Philippines’ Marcos Jnr suspends roll-out of controversial sovereign wealth fund, urges further study

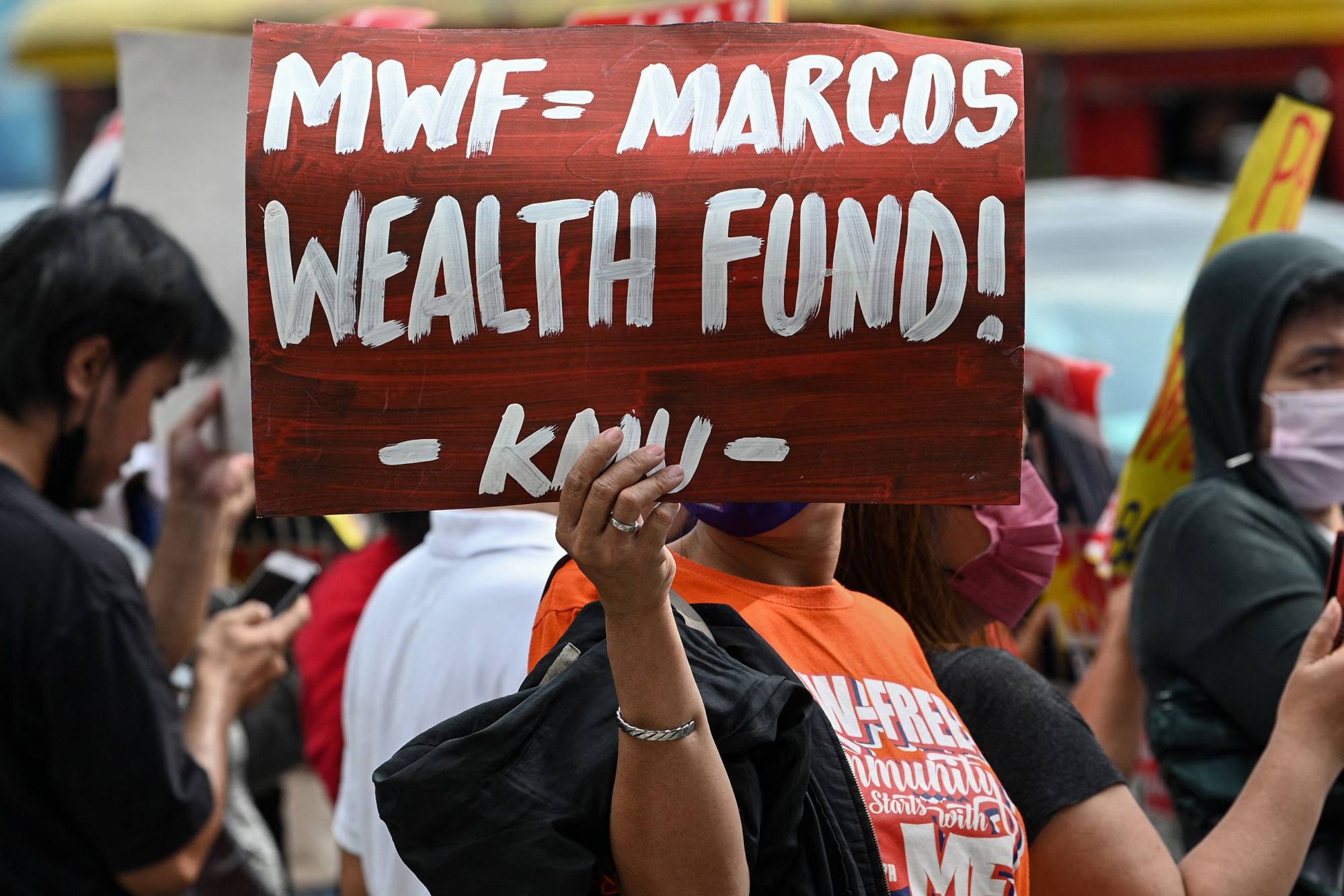

- Factors cited for suspending the US8.8 billion fund were the reasons critics cited – that it had no ‘transparency and accountability’ safeguards

- Marcos, in signing the bill creating the fund, touted it as a key plank of his economic goals to modernise infrastructure and accelerate the country’s growth

His executive secretary said in an October 12 memo there was a need to study the fund’s implementing rules and regulation, which were already in effect, to ensure that safeguards were in place for “transparency and accountability.”

It was not clear from the memo for how long the rules would remain suspended.

Opposition lawmaker France Castro said on Wednesday the suspension of the fund’s implementation showed the measure was “rushed and flawed in so many levels.”

“It would be better if President Marcos Jnr just scrapped the whole Maharlika law rather than just suspend it,” Castro said in a statement. “We don’t have excess fund for this.”

The government has envisaged the fund would issue a total of 500 billion pesos (US$8.8 billion) worth of preferred and common shares which the national government, state-run firms and banks can purchase.

The original proposal was for a US$4.9 billion fund that would be partly bankrolled by state-run pensions for government and private-sector workers, sparking public fears that retirement savings could be put at risk.

The final version of the bill approved by Congress in May said pension funds would not have to contribute.

The fund will be allowed to make a wide range of investments, including in corporate bonds, equities, joint ventures and infrastructure projects.

The word “maharlika” is widely associated with Marcos’s late father and namesake, a dictator who presided over widespread human rights abuses and corruption during his two decades in power. He was ousted in 1986.

Marcos Snr claimed to have led an anti-Japanese guerilla unit called Ang Mga Maharlika during World War II, but he has been accused of lying about his war record.

A shortlist of candidates for the board of directors to help manage the fund was submitted to Marcos Jnr this month.

Marcos Jnr, in signing the bill creating the fund in July, touted it as a key plank of his economic goals to modernise infrastructure and accelerate the country’s growth.

Additional reporting by Agence France-Presse