What you need to know about the US panel that can stop deals from transferring cutting-edge tech to China

The Committee on Foreign Investment in the United States is at the centre of Washington’s efforts to halt Chinese acquisitions of US assets seen as a security threat

The Committee on Foreign Investment in the United States, an inter-agency body under the US treasury department’s control, is at the centre of the US government’s efforts to stop the transfer of advanced technology to China through acquisitions.

US urged to act immediately to save its systems from the ‘growing threat of Chinese cyber theft’

CFIUS has blocked several proposed Chinese acquisitions of US companies in the past year, including Chinese private equity firm Canyon Bridge Capital Partners’s proposal to buy US chip maker Lattice Semiconductor Corp for US$1.3 billion and Ant Financial’s attempt to buy MoneyGram International for US$1.2 billion.

Ant Financial is an affiliate of Alibaba Group, which owns the South China Morning Post.

The panel also stopped Singapore’s Broadcom Limited from buying semiconductor and telecommunications equipment maker Qualcomm Inc for US$117 billion, saying that by undermining Qualcomm’s leadership in 5G wireless technology, the deal would have opened the door for China’s Huawei Technologies Co to become dominant in the field.

US may invoke emergency law to crack down on Chinese technology investments

The body may get more authority to block or unwind proposed purchases in response to US lawmakers’ worries that China’s acquisition of US technology presents a national security threat.

Here are important things to know about CFIUS and legislation that might strengthen its ability to block investments by Chinese companies.

History

CFIUS was established by then-President Gerald Ford in 1975 as an extension of the treasury department to advise the commander-in-chief on how to respond to investments “which, in the judgment of the committee, might have major implications for United States national interests”.

At the time, the body had no legal framework and “seemed unable to decide whether it should respond to the political or the economic aspects of foreign direct investment” in the US, according to a Congressional Research Service report published last year.

China using ‘tentacles’ to erode US security, senator warns, urging passage of bill boosting scrutiny of deals

Congress endowed CFIUS with a stronger mandate in 1988 by allowing it to recommend that the president suspend or block acquisitions of US firms by foreign entities on national security grounds.

That change followed concern caused by the proposed purchase of US semiconductor producer Fairchild by a Franco-Japanese partnership that included Fujitsu.

The US defence department, in particular, objected to the sale because Fairchild had produced computer chips for the military.

Current mandate

The scope of CFIUS’s current authority became further defined with the passage of the Foreign Investment and National Security Act in 2009.

FINSA was a result of concern that arose from Dubai Ports World’s acquisition of the Peninsular and Oriental Steam Navigation Company, a British firm whose assets included facilities at six US ports.

Dubai Ports negotiated a set of mitigation measures with CFIUS, including an FBI-vetted corporate officer assigned as a liaison with the US Department of Homeland Security, to manage all US facilities.

“Despite CFIUS approval, the political opposition to the proposed takeover was so vociferous, however, that Dubai Ports World announced that it had no choice but to sell off all US port facilities acquired from P&O to a buyer of US nationality,” according to a 2017 analysis by the Peterson Institute for International Economics.

Trump kills US$117 billion takeover of Qualcomm by Singapore’s Broadcom, citing national security threat

FINSA gave CFIUS the statutory authority to assess acquisitions of US companies or multinational companies with operations in the country to gauge the existence of three types of threats:

· A possible leakage of sensitive technology to a foreign company or government that might deploy or sell such technology so as to be harmful to US national interests.

· The ability of the foreign acquirer, acting independently or under instructions from the home government, to delay, deny, or place conditions upon the provision of output from the newly acquired producer.

· The potential that an acquisition of a US company might allow a foreign company or its government to penetrate the US company’s systems so as to monitor, conduct surveillance, or place destructive malware within those systems.

To maintain as open an investment environment as possible, CFIUS does not seek to influence or develop an industrial policy by preserving national ownership in particular industries or thwarting the extraction of commercial technology by foreigners.

