As US-China tech war rages, Washington debates steps beyond just blocking the competition

- Debate continues over how much the government should be involved in research and development, and whether a single agency should oversee national tech strategy

- US tech policy is divided among the Commerce, Defence and Homeland Security departments, as well as the National Security Council, each with a different focus

In the first of a five-part series on US-China technology policies, Jodi Xu Klein looks at how the strategies and approaches differ among US government departments and agencies towards China. The subsequent parts of the series will run on alternate Saturdays.

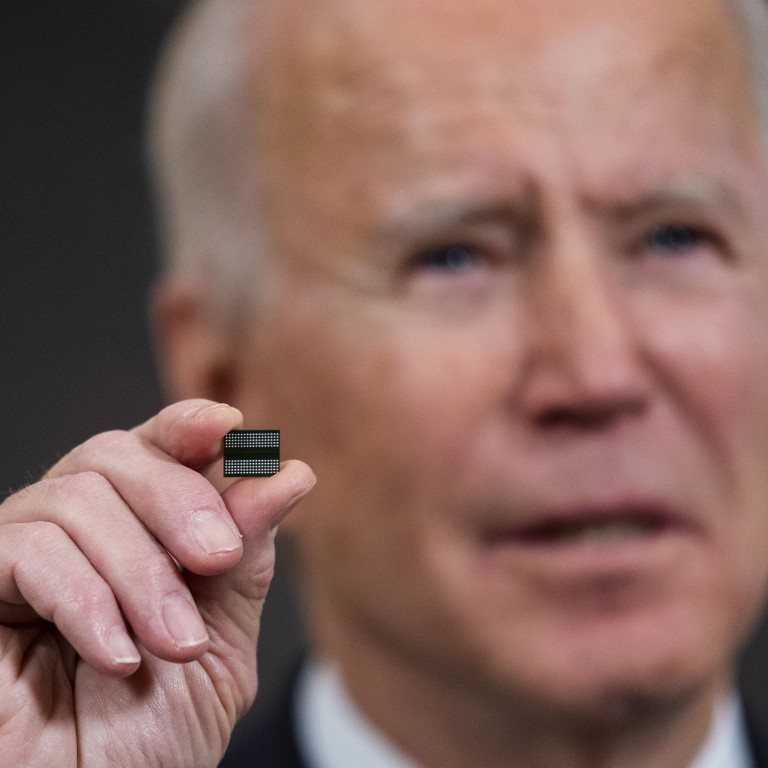

In 2018, ZTE became the first Chinese tech company cut off from US suppliers. Since then, the US government has blacklisted more than 100 Chinese firms on national security grounds. Its logic was simple: by blocking access to American technology, Washington could thwart China’s ambition to overtake the US as the world’s tech superpower.

To a degree, the strategy worked. ZTE’s revenue fell in the US and European markets last year, and China’s tech crown jewel, Huawei Technologies, which landed on at least two Commerce and Defence Department blacklists, saw revenue drop 17 per cent in the first quarter this year after losing access to crucial chip supplies.

But to maintain its tech lead, the US needs to go beyond just blocking the competition, with increased funding and an efficient government structure that can support domestic innovation. Yet three years into the tech war, Washington is still arguing over how much the government should be involved in research and development and whether it needs a single agency to coordinate national tech strategy.

“We are in a very close competition with China, and that may mean to a certain extent trying to slow your competitor,” said Naomi Wilson, vice-president of Asia policy at the Information Technology Industry Council in Washington. “But we have to make sure that we are not setting up unintended hurdles. It is also important we clear out the obstacles on our lane, so that our own companies can run fast.”

02:06

Facebook, Amazon, Google and Apple respond to Congress about whether China steals US technology

On CBS’ 60 Minutes on May 2, US Secretary of State Anthony Blinken said: “When we’ve confronted a significant challenge, we’ve managed to come together and actually do the long-term thinking for long-term investment. And that is really the moment we’re in now, and that’s the test that I think we’re facing: are we actually going to rise to it?”

While both Republicans and Democrats seem to agree that China is the most urgent threat facing the US, and with tech funding bills worth hundreds of billions introduced in recent months, the process of advancing the legislation has not moved quickly.

Two bills – the CHIPS for America Act and the American Foundries Act, which together would provide US$65 billion for tech research and manufacturing – were part of the National Defence Authorisation Act of 2021, which was signed into law on January 1, but specifics about their implementation have been delayed to at least September.

Taiwan’s TSMC asked to supply more car chips to US

The Endless Frontier Act has been circulating in Congress since last May. Seeking up to US$100 billion over five years for tech research and another US$10 billion to create new tech hubs across the country, the legislation, co-sponsored by Senate Majority Leader Chuck Schumer, has received wide industry support.

