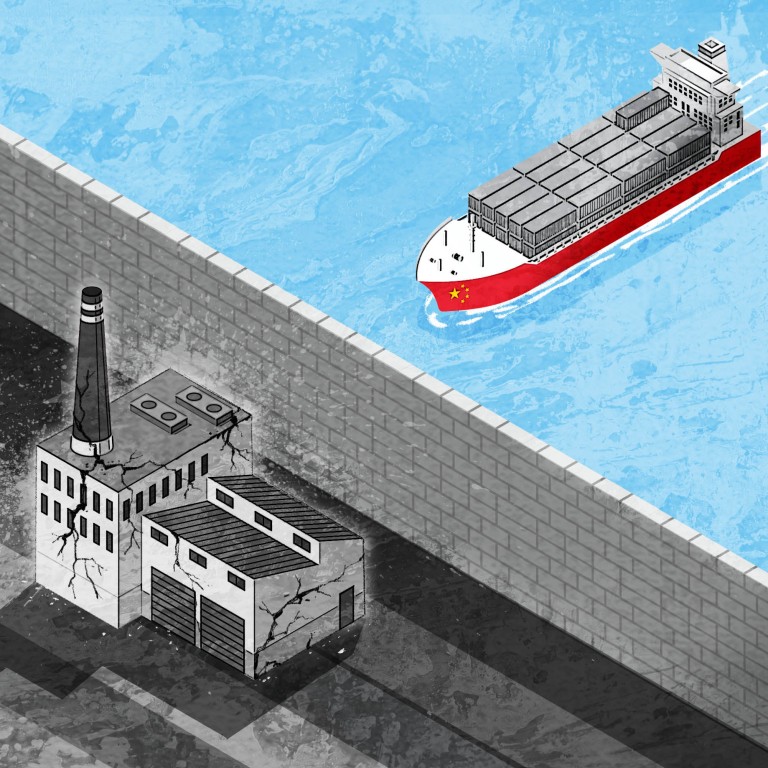

China-targeted tariffs forcing US manufacturers to relocate abroad

- Businesses whose stateside production depends on components from China decry costs they bear due to Trump-era policy continued by Biden administration

- Washington’s exclusion policy shielding some products also slammed in run-up to process review by Office of US Trade Representative

When Dan Digre, president of Misco, an American designer and manufacturer of audio speakers, delivered a keynote address in June at an industry gathering in Orlando, Florida, he minced no words decrying the impact of Washington’s import duties on Chinese goods.

Tariffs were discouraging US-based speaker companies from making their products in the United States, undermining “the current administration’s policy to build more in America”, Digre told the sympathetic audience.

A small family-owned business established in 1949 in Minneapolis, Minnesota, Misco stayed put when other manufacturers left the country chasing cheaper labour and lower costs in China.

But after surviving and thriving in a highly competitive environment, Misco struggled to keep up and moved some of its operations to China. Now, it is struggling to keep the rest in the US.

Speakers are used widely: in guitars, commercial airlines, military applications and medical equipment.

That is because the tariffs for importing speaker components from China are 25 per cent versus 7.5 per cent for finished speakers. In short, importing a final product from China makes more sense to the manufacturer of the item than making it in America.

“The idea of the tariffs would be to protect American industry, not make it less competitive,” Digre said. “But that was the effect of the tariffs. It has made our costs higher and therefore us less competitive.”

Despite passing on some of the costs to customers, Misco decided it ultimately made business sense to “build more of its product not in the US but ironically in China”.

Biden limits US investments in China tech, makes ‘emergency’ declaration

In the ensuing months, List 3 levied a 10 per cent tax on another US$200 billion worth of Chinese goods. This amount was later raised to 25 per cent. In 2019, Trump announced List 4a, imposing a 15 per cent duty on Chinese goods worth at least US$120 billion.

The agreement cut taxes on List 4a items like speakers, turntables, TVs, projectors and other electronics from 15 per cent to 7.5 per cent. However, the 25 per cent tariffs on List 3, which includes components needed to make speakers, remained unchanged.

Since May last year, the Office of the US Trade Representative has been reviewing the need for and impact of the tariffs. Its assessment is expected to conclude by autumn.

US trade representative Katherine Tai has indicated that changes to the tariffs could be imminent.

