US takes new step on delisting Chinese companies from stock exchanges for audit violations

- Rule threatens hundreds of Chinese businesses trading on US markets

- Regulation is latest step in Washington’s broader pursuit of financial decoupling from Beijing

The US audit watchdog adopted a new rule on Wednesday that will help the board force companies flouting US audit regulations to delist from US exchanges, a move that threatens hundreds of Chinese businesses.

According to the rule, which was first proposed in May followed by two months of public comment, all companies with headquarters in a jurisdiction where the authorities refuse to let businesses comply with US regulators will be considered non-compliant, with limited exceptions.

The statute adopted by the Public Company Accounting Oversight Board (PCAOB) does not mention China, but clearly refers to it since Chinese authorities – citing state secrecy laws – refuse to make available auditing results of companies based there.

The adoption of the rule was the biggest step yet by the US toward instituting the Holding Foreign Companies Accountable Act (HFCAA) that became law at the end of 2020. Under the law, foreign companies listed on US exchanges will face delisting if they fail to turn over audit results for three consecutive years.

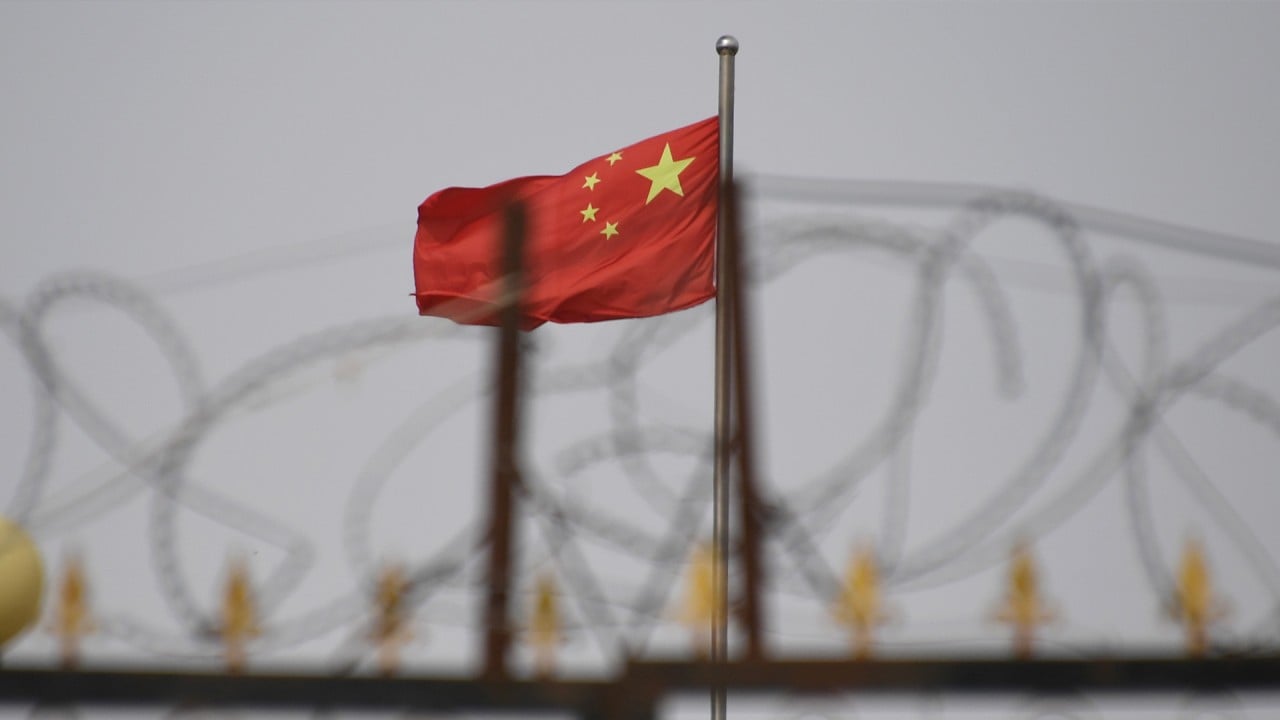

The move is part of the broader financial decoupling from Beijing that Washington has pursued in recent years.

The US has banned American tech companies from doing business with scores of Chinese firms on a blacklist known as the Entity List maintained by the Commerce Department.

The Justice Department has also put dozens of Chinese businesses on a separate blacklist for allegedly having ties with the Chinese military. American investors are prohibited from trading the securities in these firms for fear of providing capital to help build Chinese military capacity.

US penalties for technology sales to China have soared, Commerce Department says

This month, a Commerce Department official said that punitive actions taken for the sale of sensitive technology to China had soared to nearly US$6 million this year, compared to US$60,000 a year earlier.

The rule approved by the PCAOB, which is overseen by the Securities and Exchange Commission, on Wednesday means that essentially all companies based in China will be subject to delisting.

“I don‘t see any loopholes in here that would allow Chinese firms to avoid delisting,” said Gabriel Wildau of the global business advisory firm Teneo. “Absent a bilateral resolution, I think we’re on a glide path towards mass delisting in 2024.”

Absent a bilateral resolution, I think we’re on a glide path towards mass delisting in 2024

The China Securities Regulatory Commission and the State Council had signalled a willingness to negotiate, Wildau said, “but given the mood in Washington, the Biden administration does not seem inclined to accept this offer, so I think we‘re in a stalemate”.

“To some extent,” he added, “this disclosure issue has become a sideshow” because “many US politicians seem to believe that US investors shouldn‘t be funding Chinese companies no matter what”.

The audit requirement, established in 2002, has been applicable to all foreign companies that seek to issue public stocks in the US. According to the SEC, China and Hong Kong are the only country or territory that house companies refusing to abide by the rules.

03:36

Beijing hits back at Western sanctions against China’s alleged treatment of Uygur Muslims

The PCAOB, which is in charge of accounting issues of public companies, has wrestled with China over the issue for decades. None of the roughly 270 Chinese companies listed on US exchanges comply with the rule.

In recent years, the inadequate financial disclosure by several listed Chinese companies – and the losses to American investors – have brought the issue to the fore.

In 2020, the SEC accused Luckin Coffee, dubbed “China’s Starbucks”, of fabricating more than US$311 million in sales that understated its net loss by as much as 34 per cent.

Luckin paid US$180 million to settle allegations and its stock lost 90 per cent of its value, or about US$11 billion, between the time the scandal broke in April and its delisting in July last year.

Chinese firms should face faster US stock delisting over audit rules, SEC says

At Senate testimony last week, SEC Chairman Gary Gensler said that by early next year he expected to release a list of companies whose auditors refuse to open their books to US regulators – an approach to pressure auditors to abide by the US listing rules for foreign companies.

Gensler said that the SEC also supported legislation that would allow for faster delisting of noncompliant companies.

That bill – the Accelerating Holding Foreign Companies Accountable Act – would cut the time US-traded Chinese companies have to hand over their audits to US regulators before being delisted to two years from three years.

The Senate passed the bill in June; it is pending in the House of Representatives.

Two months ago, the SEC put a “pause” on Chinese share offerings in the US to address the disclosure problems found with issuers that sell shares through shell companies outside China, known as variable interest entities.

The arrangement had helped companies bypass Beijing’s restrictions on overseas listings in certain sectors. But under that structure, US investors were buying securities from overseas entities that did not own the underlying assets of operating companies. In case of financial restructuring, investors in the US could have limited recourse to obtain their assets and be reimbursed.

The SEC required the listing firms to make the financial connections clear to investors and state the risks that they might face in the event of regulatory pressure from the Chinese government.