US carmakers hit with Chinese tariffs as trade war changes gear

New 25 per cent duties on vehicles and parts targets strategic US sector already facing competition from Europe, with implications for its labour market

China has added automobiles to its revised list of US$16 billion worth of US goods targeted by its retaliatory tariffs, removing crude oil in favour of items that could do more damage to the US economy.

The updated tariff list, published by the Ministry of Finance on Wednesday, will slap 25 per cent duties on 333 products instead of the initial 114 identified in mid-June, keeping the total value of the goods unchanged.

The new list removed some imports, including crude oil, from the crossfire. Instead, a vast array of vehicles, scraps and recyclables, petrochemicals, and medical equipment were added to the list, in a move that analysts say will inflict more pain.

The latest measures were a tit-for-tat response to US tariffs on US$16 billion of Chinese goods that were finalised by Washington on Tuesday, with both sides ready to impose the new duties on August 23 in a further intensification of the bitter trade war between the world’s largest economies.

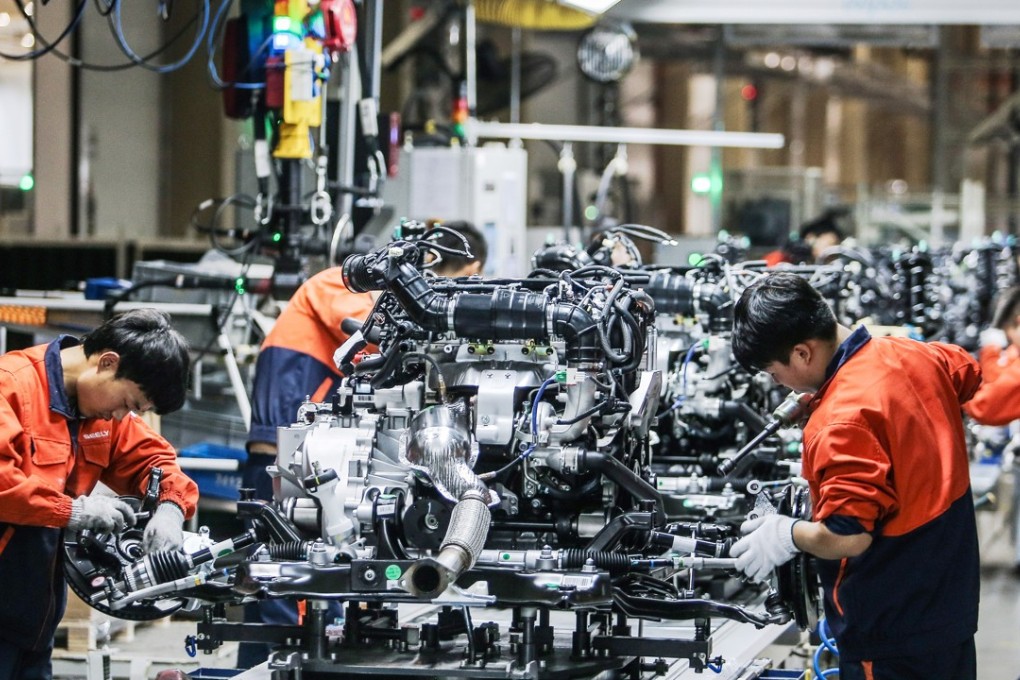

Last year, the total worth of US exports to China in passenger cars, trucks and vehicles, and various auto and engine parts reached over US$13.9 billion.