Is China’s first tax cut in 7 years too little, too late to boost consumer spending?

China cuts individual income taxes for first time since 2011, but hopes for consumer spending boost questioned

China’s taxpayers will be pocketing more of their pay from October after the country’s top legislature agreed on Wednesday to raise the income tax threshold to 5,000 yuan (US$730) per month.

Wage earners, who currently take home 3,500 yuan per month before tax, are waiting to learn how much tax deductions will be expanded from 2019, according to People’s Daily.

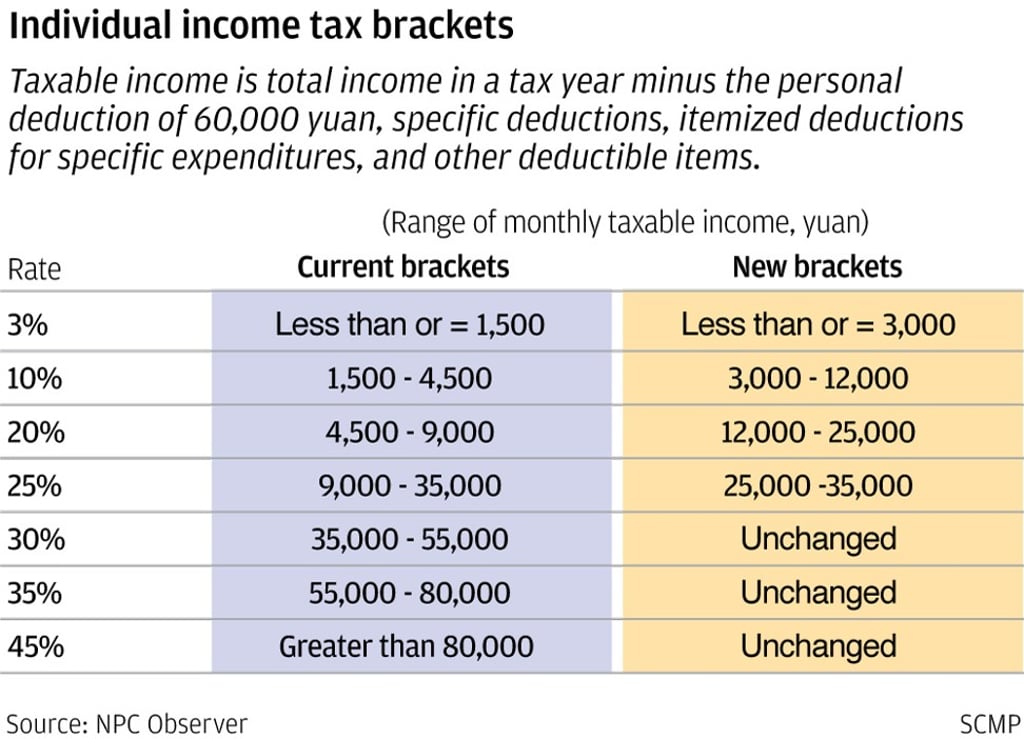

The higher threshold, and the proposed tax rates with the highest bracket at 45 per cent, were unchanged from a previous proposal, which economists argued was too modest to increase consumer spending power.

Tax cut back on the table for China’s legislature but impact on growth likely to be modest

The implementation date of the tax cut was brought forward to October 1 from January 1.

“The revised bill is comparatively mature and [we] agreed to approve and implement it as quickly as possible to let people enjoy the tax cut,” the official newspaper reported on Thursday, citing several participating lawmakers.

The Standing Committee of the National People’s Congress, China’s legislature, is scheduled to give final approval to the proposal on Friday. It will be the first tax cut since 2011.

The tax cut is part of the government’s plan to stabilise the world’s second largest economy, which has started to slow due to the effects of Beijing efforts to reduce risks in the financial system and the effects of the trade war with the United States.