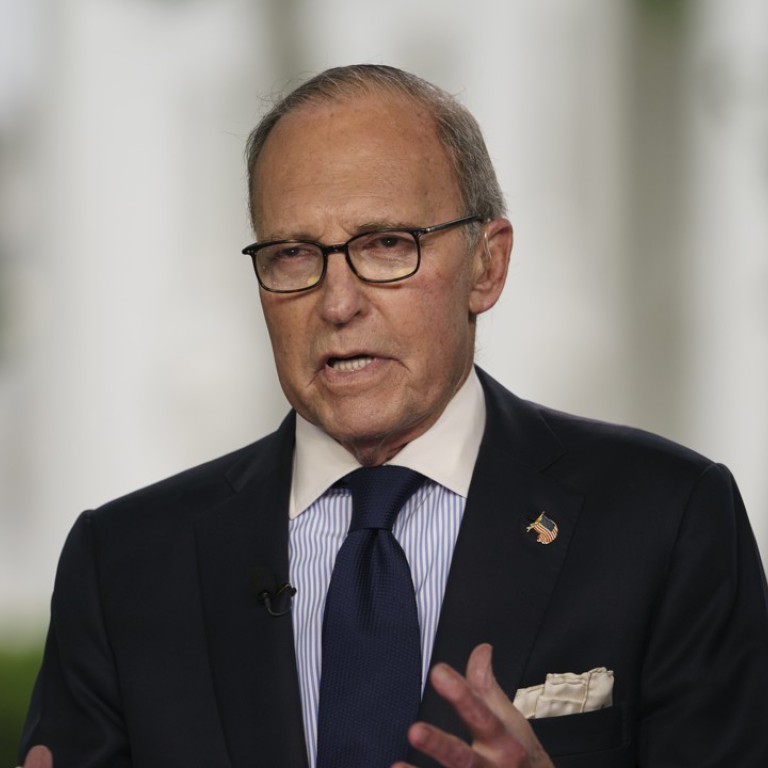

US will push China to let its firms hold majority stakes in companies, says Trump economic adviser Larry Kudlow

American government and business have long complained that restrictions on equity holdings are used to force technology transfers

The United States will pressure China to allow US investors to hold a majority stake in their Chinese ventures in the latest round of trade talks, according to Larry Kudlow, a senior economic adviser to Donald Trump.

The US advance team for the trade talks landed in Beijing on Wednesday afternoon and preparatory discussions are under way ahead of the start of the formal talks on Saturday.

Chinese observers have said Beijing was expected to continue loosening restrictions on foreign investors and companies at its own pace rather than yielding to US pressure – especially given Trump’s inconsistent approach towards China.

The Trump administration has accused Beijing of using restrictions on ownership and technology licensing, which prevent foreign companies holding a majority stake, to force US investors to transfer their most sophisticated technology to their Chinese joint venture partners.

Foreign businesses have complained that mandatory technology transfers are rife in the car, semiconductor and new energy industries.

In a radio interview late on Wednesday, Kudlow, director of the National Economic Council, said that in addition to lowering trade imbalances, the issue of equity ownership has been raised during the previous two rounds of talks, but China had not seriously addressed the issue.

“American businesses, in many cases, are forced to go into joint ventures with Chinese companies in order to produce,” he told The John Batchelor Show.

He continued that because US companies are not allowed more than a 49 per cent stake, the Chinese majority owners can“force the transfer of technology to these new companies they create”.

“The only way to stop the transfer of technology is to give American companies ownership, move up to 51 per cent, move up to 55 per cent and move up to 100 per cent, then we won’t be forced to lay the blueprints on the table and open up the tech door,” Kudlow said.

He also told the programme that if China agreed to the demands “that would be news and would be encouraging. So far, they haven’t”.

The first round of trade talks in Beijing in early May ended without agreement because of the deep divisions between the two sides.

The second round ended with China’s agreement to make “meaningful” increases in its purchases of US energy and agricultural products to cut its trade surplus with the US – a key demand of Trump’s.

But there were no details as to what this would entail, and this week’s visit by the US party, led by Commerce Secretary Wilbur Ross, is expected to nail down the specifics.

The US has been pushing for sweeping concessions from China, including an agreement to cut the trade gap by US$200 billion by 2020 and an end to state subsidies for industry.

It also wants China to offer non-discriminatory market access, including the removal of foreign investment restrictions and foreign ownership and shareholding requirements.

China has already said it will further open up access to its markets and lower equity caps, saying this move also serves its own interests.

Zhao Xijun, a finance professor with Renmin University, said the major difference between the two countries was in the timing of these reforms.

“Loosening equity caps has been an area of discussion between China and the US for many years. When promoting the reform of state-owned enterprises, the Chinese government has different considerations in different sectors,” he said.

“We are not clear about what the outcome and impact would be if we fully liberalised some sectors,” he added.

China’s financial regulators are revising the rules to raise the caps for foreign investors in brokerage, wealth management, banking and insurance.

Beijing will also phase out equity controls in the car-making sector within five years.

China’s banking and insurance watchdog is also seeking public feedback on the revised rules governing foreign insurance companies, which focuses on raising equity caps in joint life insurance companies and fewer restrictions on setting up branches.

The US Chamber of Commerce in China welcomed the recent announcements, but said US investors still lacked access to some sectors such as agriculture and entertainment sector and were subject to a 50 per cent equity cap in cloud services.