Why the ‘honeymoon is over’ between the Czech Republic and China

- President Milos Zeman says Beijing has not fulfilled its promises and he will not attend this year’s 17+1 summit

- He had hoped the country would be an ‘unsinkable aircraft carrier’ for Chinese investment in Europe, but now Zeman has changed his tone

And China could face similar trouble with other nations looking for more at this year’s “17+1” summit with Central and Eastern European nations in Beijing.

Zeman was a strong advocate for deepening economic ties with China and investments were on the rise, for a time. But Zeman and other Czech leaders have increasingly questioned the nature of the relationship, especially as the economic benefits have dwindled.

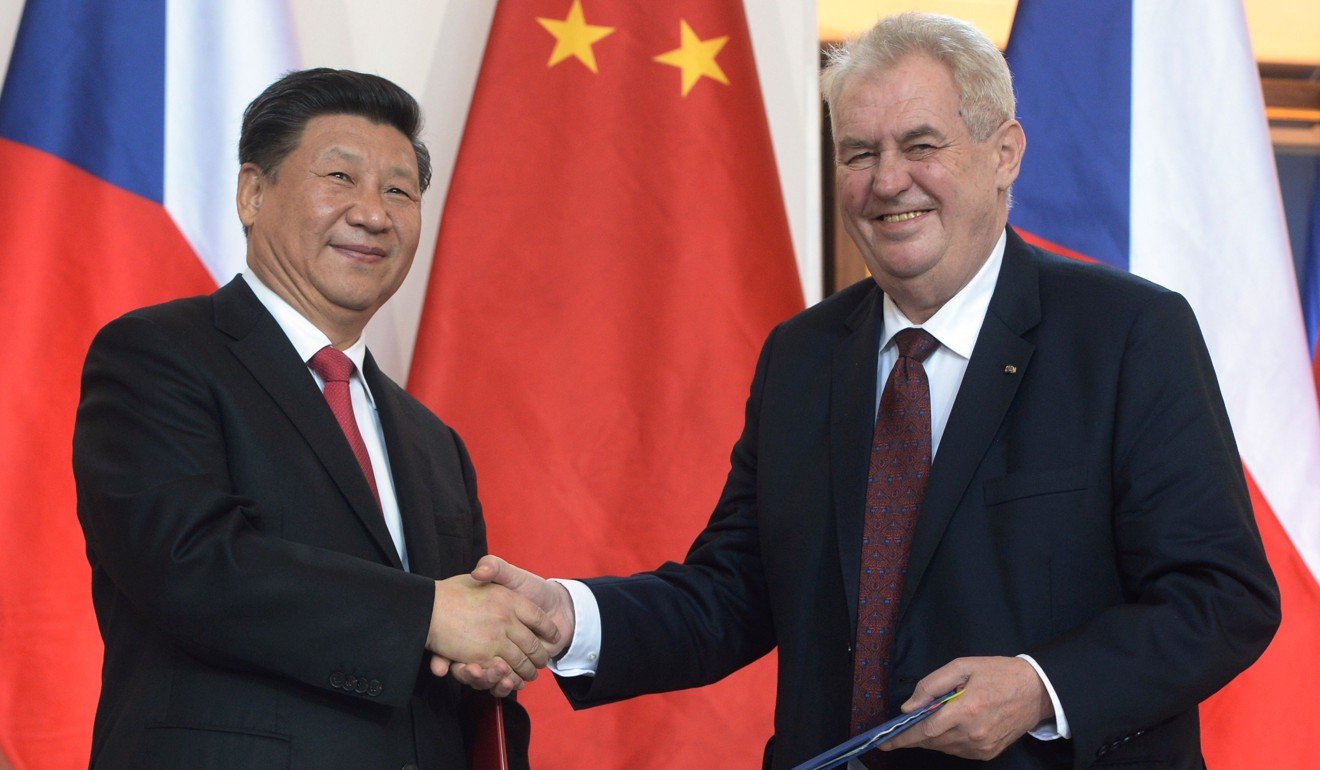

Relations with China grew after Zeman, who is in his second term as president, took office in 2013. The peak came in 2016, when Xi visited the country and promised more Chinese investment. That year, Zeman said he hoped his country would be an “unsinkable aircraft carrier” for Chinese investment in Europe.

