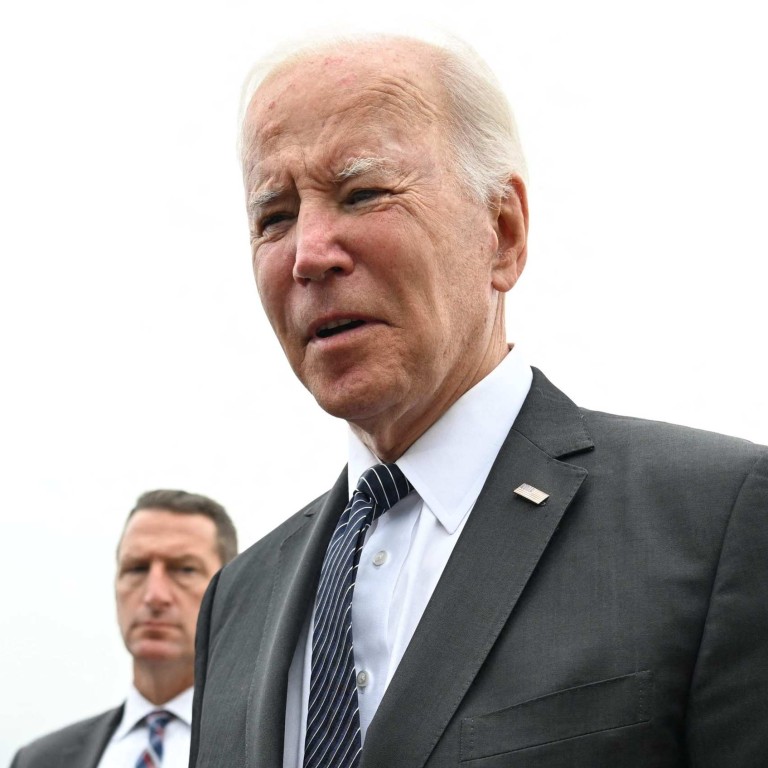

Joe Biden orders tighter scrutiny on foreign investments in move seen to target China

- President’s executive order ‘sharpens’ focus of the Committee on Foreign Investment in the United States, which reviews business acquisitions for national security risks

- Panel is directed to review foreign transactions that involve personal data and advanced technologies and to consider ‘aggregate industry investment trends’

US President Joe Biden has directed a government investment screening panel to sharpen its focus on foreign transactions that involve personal data and advanced technologies, a move that appears aimed at national security risks that the US sees in China.

Without changing the legal authority of the Committee on Foreign Investment in the United States, or CFIUS – which reviews US asset purchases by overseas entities for national security risks – the Biden administration wants it to put deals under closer scrutiny for several specific concerns, the White House said.

These include “priority emerging and critical technologies, like semiconductors, quantum technologies, biotechnology and artificial intelligence, as well as supply chain considerations”, a senior administration official said in a briefing with reporters on Wednesday.

“By highlighting and sharpening the committees focus on these evolving and emerging risks, the executive order will help guide the committee and should also help businesses and investors better identify early on national security risks,” said another senior administration official on the call.

Biden’s executive order on Thursday also directs the committee to consider “aggregate industry investment trends”, which refers to the possibility of a foreign entity gaining control over a specific sector or technology through a series of transactions, under the radar of bureaucrats looking for potential threats.

The move was motivated by “what we’ve learned from the past few years and the administration’s related efforts to address the need for supply resilience of key supply chains, both inside and outside of the defence industrial base”, the first official said.

China is a clear target of these policies

China has been central to these concerns, especially since supplies of medical equipment, mostly sourced from that country, dried up at the start of the Covid-19 pandemic, hobbling many hospitals. Delays in shipments of other products from China also caused backlogs in the automotive and other sectors.

Chinese businesses ranked second behind Canadian deals in the number of CFIUS reviews conducted in 2021, overtaking Japan, according to the US Treasury Department, which oversees the CFIUS process. Other departments involved in CFIUS are homeland security, commerce and defence, as well as the offices of the US trade representatives and science and technology policy.

Before the pandemic, US lawmakers and policy analysts were already sounding the alarm about the extent to which Chinese companies were procuring dual-use technologies through the acquisition of hi-tech companies in Silicon Valley and other US tech hubs.

US investments in foreign chip firms a potential concern, White House says

The order on Thursday also directs CFIUS to focus on risks relating to sensitive personal data, “providing clarification and a signal to industry [that] technological and big data advances undermine the concepts of de-identified or anonymised data”, the administration official said.

Kevin Allison, vice-president for Europe and Eurasia and technology policy at Albright Stonebridge Group, said that the US “is concerned not just about what data an acquirer might get access to through any one particular company’s own data set, but how that data could be used and combined with other data sets that might already be accessible by an adversary country, and might be able to be combined and used in different ways”.

“It’s also not only a concern about what an adversary country could do with access to that data today, but what it might be able to do with access to that data in the future,” Allison added. “China is a clear target of these policies.”

In a statement, US Treasury Secretary Janet Yellen said that Biden’s order reflects “the evolving nature of national security risks that CFIUS addresses under its current authorities”.

China’s rise to second in the ranking of CFIUS reviews does not necessarily mean that transactions are falling afoul of the panel’s guidelines, according to the New York law firm White & Case.

The tally likely includes some deals counted multiple times following voluntary withdrawals and subsequent resubmissions as well as some involving transactions that closed before 2021, the firm reported.

“Even though there was not a notable increase in overall Chinese [foreign direct investment] into the United States … more Chinese investors may be inclined to notify their transactions given known CFIUS sensitivities to China and the more aggressive non-notified process making a call-in generally more likely,” it said.