US temporarily letting EVs with Chinese minerals in batteries qualify for tax credits

- The new rules are intended to help spur US electric vehicle sales while weaning the battery supply chain away from China

- General Motors praises the move by the Treasury Department while some Republican lawmakers condemn it

US President Joe Biden’s administration has issued long-awaited rules that will temporarily allow small quantities of China-sourced critical minerals in batteries for electric vehicles that will be eligible for federal tax credits, a move cheered by General Motors and assailed by some lawmakers.

The guidelines issued on Friday by the US Treasury Department were required by the massive Inflation Reduction Act (IRA), which was signed into law by Biden last year and is regarded as the most significant effort in US history to curb the effects of climate change, with US$360 billion allocated for a shift toward renewable energy.

The law was also meant to align with efforts to remove Chinese companies from the supply chain for these technologies, a difficult challenge given that the EV industry is still heavily reliant on China for critical minerals and components that go into their products.

Currently, 200,000 EV buyers from an individual manufacturer receive a tax credit of US$7,500. The new law will remove the cap starting next year, but adds a requirement aimed at blocking countries deemed to be a “foreign entity of concern” (FEOC) – a label applied to China – from supply chains.

Companies controlled by North Korean, Iranian and Russian entities are also FEOCs under the new rules, which will be applied to completed batteries in 2024 and for critical minerals used to produce them in 2025.

General Motors said that the decision to temporarily allow some Chinese mineral content preserved “consumer purchase incentive” for its products.

“Due to GM’s historic investments in the US and efforts to build more secure and resilient supply chains, we believe GM is well positioned to maintain the consumer purchase incentive for many of our EVs in 2024 and beyond,” the company said shortly after the Treasury announcement.

In a blog post, John Bozzella, chief executive of the Alliance for Automotive Innovation – an industry association for most major US carmakers – wrote that “We don’t know yet how the FEOC rules will impact which EVs qualify for some or all of the tax credit. Time will tell”.

US climate bill focuses on breaking Chinese supply chain for electric cars

“Only about 20 vehicles qualify now (out of 103+ EV models for sale in the US), but Treasury’s effort to make the rules workable means the list of eligible vehicles won’t completely disappear in 2024 (which was a real worry).”

Treasury said that the materials being exempted each accounted for less than 2 per cent of the value of battery critical minerals – an assertion that failed to prevent an outpouring of anger from many US lawmakers, mostly Republican.

