Normally bellicose China’s meek response to US chip restrictions raises eyebrows

- Beijing typically ‘retaliates fully plus 10 per cent’, but this time it doesn’t seem to have many punitive options

- ‘It is a puzzle,’ says an American analyst. ‘On everything else, they seem to have skin that’s thinner than Saran Wrap.’

China has a long history of biting back when other countries adopt policies it does not like. In 2020, when Australia called for an investigation into the origin of the Covid-19 virus, it was hit with duties and bans on barley, wine, wheat, wool, copper, timber and grapes totalling over US$1.3 billion.

After Meng Wanzhou, chief financial officer of Huawei Technologies, was detained in Canada in 2018 for allegedly violating US sanctions against Iran, Beijing quickly detained two Canadians in China and blocked or slowed a slew of farm imports from Canada.

And after Taiwan opened a representative office in Lithuania in 2021 using “Taiwan” rather than “Taipei”, China sanctioned its officials, downgraded relations and banned its imports. Other recipients of heavy-handed reprisals include Japan, Mongolia, Norway, the Philippines and South Korea.

“China retaliates fully plus 10 per cent,” said Jeffrey Moon, president of China Moon Strategies. “They have consistent goals when they retaliate. They want to inflict proportionate pain, avoid negative impact on China and want to claim deniability.”

