Chinese rail company CRRC withdraws bid from Bulgarian public tender amid EU inquiry

- The European Union’s investigation was the first use of a foreign subsidies regulation designed to stop state handouts from distorting the bloc’s single market

- CRRC Qingdao Sifang Locomotive’s bid to provide and maintain 20 electric trains was reported to be around half that of a Spanish competitor

A Chinese train maker has withdrawn from a public tender in Bulgaria after the European Union launched an investigation into a bid it said was undercutting local firms.

The inquiry, announced last month, was the first of its kind and marked the maiden use of a foreign subsidies regulation designed to stop state handouts from distorting the EU’s single market.

CRRC Qingdao Sifang Locomotive Co, a division of state-owned rolling stock manufacturer CRRC Corporation, had hoped to provide 20 electric push-pull trains and their maintenance.

Its bid was reported to be around half that of a Spanish competitor, with the European Commission announcing that the Chinese company had withdrawn its bid on Tuesday evening. Brussels had alleged that CRRC had received almost US$2 billion in state subsidies.

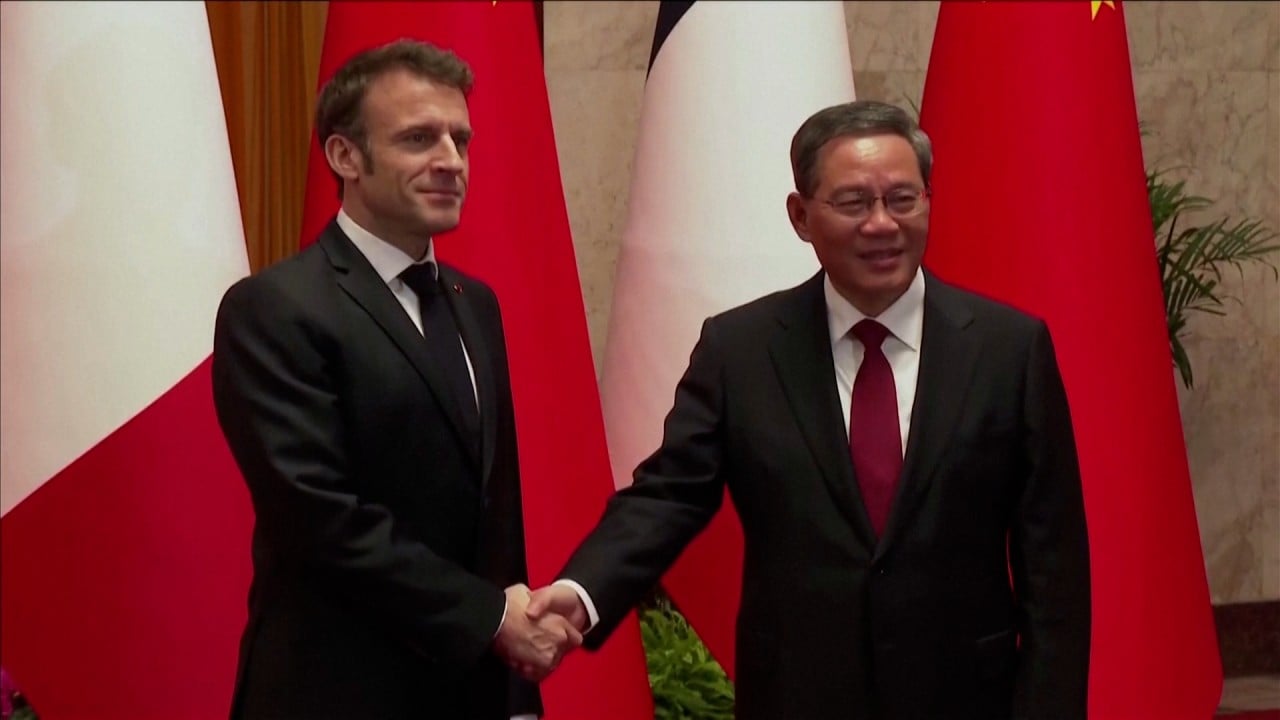

“In just a few weeks, our first investigation under the foreign subsidies regulation has already yielded results,” said Thierry Breton, the commissioner for internal market of the European Union.

“Our single market is open for firms that are truly competitive and play fair. We will continue to take all necessary measures to preserve Europe’s economic security and competitiveness – with assertiveness and speed,” the French commissioner added.

The commission believed that CRRC had not declared the state subsidies it had received in its bid, which enabled it to hugely undercut Talgo, a privately owned Spanish rail company, which was the only other bidder.

Brussels has been adding to its commercial weaponry in recent years with a view to countering what it considers unfair competition from China. The wielding of the foreign subsidies regulation against CRRC was the latest in a series of trade defence measures taken with this in mind.

It is expected to soon make use of a new international procurement instrument designed to punish companies that do not offer reciprocal access to their public tenders. EU sources say an investigation into the closed Chinese medical device procurement sector is imminent.

China berates EU at World Trade Organization for policies it calls unfair

There are additional anti-subsidy or anti-dumping investigations into industries in China that range from electric vehicles and biodiesel to mobile access equipment and electric bicycles.

The highest-profile of these, the electric vehicles probe, is expected to result in duties applied to imports from China starting in July.

Officials expect such investigations to continue owing to the level of subsidies they observe in the Chinese economy. They believe that a relatively open European market will be flooded with cheap Chinese imports because of the lack of consumer demand in China.

The issue of overcapacity has become a dominant element of the EU-China debate.

“Going forward, our successors will have to stay on watch over possible overcapacities in clean-tech and digital sectors, in addition to existing concerns in traditional sectors,” EU trade chief Valdis Dombrovskis said last week in his final address to the European Parliament before the elections.

Meanwhile the bloc is putting the finishing touches to new legislation that will also tackle what it views as malign business practices in China.

Laws banning products made using forced labour from the EU market and requiring big companies to audit their suppliers for social and environmental abuses are set to be sealed before elections in June.

China is unlikely to take the tougher approach lying down. In response to the electric vehicle probe, which was supported by the French government, it began an investigation into the dumping of liquor products, including French brandy and cognac.

An editorial in the state-run People’s Daily on Tuesday railed against “double standards” in the EU debate.

‘Just the beginning’: Chinese EVs face uphill path as US, EU put down roadblocks

“This new variant of ‘China threat’ theory is just a pretext for certain Western countries to poison the environment for China’s domestic development and international cooperation and take more protectionist measures for their own industries,” it read.

CRRC has long been a topic of debate in the EU. In 2019, the commission blocked the merger of the European engineering giants Siemens and Alstom, the continent’s two biggest providers of rail equipment. Many commentators had argued that the merger would have created a “European giant” that could have competed with CRRC in third markets.

A Chinese business group in Europe expressed “deep concern” about the events.

“While we sympathise with the Chinese company’s decision, it’s crucial to highlight that this saga adds to the evidence suggesting the EU side wields the regulation as a new tool to deter foreign companies, coercing them into withdrawal and subsequent business exclusion,” read a statement from the China Chamber of Commerce to the EU.