Top US senator and Donald Trump ally takes swipe at China but urges caution on tariffs

Tariffs are ‘taxes paid by Americans … and new tariffs would jeopardise the new opportunities we created through tax reform’, Orrin Hatch says

US Senator Orrin Hatch, a staunch ally of President Donald Trump, took a thinly veiled swipe at China this week just as a high-ranking envoy from Beijing was landing in Washington for talks aimed at reducing trade tension.

The US must “combat trade practices by foreign nations that harm American businesses and undermine the world trade system, but the tactics we choose should be targeted directly at specific countries and specific practices”, Hatch said at the US Chamber of Commerce’s Invest in America! Summit, an event sponsored by the China General Chamber of Commerce.

Hatch’s comments came just before Trump confirmed he would sign off on hefty tariffs for steel and aluminium products from other countries – including China – next week.

The US president said he would place a 25 per cent tariff on steel and 10 per cent tariff on aluminium product imports, which he said were harming US producers.

“You’re going to have protection for the first time in a long time,” Trump told a gathering of metals industry executives at the White House.

Trump will sign off on 10-25pc steel and aluminium tariffs next week

But Hatch said he wanted Trump to think twice before levying new punitive import tariffs.

“We must keep in mind that tariffs aren’t paid by foreigners,” he said.

“Tariffs are taxes paid by American businesses and American families and new tariffs would jeopardise some of the new opportunities we created through tax reform.”

Liu He, director of the Office of the Central Leading Group for Financial and Economic Affairs, and his entourage arrived at a time of sharply divided sentiment towards China.

A spokesman for Trump’s National Security Council said the administration was concerned about unfair practices in the steel industry, such as China’s subsidisation and overcapacity.

“We expect a frank exchange of views on the trade and economic relationship, and that talks will focus on the substantive issues,” the spokesman said.

“The president will consider options and make decisions based on what is best for the American people and our economy.”

Liu and the Chinese delegation met US Trade Representative Robert Lighthizer, National Economic Council Director Gary Cohn and Treasury Secretary Steven Mnuchin at the White House on Thursday, a spokesman for the president’s National Security Council said.

Why the US isn’t ready for a full-blown trade war with East Asia

By hedging on the best step for the US and not naming China, Hatch, the second-highest ranking congressional Republican, embodied the dilemma the US government faces at a critical moment in US-China relations.

The debate pits those suspicious about Beijing’s treatment of foreign companies and efforts to acquire advanced US technology, on the one hand, against those aiming to attract Chinese investors, on the other.

