Chinese investments in US dip to lowest level since 2009 with outlook for 2020 bleak amid global pandemic

- A combination of US restrictions, Beijing’s outbound capital regulations and the uncertainty around the US-China relationship contributed to the pullback

- The outlook for 2020 is bleak as the Covid-19 pandemic wreaks havoc on the global economy

Chinese investments in the United States have fallen to the lowest level since the financial crisis of 2008-09, with the outlook for 2020 looking bleak amid bilateral tensions and the Covid-19 pandemic.

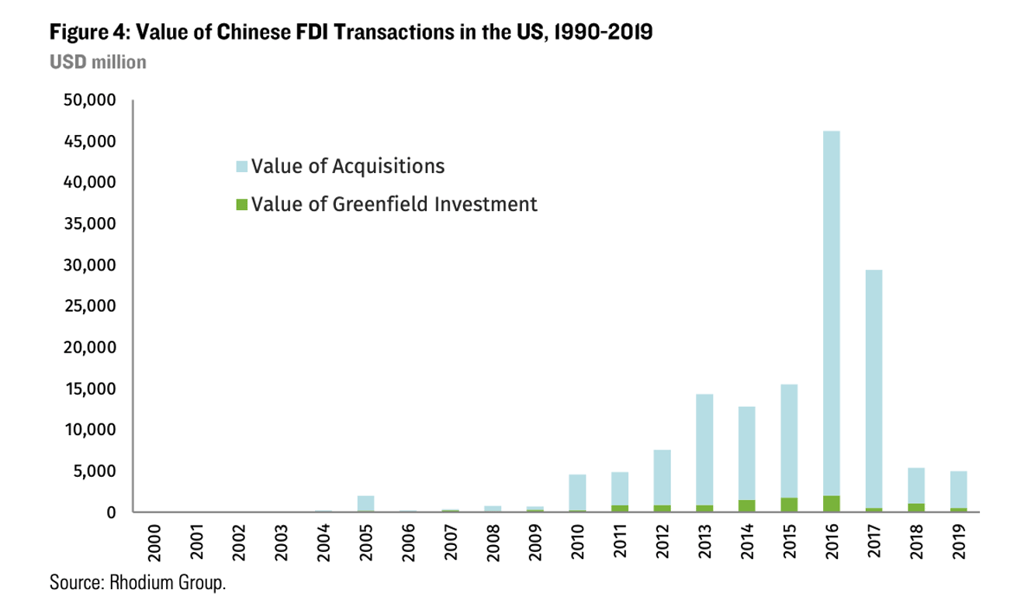

Foreign direct investment (FDI) from China to the US dropped to US$5 billion in 2019, the lowest level in a decade, according to a report by the National Committee on US China Relations and Rhodium Group.

Only a handful of investments were completed last year, led by Shandong Ruyi’s US$2 billion acquisition of INVISTA’s textile unit in Kansas.

A combination of Beijing’s tightened outbound capital regulations, heightened US scrutiny of Chinese investments, as well as the deteriorating US-China relationship contributed to the decline in investments.

Capital flows in technology had an even steeper drop as Chinese venture funds pulled back from a turbulent tech market in China and the US imposed more restrictions on direct Chinese investments in US technologies and companies, particularly in the early-stage tech funding space.