US, EU rare earth race to break China dominance ‘risks fuelling global rivalry’

- Study finds efforts by Washington and Brussels to reduce reliance on Chinese supplies could intensify competition for access

- Rare earths are a vital component of many hi-tech industries including electric car batteries and solar panels

China’s dominance of rare earths supply is a concern in the West

In a study released on Wednesday, researchers at London-based think tank Overseas Development Institute (ODI) said: “China’s dominance is likely to erode in the near term amid efforts by the US and European Union to expand their processing capacity and reduce their rare earth elements reliance on China, which has tightened export regulations amid rising geopolitical tensions.”

The study said the growth of hi-tech industries with specialised manufacturing needs had increased global attention on rare earth elements, valued at US$8 billion in 2018 – “a fairly small share of the global metals and minerals trade but a significant component in advanced manufacturing value chains”.

Rebecca Nadin, ODI’s director of global risks and resilience, said Beijing knew its innovation-driven growth required secure energy and mineral resources, including rare earth elements and other technologically critical minerals.

“Expect to see even more emphasis on building up ‘strategic mineral resource reserves’ and expanding exploration, as well as a commitment to taking part in ‘global mineral resource governance’,” said Nadin, who co-authored the report on China’s outward investment appetite and its implications for developing countries.

China has strategically positioned itself to become the dominant player in the extraction and processing of the elements, controlling about 36.7 per cent of the world’s rare earth elements reserves, according to the study.

Australian firm signs South Korea rare earth deal as mineral race heats up

China produces 140,000 tonnes – equal to about 58 per cent of global production in 2020 – according to the US Geological Survey. The US is in second place, at 15.8 per cent, while the world’s third-largest rare producer is Myanmar, with 12.5 per cent.

Beijing also holds 85 per cent of the world’s processing capacity for rare earth ores, and even countries where the elements are mined – including the US – ship their unrefined ores to China for processing.

A growing number of Chinese companies are looking abroad for alternative sources of metals, especially in Myanmar, Australia, the US, Burundi, Greenland and Madagascar.

03:17

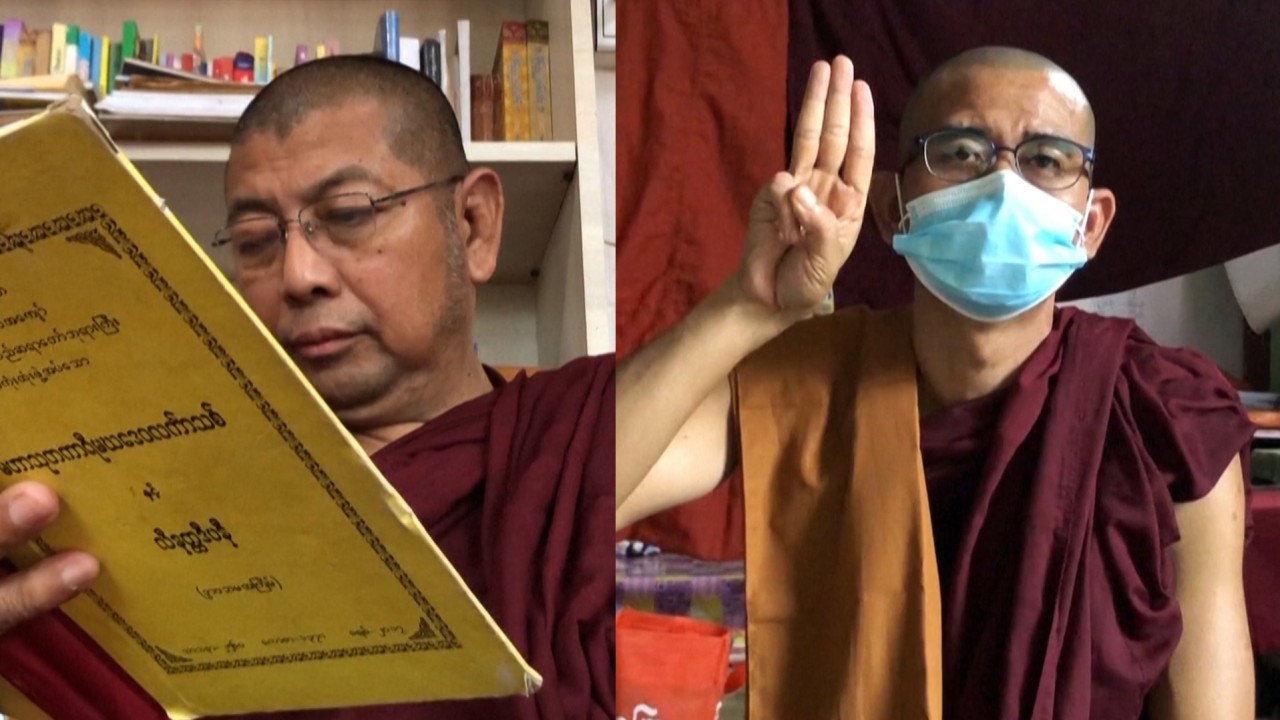

Buddhist monks in Myanmar divided over military coup

Australian firm Greenland Minerals (GME) has engaged with Chinese partners since 2012 to develop the Kuannersuit (Kvanefjeld) mine on the North Atlantic island. GME’s largest investor is Chinese rare earths giant Shenghe Resources, which has close ties to Chinalco, one of the six state-owned firms that control China’s rare earths production quotas, according to the ODI study.

In Burundi, the Gakara Rare Earth Project – one of the richest rare earth deposits in the world – exports its entire output to China.

ODI warned supply disruptions would remain a long-term concern, given political unrest in Myanmar and the concentration of production around conflict zones in Kachin state near the Chinese border.

But the logistical supply chain nightmare caused by last year’s closures of ports and borders in many countries because of the pandemic had already prompted the US and EU to look again at their critical metals as well as other sectors such as pharmaceuticals.

Any further disruption to their supply chains for these products would hurt key industries, according to Washington and Brussels.

The US said recently it would rebuild its rare metals supply chain to reduce its dependence on China for the critical metals and rare earth minerals that power its aviation, military and car industries. The Mountain Pass mine in California has been reopened to rebuild rare earth production.

The European Union last year identified 30 raw materials as critical for industries and said China’s dominance in the market “renders the value chains extremely vulnerable”.

Japan moves to secure rare earths to reduce dependence on China

She said recent “efforts to strengthen critical minerals supply chains include the US’ development of midstream capabilities, the EU’s orchestrated support for its battery sector, and Japan’s stockpile modernisation and resource development abroad”.

“Competition over critical minerals supplies is also rising between import-dependent economies. Such competition could hinder effective international partnerships that might otherwise mitigate existing risks to supply chains.”

But there are growing concerns over the destructive nature of the extraction of the metals. “This report notes the overwhelming cost of the necessary pollution clean-up faced by some of China’s rare earth elements extraction hubs. This underscores the tricky decisions before developing countries in weighing up the economic opportunities and environmental risks of rare earth elements mining,” Nadin said.

“The growth of China’s extractive industry was accompanied by severe water and soil pollution that has in some regions muddled the overall benefits of the industry for extraction hubs,” the ODI researchers said, pointing to official clean-up cost estimates of up to US$5.5 billion in Jiangxi province, southern China.