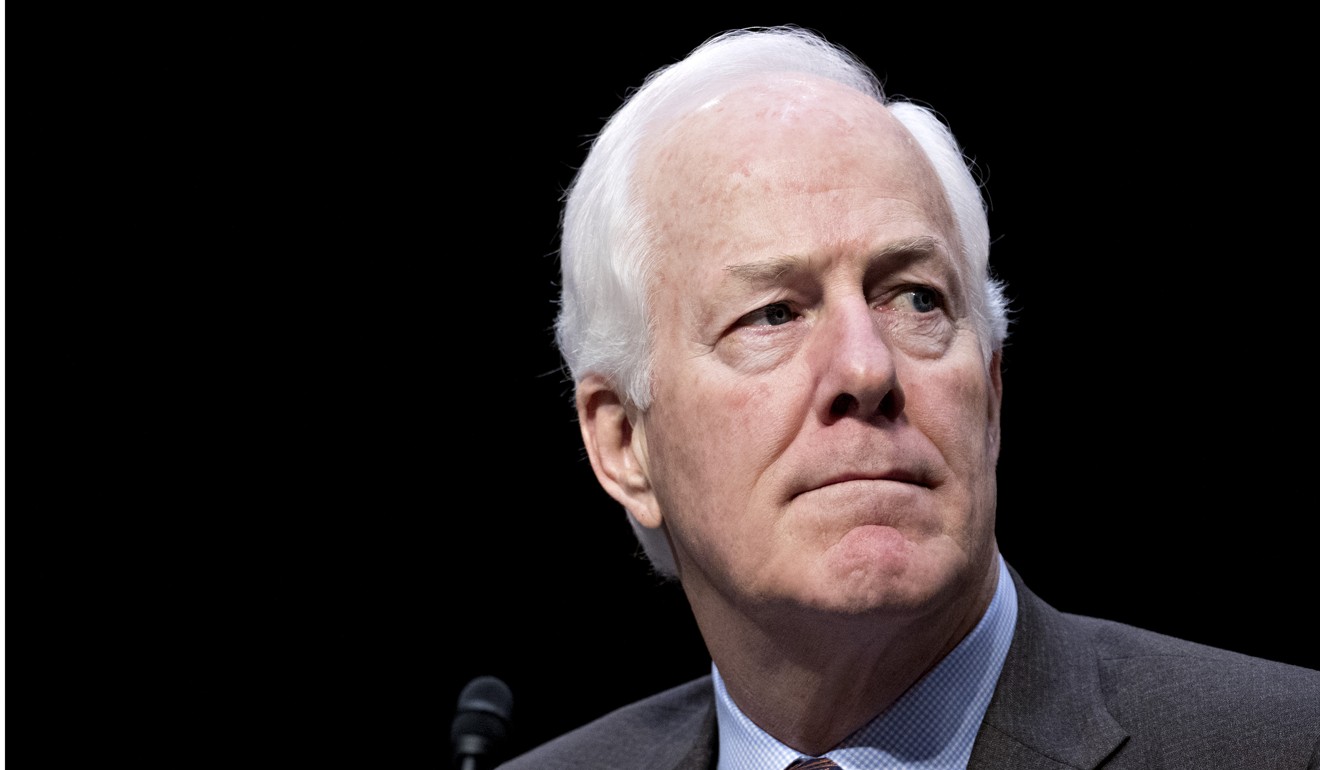

High-ranking power brokers like Senator John Cornyn from Texas, acting on urgent warnings from the US defence department last year, are trying to stop China’s “tentacles” from undermining American prosperity and security.

Trump amplified this suspicion when he alleged in a high-profile national security speech in December that Beijing was “attempting to erode American security and prosperity”.

Is China ready for what US could unleash in trade war?

And the negative perception of China is shared broadly in the US.

Only 44 per cent of Americans view China favourably, according to the most recent data provided by the Washington-based Pew Research Centre. That is lower than other Western allies such as Britain, at 45 per cent, and the Netherlands, at 49 per cent.

Meanwhile, other leaders worried about the economic toll a trade war would exact on constituents who voted Trump into office are counselling restraint.

They include governors of Republican-leaning states, also known as “red states”, such as Kentucky and Mississippi.

While media reports had suggested that Trump would seek to raise tariffs on all imports of aluminium and steel, which would affect trade with China, he could seek even greater across-the-board punitive tariffs on all imports from the country.

US duties foil up to 15 per cent of China’s aluminium exports

The latter measure is one option Trump could use in response to a wide-ranging investigation he initiated in August into policies that force foreign companies in China to turn over their intellectual property to their joint-venture partners.

This study, known as a Section 301 investigation, is authorised under the US Trade Act of 1974.

Such a blunt instrument, analysts said, would create a much more significant confrontation than the new steel and aluminium tariffs, therefore jeopardising the world’s largest trade and investment relationship.

Canada exports as much as 10 times more aluminium to the US than China, according to US Geological Survey data, and China did not even make the top 10 list of countries exporting steel to the US, according to the most recent commerce department stats.

Washington and Beijing in ‘active’ talks to avoid trade war: Mnuchin

Moreover, metal imports did not show up in the top categories of the USTR’s most recent report on the country’s trade with China. The top groupings were machinery, at US$226 billion, followed by furniture and bedding, at US$29 billion, then toys and sports equipment at US$24 billion and footwear at US$15 billion.

“The August self-initiation of the 301 investigation was a big wake-up call for the Chinese,” Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics, said.

Penalties initiated as a result of 301 examinations are directed at specific countries, unlike tariffs placed on product categories.

Trump has not made that move yet, despite predictions from former US policymakers over the past month that it was imminent, possibly because of warnings about how such a move would undo progress the president has claimed on the employment front.

“The federal government has been good about listening to governors and subnational leaders and the subnational leaders and governors have been good about being aggressive about saying ‘hey, you need to understand the implications’,” Scott Pattison, executive director of the National Governors Association, said when asked about trade tension with China.

Hong Kong condemns US tariff plan as ‘discriminatory act’

“You can be here in DC and get caught up in what’s going on here and you don’t realise that there’s a little plant in Indiana that’s doing well and creating high-paying jobs and you don’t want to do something that interferes with that,” Pattison said, referring to US Vice-President Mike Pence’s home state.

State governors have reason to fear a trade war with Beijing.

California last year imported US$159 billion worth of goods from China, its biggest source of overseas freight, and shipped US$16.4 billion worth of goods to the country, the state’s third-largest export destination after Canada and Mexico.

And it is not just Pacific Rim US states that depend on China for a large chunk of their economies.

Tennessee, for example, depends on trade with China – amounting to US$26.2 billion last year – for 13 per cent of the landlocked, southern state’s economy.

Still, given the hardline rhetoric that Trump has been using against China in recent months and the indifference from his administration to reforms Beijing announced soon after the president finished his state visit to China in November, tariffs on specific products and as a result of the 301 investigation are likely.

US imposes anti-dumping duties on Chinese pipe fittings

Those reforms included a lowering of tariffs on a wide range of consumer goods and an eventual lifting of caps on foreign ownership of asset management and other companies in the financial sector.

Trump will want more from China to convince him to veer away from his trajectory towards a trade war.

“The things [China] has offered have all either been turned down or ignored. I think there’s a significant chance of a substantial 301 case against China,” said the Peterson Institute’s Lardy.

“The problem with 301 is that the government will undoubtedly come up with a very big number on US losses from the forced technology transfers.

“Liu He can’t be coming here to tell Lighthizer that trade is win-win and we shouldn’t go down a protectionist path because we’ll both lose.

“I would think he’d have to have something more to put on the table.”