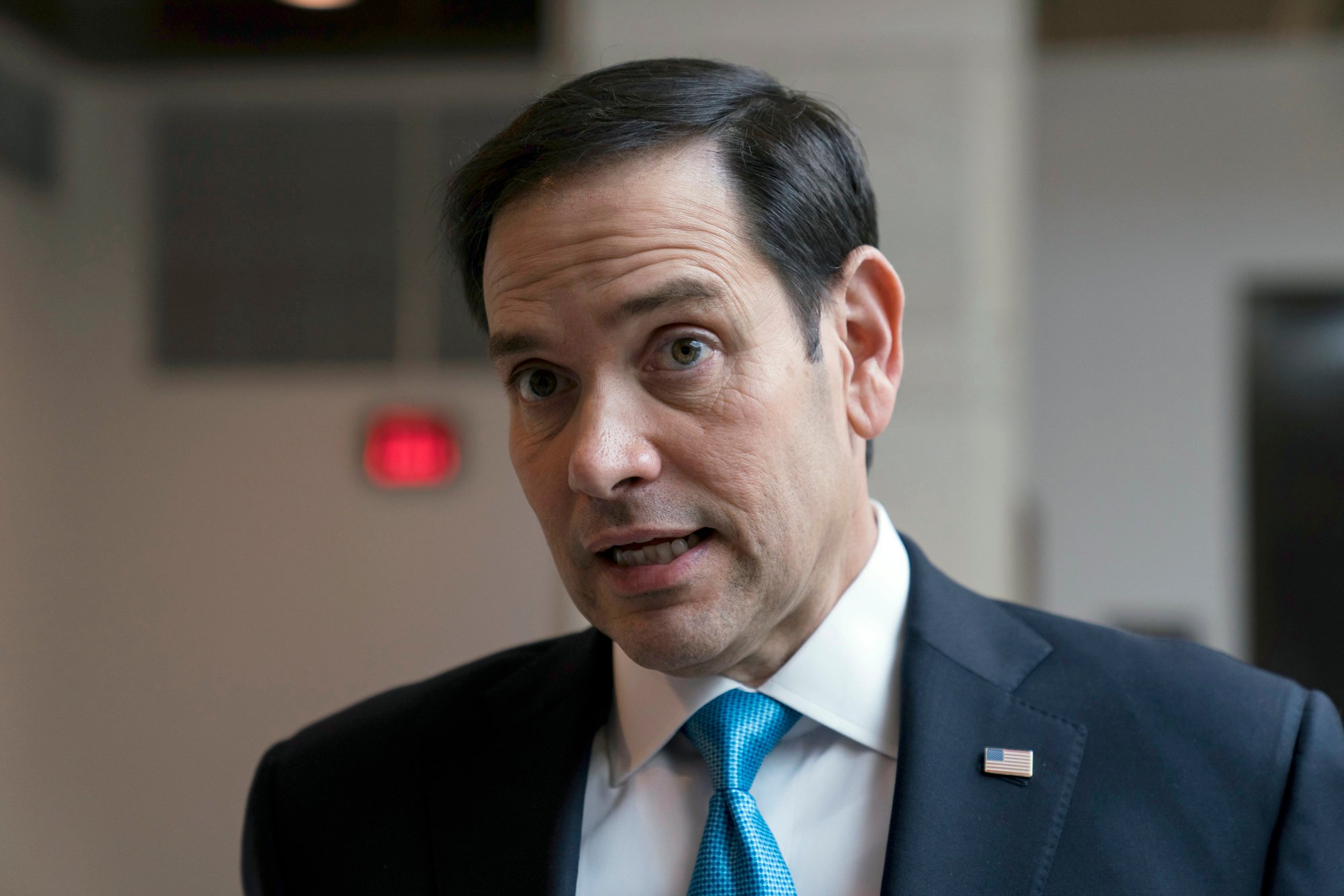

Citing Ford Motor’s plan to use technology developed by the Chinese battery manufacturer CATL in a proposed US$3.5 billion EV plant in Marshall, Michigan, Senator Marco Rubio, a Florida Republican, said that the new rules put “EV special interest groups ahead of America’s interests”.

Earlier this year, Rubio pressed Janet Yellen, Jennifer Granholm and Pete Buttigieg – Biden’s treasury, energy and transportation secretaries – for a government review of the Ford-CATL licensing agreement and sought a commitment from Biden that no Chinese companies would receive any IRA subsidies.

Ford spokesperson Richard Binhammer said that the company was still reviewing the rules, in an emailed response to Politico.

“It is worth pointing out that the Marshall plant will be built, owned and run by Ford (through a subsidiary) – that CATL will have zero ownership interest,” Politico cited him as saying.

Treasury’s new rules are part of a broader geostrategic struggle for control of critical mineral supply chains, as climate change increases the urgency in transitioning to renewable energy, with Washington and China at the forefront of the competition.

Underscoring the issue, new Chinese export controls on graphite, a material used in EV batteries, took effect on Friday.

Exporters of nine highly sensitive graphite products in China now need to apply for permits, according to a joint notice from the Commerce Ministry and the General Administration of Customs in October.

China’s electric vehicle exports to EU hit record level amid subsidy probe

And on Thursday, China’s anti-spy agency listed safeguarding of the country’s supplies of critical minerals among its top tasks, accusing the West of trying to contain China’s development.

“Critical mineral resources are the important basis for serving the development of new industries. They are the top priority for resource security,” the Ministry of State Security said in a post on its official social media account.

While most Democratic lawmakers praised the Treasury Department’s new rules as necessary to support climate goals, Senate Energy Committee chairman Joe Manchin was an exception, vowing “to reverse this unlawful, shameful proposed rule and protect our energy security”.

Representative Debbie Dingell, a Michigan Democrat, was more representative of the party’s response.

She said the rules aimed to strike “the right balance” between getting China out of EV supply chains while ensuring EV vehicles remain affordable.