Xi Jinping’s trip to Africa cements continent’s growing ties to China, and Beijing’s loans

Worries that the ambitious push for belt and road projects will leave African nations saddled with debt

China is doubling its commitments to Africa as it builds support from the developing world amid an escalating trade war with the US.

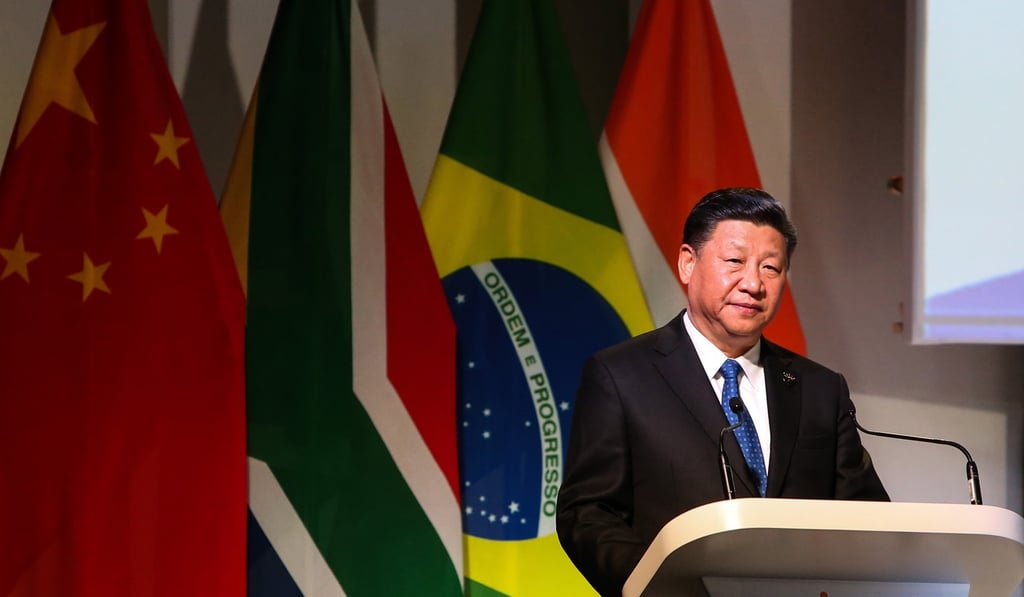

The moves came during Chinese President Xi Jinping’s recent tour of four African nations, capped last week by the BRICS meeting of emerging economies – Brazil, Russia, India, China and South Africa, which hosted the summit.

But some observers say that as Beijing is ambitiously pushing ahead Xi’s flagship investment and infrastructure project, the “Belt and Road Initiative”, China still faces the challenge of debt problems on the world’s second largest continent.

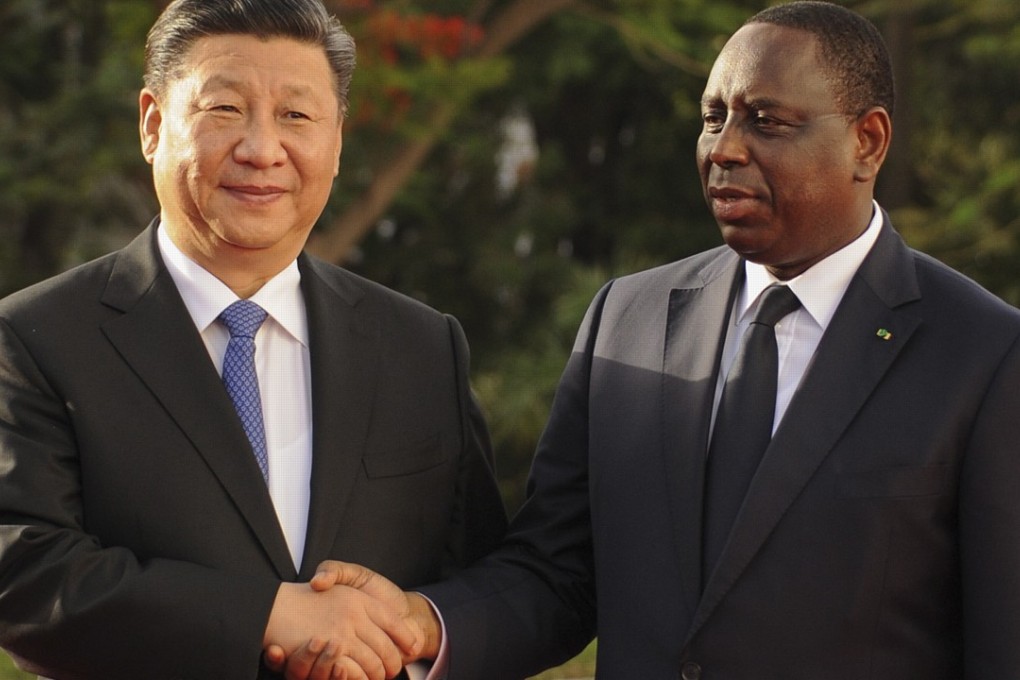

Xi’s visits to Senegal, Rwanda, South Africa and Mauritius, his first overseas trip since starting his second term in March, came as the US-China trade war intensifies, with US President Donald Trump accusing Beijing of unfair practices and stealing innovation, and threatening punitive tariffs on hundreds of billions of dollars of Chinese products.

In coastal West Africa, Xi and Senegalese President Macky Sall oversaw the signing of agreements on belt and road projects, Xi’s plan to link countries in a China-centred trading network. Under the strategy, Beijing will invest hundreds of billions of dollars in infrastructure, such as roads and ports, with the goal of connecting China with the rest of the world.