But some lawmakers are concerned that a government role in promoting certain technologies could be problematic, and that massive federal R&D spending could crowd out private sector investment. Senator Mike Lee, a Republican from Utah, said in April that the US lacked a framework to determine the appropriate level of government funding for tech research. Disagreements over how fast and where the funds should be allocated are likely pushing out the vote on the legislation until later in the year.

The discomfort over heavy government involvement in markets and businesses has always been a thorny issue on the Capitol. On the other hand, industry leaders say Washington needs to make this funding available quickly.

We’re asking leaders in Washington to join industry in investing ambitiously

“US government investments in chip research have been mostly flat as a share of GDP for years, so we’re asking leaders in Washington to join industry in investing ambitiously,” said John Neuffer, president of the Semiconductor Industry Association, which represents companies including Intel and Qualcomm.

“We think that level of funding is properly ambitious and would strengthen America’s semiconductor supply chains,” he said.

Wilson, of the Information Technology Industry Council, said she supported the government funding “so that the US can offer similar incentives to what East Asian countries already offer.”

China spent 2.44 trillion yuan (US$378 billion) last year on R&D, a 10.6 per cent increase that accounted for 2.4 per cent of GDP, according to government data. That number will rise by 7 per cent each year over the next five years, Premier Li Keqiang said in March. Government spending on basic research is expected to grow by 10.6 per cent during the period.

The US spent US$656 billion on R&D in 2019, accounting for about 3 per cent of GDP, according to the National Centre for Science and Engineering Statistics. Federal spending dropped to about 0.8 per cent last year, the lowest percentage of GDP in more than 60 years, according to data from the National Science Foundation.

But Wilson said she did not see a need that “requires drastic government intervention. We certainly don’t want to see the US become akin to China in terms of providing overwhelming subsidies that create market disruptions and unfair advantages.”

Eventually, sometime later this year or in 2022, legislation will be approved by Congress and the funding will be there, industry watchers predict. As hundreds of billions of dollars become available, the question becomes: who will oversee and allocate it.

US lawmakers back US$100 billion science push to compete with China

Unlike countries such as Japan and China with ministries in charge of science and tech development, tech policy in the United States is divided among the Commerce Department, the National Security Council, the Federal Communications Commission (FCC), the Defence Department, and the Department of Homeland Security, each with a different focus.

“At one point in time, we had FCC policy being disagreed by three or four federal agencies, including Nasa and the Department of Transportation,” Senator Maria Cantwell, a Democrat from Washington, said on Wednesday at the Senate Commerce Committee hearing she chairs.

“One thing we’ve heard is that the federal agencies need more coordination on these policies, instead of leaving the battle to be fought in the halls of Congress, with various agencies within the same administration fighting each other.”

Paul Triolo, director of tech policy practice at Eurasia Group said “the problem is that there are bits and pieces of authority that are spread out among too many different organizations. There’s no doubt that has led to inertia.”

Japan has Koichi Hagiuda, its minister of Education, Culture, Sports, Science and Technology, and the European Union has Margrethe Vestager, its commissioner for tech and digital competition. “Who is the digital tsar in the US government? It is unclear,” said Triolo. “So there hasn’t been a very good articulation of what this overall strategy is and what the desired endgame is.”

Triolo said the US would benefit from a new agency that exists beyond federal election cycles and can maintain consistent policies.

“That’s a tricky thing because the US government doesn’t do restructuring well,” said Triolo, adding that Washington is behind the curve in identifying a clear leadership structure compared with other governments.

In the past few years, multiple tech-related task forces were formed under the Federal Communications Commission, the Department of Homeland Security, the Federal Trade Commission, and the Defence Department. Still, not one person or one team is in charge of the overall complex national tech strategy.

In March, the National Security Commission on Artificial Intelligence recommended that a Tech Competition Council be formed in the executive branch, something resembling the National Security Council and the National Economic Council, to create a tech competitiveness strategy that balances both security and economic interests.

US must face artificial intelligence competition from China, report says

Others, like Wilson, don’t believe this is necessary.

“I want to caution that it’s important that the US does not try to mirror what China does in terms of an extreme, top-down approach,” she said. “We need to trust the market-based system that has fostered innovation, creativity, and risk taking, in a way that the Chinese system hasn’t always.”

“We have to remember that under the US system, US companies have led in tech for a long time. There needs to be some sense of confidence that the US model has proven successful.”

By getting out of the way, Wilson said, government will allow American companies to run as fast as they can to compete when the next ZTE or Huawei shows up.