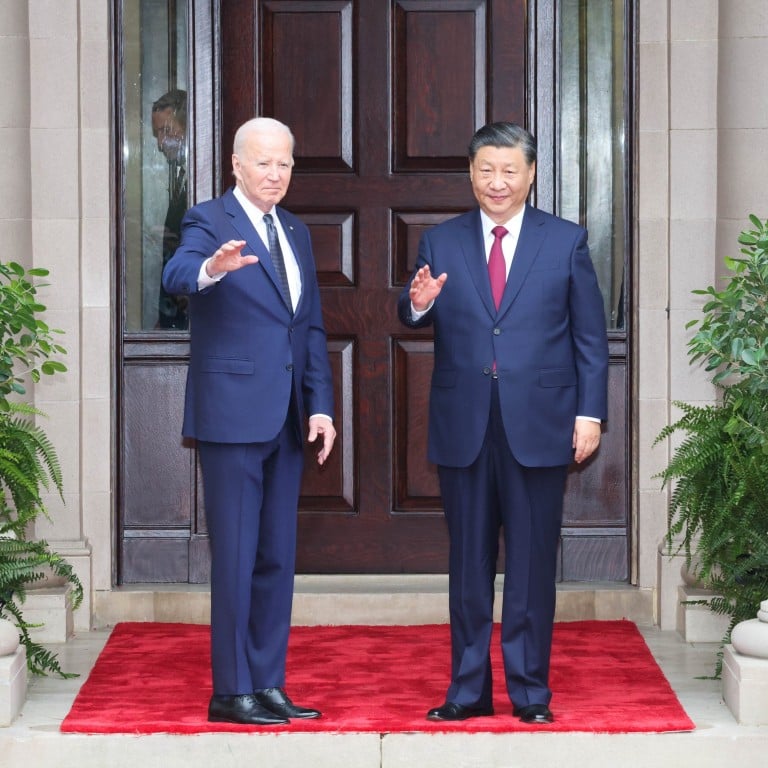

In San Francisco, Chinese President Xi woos US business investment but welcome mat not enough, say analysts

- Structural tensions continue to cloud the Sino-US economic relationship as companies look to diversify supply chains to other Asian countries

- Many foreign investors remain wary given Beijing’s emphasis on national security, raids on foreign companies and strict data laws

Chinese President Xi Jinping is courting big American businesses in China in San Francisco this week, but analysts and investors say structural tensions continue to cloud the Sino-US economic relationship as companies look to diversify supply chains to other Asian countries.

“The more difficulties there are, the greater the need for us to forge a closer bond between our peoples and open our hearts to each other,” Xi said at the dinner.

Xi’s visit to the US was preceded by China announcing the largest purchase of American soybeans in months. Reports surfaced before Xi’s visit that Beijing might also place orders for new Boeing jets for the first time in more than four years, but the deal did not materialise this week.

While Xi hoped the steak dinner would allay concerns from American business elites over a tightened regulatory environment in China and high tensions between the US and China, Mary Lovely, Peterson Institute for International Economics senior fellow, said words would not be enough.

“I think that they have to see real change,” Lovely said. “Xi was charming, he said all the right things to them, but they need to see it on the ground and I think businesses are very sceptical right now.”

China needs foreign investors as its economy wobbles under the weight of a property meltdown, slowing growth, a weaker yuan and rising unemployment, which has fuelled the corporate charm offensive in San Francisco this week.

Many companies remain wary despite the proffered welcome mat, given the Xi administration’s inordinate emphasis on national security, raids on foreign companies and strict data laws.

US has every right to be in Indo-Pacific, Biden tells Apec CEOs

“The outcome of the Biden-Xi summit did not materially change the cross-border tech business environment, though it did put a temporary floor on the overall downward trajectory of bilateral relations,” Xu said.

“Chinese technology companies’ struggle to obtain GPUs will continue, as they attempt to build up domestic chip design, supply chain and semiconductor manufacturing capacity,” he added, referring to graphic processing units, semiconductor chips critical to AI development.

The Biden administration has imposed strict export controls on high-end chips going to China, and has continued to place Chinese tech companies – such as AI chip makers Moore Threads and Biren Technology – on a government blacklist that regulates all exports to listed companies.

Biden’s tough tech policies have led companies such as Nvidia and Intel to worry about their bottom line as sales of certain products to China’s massive market come into question. Of its US$27 billion in total revenue for 2022, Nvidia drew US$5.8 billion from sales to China. Meanwhile, US$17.1 billion of Intel’s total 2022 revenue of US$63 billion came from China.

“It’s no doubt there is a challenge, no one denies that. [The Chinese and US presidents] openly admit that. But both sides are making efforts, trying to communicate and trying to manage the relationship,” said Yangbin Wang, CEO of Vobile Group, a software firm that serves independent content creators.

“The Apec economy leadership, CEOs coming together, they felt encouraged … there’s challenges ahead, but they felt encouraged,” said Wang, whose company is a corporate sponsor of the summit.

Most countries, including the US, do not recognise Taiwan as an independent state. Washington, however, opposes any attempt to take the island by force.

“We’d like to encourage some of these firms that are moving out of China to come to the Philippines,” George Barcelon, president of the Philippine Chamber of Commerce and Industry, said at an event on the sidelines of Apec.

“I know sometimes we’re not shortlisted. A lot of companies will go to Vietnam or elsewhere.”

‘Slowly moving in a positive direction’: 7 takeaways from China’s economic data

During a fireside chat at the summit Raymund Chao, Asia-Pacific and China chairman for the accounting firm PwC, said it was not feasible for all Western companies to shift out of China quickly.

“It’s very difficult, if not even impossible, to replace China with any one location. That’s a reality that we need to understand,” he said.