Advertisement

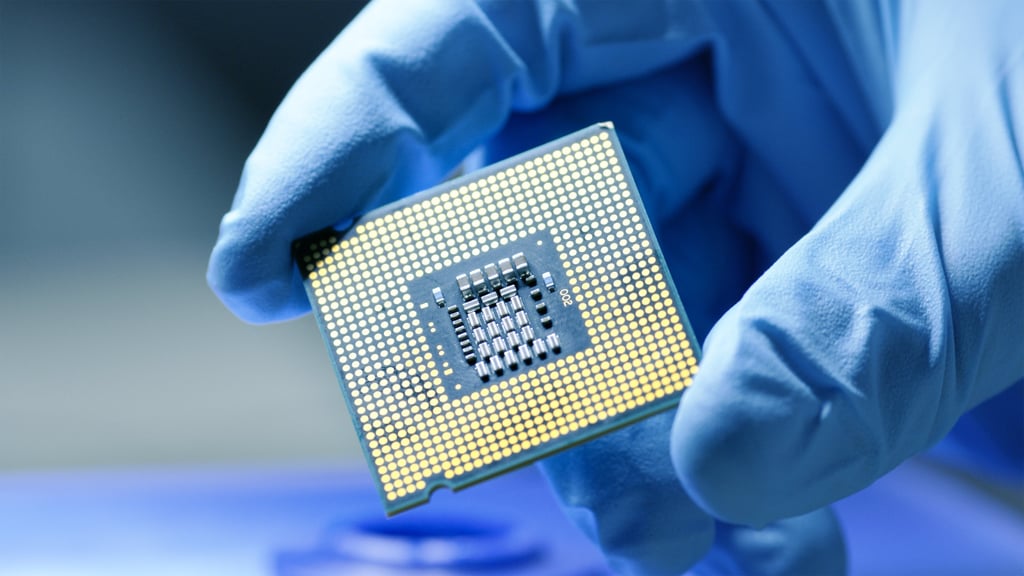

US-China tech war: second-tier ‘legacy chips’ at forefront of battle for semiconductor supremacy

- In race for cutting-edge technology, the realisation is rising that older-generation chips are still vital to military use as well as cars and consumer electronics

- Slew of US policy actions targeting China expected ahead of American presidential election as rivals pour in resources

Reading Time:6 minutes

Why you can trust SCMP

27

Khushboo Razdanin Washington

When the US Commerce Department this week announced its largest award to date under the US$50 billion Chips for America programme, it signalled that Washington’s semiconductor battle with Beijing would increasingly focus on second-tier “legacy chips”.

In all, about US$1.5 billion would go to leading American chip maker GlobalFoundries to help the firm expand two manufacturing facilities, open a new one and “strengthen domestic legacy chip supply”, the US government said on Monday.

The older-generation chips are traditionally made using 28-nanometre or larger etching technology. GlobalFoundries also produces chips measuring 12nm and above, which it has called “essential chips”. Such integrated circuits are still used widely in cars, home appliances and consumer electronics.

Advertisement

“I wouldn’t be surprised if some Western countries begin to either discuss or perhaps even implement restrictions on the use of Chinese chips,” historian Chris Miller, author of the 2022 book Chip War, told the Post, adding that legacy chips were going to be an “increasing part of public discussion and debate in Western countries”.

These contrast with the most advanced chips measuring under 8nm in size and used in products like smartphones and supercomputers.

Advertisement

Neither the US nor China has yet been able to make the world’s most cutting-edge 3nm chips, manufactured exclusively by Taiwan, although both are trying, and this pitched battle has sharpened their attention on the legacy category.

Advertisement

Select Voice

Select Speed

1.00x