Also, CFIUS currently does not apply a national economic-benefits test to foreign acquisitions; nor does the body base approvals or rejections of specific transactions on reciprocal treatment for US investors in the country of the acquiring firm.

Proposed changes

Prompted by warnings from the US defence department early in 2017, senior lawmakers in Washington have proposed legislation to give CFIUS more authority to scrutinise proposed acquisitions in the US by foreign companies.

China’s investments into US fell 35pc in 2017 due to outflow curbs and tighter screening of deals

The Senate bill that has received the most attention is the Foreign Investment Risk Review Modernisation Act (FIRRMA), co-sponsored by ranking lawmakers John Cornyn, a Republican, and Dianne Feinstein, a Democrat. Representative Mark Pittenger, a Republican, has sponsored an identical bill in the House of Representatives.

The proposed legislation would widen the scope of government reviews of foreign investments to any level of equity control and joint ventures. Currently, CFIUS only reviews acquisitions that give the foreign party majority control.

Why Trump’s stance on China could stifle asset acquisitions in the US

The bill would also give CFIUS the latitude to consider additional factors, including whether a deal could give a foreign entity access to data pools that include personally identifiable information and to order the dissolution of deals previously concluded, however far in the past.

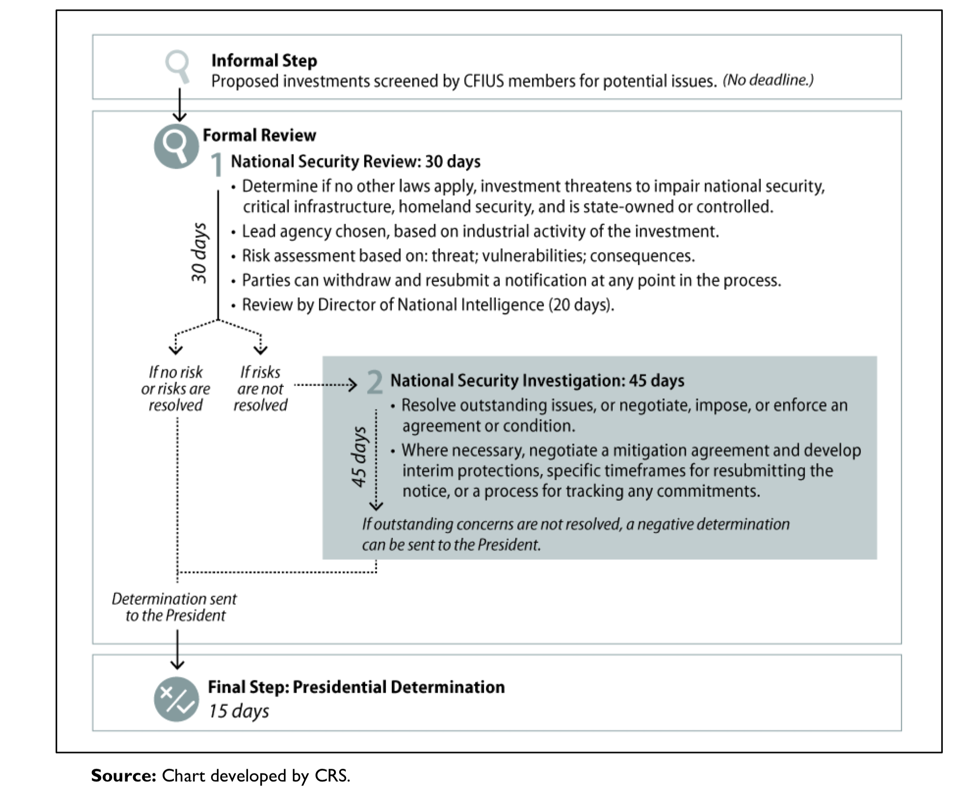

Finally, FIRRMA would extend the formal CFIUS review process to as long as 135 days from the current 90-day period.