01:36

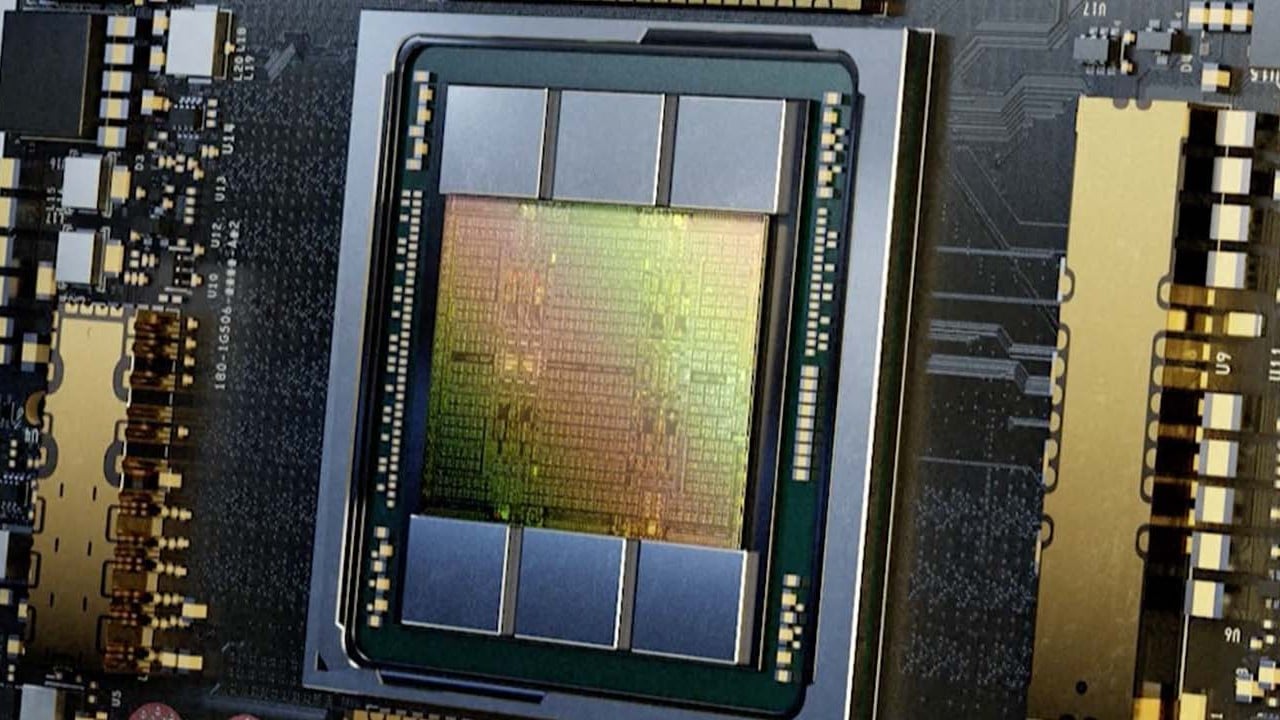

AI chip maker ordered by US government to halt exports to China

The relatively muted response from normally blustery Beijing after Washington announced restrictions on high-end semiconductors and chip-making equipment – a potentially huge blow to its economy, youth employment and vision of a reshaped society under the Communist Party blueprint – has analysts and former US officials parsing China’s thinking even as they wait for the other shoe to drop.

Within days of the early October announcement, Beijing issued a pro forma verbal response – terming the US restrictions “sci-tech hegemony” and a “malicious” violation of trade rules. But there has been little concrete resistance or lashing out.

“It is a puzzle,” said Scott Kennedy, a senior adviser at the Centre for Strategic and International Studies. “On everything else, they seem to have skin that’s thinner than Saran Wrap.”

Analysts say several factors appear to be at play. Beijing has a lot on its plate. The US announcement came a week before the hugely consequential 20th party congress – apparently driven more by Washington’s bureaucratic timelines than any desire to poke Beijing in the eye – during which President Xi Jinping secured an unprecedented third term.

Tech war: Washington takes new steps to frustrate China, advance US chip-making

That said, Beijing is fully capable of multitasking, analysts said, especially when it comes to expressing – and acting upon – its displeasure.

Washington announced the chip export restrictions in early October, without warning, to thwart China’s ability to stockpile chips of potential military use. These include a ban on high-end semiconductors and chip-making technologies with potential dual civilian and military applications, prohibitions against US citizens working on Chinese practices and expanded trade blacklists of Chinese companies.

Dutch chip equipment maker ASML’s CEO questions US export rules on China

A second possible factor behind China’s relatively muted response may be divisions among party and government officials and top industry executives – including those from national champions YMTC, Semiconductor Manufacturing International Corporation and Chang Xin Memory Technologies – on how to respond.

“Officials in Beijing are likely still digesting the full impact of the 7 October controls on key companies … and coming up with a response focused on assisting the domestic industry,” said Paul Triolo, senior vice-president at the Albright Stonebridge Group.

“Beijing may also be reluctant to take a major public retaliatory measure before the visit of Secretary of State [Antony] Blinken to China early next year.”

Kennedy, who recently met with Chinese and foreign embassy officials and company executives in Beijing, said he heard widely divergent views on China’s ability to overcome the restrictions, and about what counter policies it might pursue, suggesting a lack of consensus.

“Although the Xi Jinping-led CCP has the image of a risk-taking, rapid reaction force, actually, on a wide range of issues, they seem to be highly tentative or unsure about how to proceed,” Kennedy said, citing policies related to Covid-19, the beleaguered property sector, fiscal reform and property taxes.

A third, and potentially the most consequential, factor behind Chinese reticence may be China’s weak leverage. One of its go-to responses when angry – cutting off access to its huge consumer market – is not terribly effective in this case. China badly needs the high-end chips, most of which go into exports or military technology and not domestic products. And it would likely come out worse in any tit-for-tat showdown, making it difficult for Beijing to inflict proportionate pain.

Beijing’s inclination to hit back hard when challenged follows in part because it often plays well domestically and can be an effective strategy for getting its way, particularly with smaller, less powerful nations more easily intimidated.

While China has the legal architecture to intensify pressure on multinationals and foreign governments – including unreliable entity lists, antitrust and anti-competitive laws, review authority over global mergers and acquisitions, anti-foreign sanctions and foreign direct product rules, national security, cybersecurity and data privacy laws – it has rarely used these against tech firms. In a couple of cases, it has threatened to sanction US defence contractors without following through.

Limits on China biotech and AI next after semiconductor curbs: US official

Blocking – or threatening to block – Intel, Texas Instruments, Micron, Nvidia, Apple and other US companies’ access to the Chinese market would further curtail chip supplies that China needs and scare away already skittish multinationals in other industries. This comes as China struggles to attract foreign investment, its economy swoons on the heels of Covid restrictions and unemployment among new college graduates hits a record high.