But since then, the investments have faltered, not just in the Czech Republic, but across Central and Eastern Europe, and Zeman has changed his tone. In April, he called the lack of investment in his nation a “stain on the Czech-China relationship”, in an interview with Chinese state broadcaster CCTV.

“I suppose he feels that promises made to him personally were not fulfilled, since he has had personal contact with Xi Jinping on a number of occasions … he surely feels that his commitment to China has not been reciprocated,” said Jeremy Garlick, assistant professor of international relations at the University of Economics, Prague.

Zeman has visited China five times and was the only EU leader to attend a Chinese military parade in 2015 to mark the 70th anniversary of the end of World War II.

I suppose he feels that promises made to him personally were not fulfilled, since he has had personal contact with Xi Jinping on a number of occasions

Rudolf Furst, a senior researcher at Charles University in Prague, said Zeman had given up his unequivocal support for a pragmatic pro-Chinese agenda.

“Chinese investments flow in Czechia have remained low, and not matching the Czech structural needs for stimulating the GDP growth,” he said.

Most of the 17+1 member states, except for Hungary and Greece, were now “perceiving the Chinese investment promises as merely virtual”, Furst said. “The 2012 new wave of China’s honeymoon is over.”

Rhodium Group has tracked Chinese foreign direct investment data in Europe since 2000. Its data shows that while total Chinese investment in the Czech Republic had grown to about €1 billion (US$1.1 billion) by 2018, growth has been slow, while neighbouring countries like Italy and Germany had some 15 to 20 times more investment in their economies.

Cumulative Chinese foreign direct investment in the Czech Republic between 2000 and 2017 sat at about €600 million, and grew to €1 billion in 2018, while that in neighbour Germany grew from €20.6 billion to €22.2 billion over the same period.

The picture is much the same for Eastern Europe as a whole – Austria, Bulgaria, the Czech Republic, Hungary, Poland, Romania and Slovakia received just 2 per cent of China’s overall investment in Europe in 2018, according to the data.

Countries like France, Germany and Britain meanwhile received 9, 12 and 24 per cent, respectively.

Czech Republic becomes unlikely front line in China’s soft power war

Other Czech politicians have also taken a tougher line on China. Babis warned of a “considerable” trade deficit with China in 2018. The country exported US$1.8 billion of goods to China in the first nine months of last year, down 4.3 per cent from a year earlier. But it imported US$11.7 billion of products from China – by far its largest source of imports.

And after Zeman’s announcement this week, the Green Party, which holds a handful of seats in the Czech Senate, called for Prague to pull out of the 17+1 platform altogether.

Richard Turcsanyi, director of the Central European Institute of Asian Studies at Palacky University in the Czech Republic, said both Prague and Beijing were expecting too much.

“I see the current sharp downturn of Czech-China relations being related to very high and unrealistic expectations which existed perhaps on both sides, driven to a large extent by the ignorance of each other,” he said.

“Due to the impressive economic growth of China and also its international economic expansion, many expected that China could quickly become a significant economic actor in the Czech Republic,” he said.

“In reality, the Czech Republic and China are not natural trading or investment partners. They are more of competitors when it comes to moving up the value chain, rather than complementary economic partners – contrary to what has been claimed for years as part of the diplomatic exchanges.”

And although Zeman has been critical of the US-led campaign against Huawei, Babis ordered Czech government institutions to stop using products from the Chinese tech giant last year.

“There has been a breakdown of trust in China, at the level of the public, the media, and now even the president,” Garlick said.