical manufacturing overtook the chemicals sector as the second-largest source of investment commitments, accounting for 15 per cent of the total last year from just 3.7 per cent in 2020. The pandemic has created impetus for new products and services, such as mRNA vaccines, biologic products and medical devices, according to EDB Managing Director Jacqueline Poh.

The US remains the largest source of investments at 67 per cent of total, but the EDB noted that a rising number of Chinese firms were relocating from Hong Kong and the mainland to set up shop in Singapore. China accounted for 1.1 per cent of investments in the city state last year.