As nations build 5G networks, US national security fears about Huawei aren’t broadly shared, report finds

- ‘A common security policy towards Chinese investment in digital infrastructure is unlikely’, a new study by the Overseas Development Institute says

- Some countries are following the hardline US policy, so Huawei may have to focus on building self-sufficiency in key components such as chips

In a study released on Wednesday, the London-based think tank the Overseas Development Institute concluded that “a common security policy towards Chinese investment in digital infrastructure is unlikely”.

The study also said “growing concerns about technology dependence are prompting some wealthier developed countries to reassess engagement with China in digital infrastructure construction, but poorer developing countries appear reluctant to follow suit”.

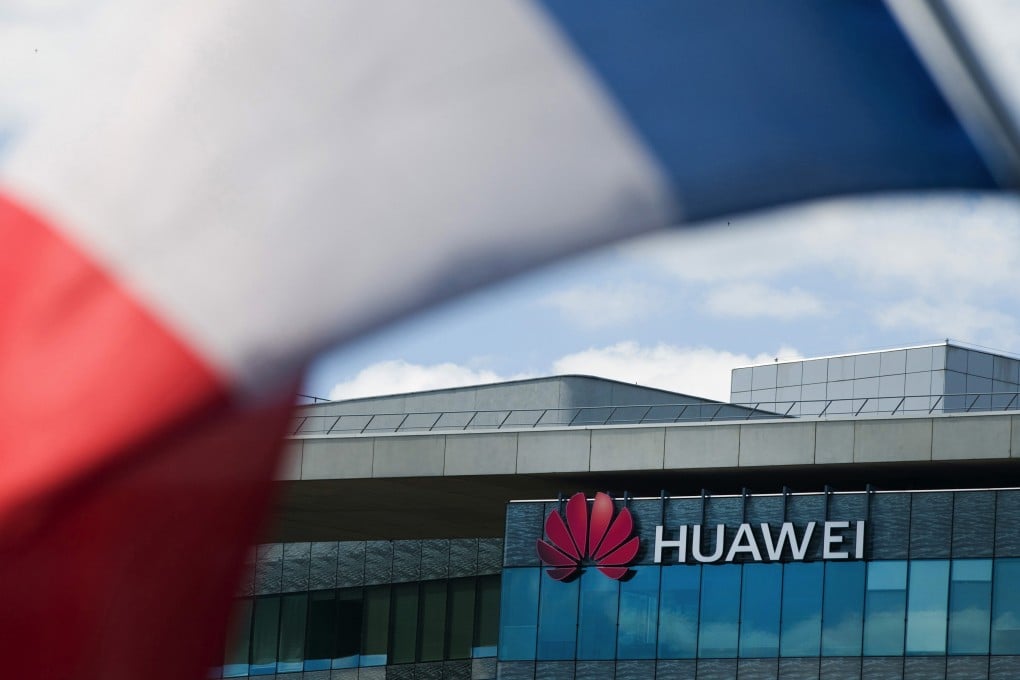

The Shenzhen-based telecommunication giant plans to build a €200 million (US$244 million) manufacturing facility in France. The plant, which is expected to open in 2023, will make equipment for the production of wireless base stations for Huawei customers in Europe, according to a company statement.