“As part of this review, we are considering the existing tariffs structure and how to make the tariffs more strategic in light of impacts on sectors of the US economy as well [as] the goal of increasing domestic manufacturing,” her office said in July in response to inquiries from the US Senate Finance Committee.

Is China’s slice of export pie melting as geopolitical uncertainties heat up?

The USTR would consider whether an additional tariff exclusion process may be warranted as well as the “ways a future exclusion could be altered to be more effective”, according to the statement.

More than 300 exclusions are in effect, and each is expected to expire on September 30.

In an open letter addressed to USTR and released on July 27, Americans for Free Trade, a coalition of 170 trade associations, urged Tai to “timely” announce a continuation of existing exclusions.

American families, workers and businesses continue to face unprecedented and uncertain economic challenges

Americans for Free Trade represents manufacturers, farmers and agribusinesses, retailers, technology companies, service suppliers, natural gas and oil companies, importers, exporters and other supply-chain stakeholders.

The group said that in the past five years “American importers, including members of our coalition, have paid more than US$183 billion” in tariffs, and the USTR’s “last-minute” decisions on exclusions had undermined the administration’s “stated goals of ensuring supply-chain resiliency”.

“American families, workers and businesses continue to face unprecedented and uncertain economic challenges,” the coalition added, describing itself as “one of hundreds of groups and companies who commented about the continuing negative impact of the tariffs and the need for a new strategic approach to address China’s unfair trade practices”.

Divide grows in Washington’s hawkish bipartisanship over US-China trade

Meanwhile, lacklustre manufacturing continues to bode ill for those championing US domestic production.

The data showed the purchasing managers’ index at 46.4 last month, a slight increase from 46.0 in June, which was the lowest figure since May 2020. Readings below 50 indicate declining activity.

In addition, US factory employment in July dropped to a three-year low as struggling businesses slashed their headcount to stay viable.

Seven of the 18 industry groups covered by the survey reported a decline in production and employment in June. These manufacturers ranged from textile mills to electrical equipment and from plastics to appliances.

In a letter to Republican congressman Mike Gallagher of Wisconsin, chairman of the House select committee on China, Americans for Free Trade said the tariffs had “disincentivised manufacturing” in the US.

The letter referred to Misco’s experience and quoted the company as saying it felt it had been “penalised for building speakers in America”.

Americans for Free Trade also identified for the panel others burdened by the China-targeted tariffs, such as an IT firm that said it had paid more than US$350 million per year on parts and components designated on Lists 3 and 4a.

American chip companies need access to China: semiconductor trade group

Digre said requests for product exclusion from Misco and another speaker company were denied by the USTR during the Trump administration without explanation. He criticised the exclusion review as opaque.

“Nobody knew how the process worked. Nobody knew what the criteria was. And there was no evidence, never any explanation given, of why the exclusion request was denied,” he said. Digre said he believed the review process should be reconsidered by the Biden administration.

In its letter to Gallagher, Americans for Free Trade said it was disappointed the USTR did not offer a public hearing of the government’s tariffs review.

“We believe the USTR must move expeditiously to announce determinations related to its review,” the coalition wrote, arguing it was imperative that the review be “fair and transparent”.

Some analysts have also slammed the tariffs as counterproductive.

Clark Packard and Scott Lincicome of the Cato Institute, a Washington-based think tank, said the government’s response to problems with Beijing’s international trade and investment practices “has been woefully inadequate across the past two presidential administrations”.

“Neither tariffs nor domestic subsidies are up to the serious task of outcompeting China in the 21st century,” they said in their report on US-China trade in May, describing the policy as a “failing approach”.

Slow but key progress made in US-China relations: American entrepreneurs

According to the report, Moody’s Analytics estimated that the US-China trade war had led to the loss of about 300,000 American jobs, while a New York Federal Reserve study said the tariffs resulted in “approximately US$1.7 trillion in lost market capitalisation for firms through investment slowdowns”.

Digre suggested that officials were “paralysed” despite the government being aware of the challenges its policy had spawned. He said political discussions in the US concerning China policy were “very polarising” and “very toxic”.

“For a politician to say anything that could be construed as soft on China is a losing argument,” he added. “I think that the Biden administration is afraid to do anything that political opposition could say, ‘Well, you’ve just benefited the Chinese.’”