A sledgehammer option where it does have leverage would be an export ban on rare earth alloys and magnets, lithium and other minerals. China accounts for 63 per cent of the world’s rare earth mining, 85 per cent of rare earth processing, 92 per cent of rare earth magnet production and 60 per cent of lithium processing. These materials are vital for a wide array of hi-tech products, from cellphones, missiles and stealth aircraft to electric vehicles and wind turbines central to Biden’s climate agenda.

But Beijing would potentially face even tougher US tech restrictions and suffer a major hit to its global stature with such a move. When China limited rare earths exports after 2006, ostensibly on environmental grounds, and threatened shipments to Japan after a 2010 collision near contested islands, it faced global opprobrium and a World Trade Organization (WTO) challenge by the US, Japan and the European Union that it ultimately lost.

“Beijing has few ready options to engage in a punitive symmetric response, and the tools that are available all have major downsides, like further poisoning the business climate for foreign firms,” said Triolo. “With the economy already reeling from Covid lockdowns, Beijing is eager to avoid making things worse.”

Short on punitive moves, Beijing has mapped out longer-term strategies aimed at reducing its dependence on foreign technology.

Intel gets foundry expertise with US$5.4 billion Tower Semiconductor buyout

China also has a history of exacting stealth retribution in ways difficult to pin down, such as slowing down visas and trade flows, enforcing debatable safety and health standards and enacting restrictive policies based on environmental or other difficult-to-quantify standards.

“I think China is taking a quiet approach,” said Xiaomeng Lu, geotechnology director at the Eurasia Group. “That’s how I would categorise their reaction so far.”

One closely watched area is China’s antitrust vetting authority. Intel has announced plans to buy Israel-based Tower Semiconductors for US$5.4 billion, which would require that major global regulators sign off.

China, potentially, could drag its feet on approving the deal until it expired to punish the US chip maker. “And then maybe months later, or years later, the words will come out that the real reason is political,” Lu said. “But at the time, they will say, we did our math, the economic impact is the reason we’re blocking this deal, or just not explain at all.

“That’s one very likely scenario.”

Another possible Beijing move would be to tweak regulations by, for instance, revising its energy efficiency standard for servers. These standards are updated regularly, typically on esoteric, technical grounds. But some industry watchers are concerned that the latest standards give older-generation computers – where China is stronger – better ratings than those powered by more efficient chips where US companies prevail in this huge market.

But experts also cite the risk of tech competition going too far in this high-stakes face-off, undercutting global investment, R&D and long-term planning. Many sub-sectors are not militarily sensitive, and having interdependent supply chains often lowers cost on both sides, benefits consumers and can reduce tensions and potential conflict.

“You’ve got the world’s largest market and the world’s largest economy at loggerheads with each other, that’s going to create a whole lot of tension,” said Jimmy Goodrich, a vice-president at the Semiconductor Industry Association. “What that’s meant is that firms increasingly are being forced to choose a side.”

Leading China chip company added to US trade watch list

Some analysts say China may be rethinking its long-standing use of blunt economic leverage as resistance grows. “Crass economic coercion is running into more headwinds than it used to,” said Kennedy.

In recent months, China has been taken aback not only by the relatively unified European opposition to its retaliation against Lithuania, but also the way the West has closed ranks behind Ukraine, even as Beijing supports Russia. And with recent, more targeted US tech restrictions, it finds itself with fewer cards to play.

“This is probably the most effective response to China’s industry policy that any US administration has ever introduced; we’re seeing real results,” said Moon, formerly with the Office of the US Trade Representative and a consul general in Chengdu. “China doesn’t have the option of inflicting proportionate pain because semiconductors are so import to China’s economic future and five-year plans and all the party documents.”

“If it did, I think it’s pretty clear that the Biden administration is prepared to ratchet up sanctions even more,” he added. “It would probably be self-defeating.”