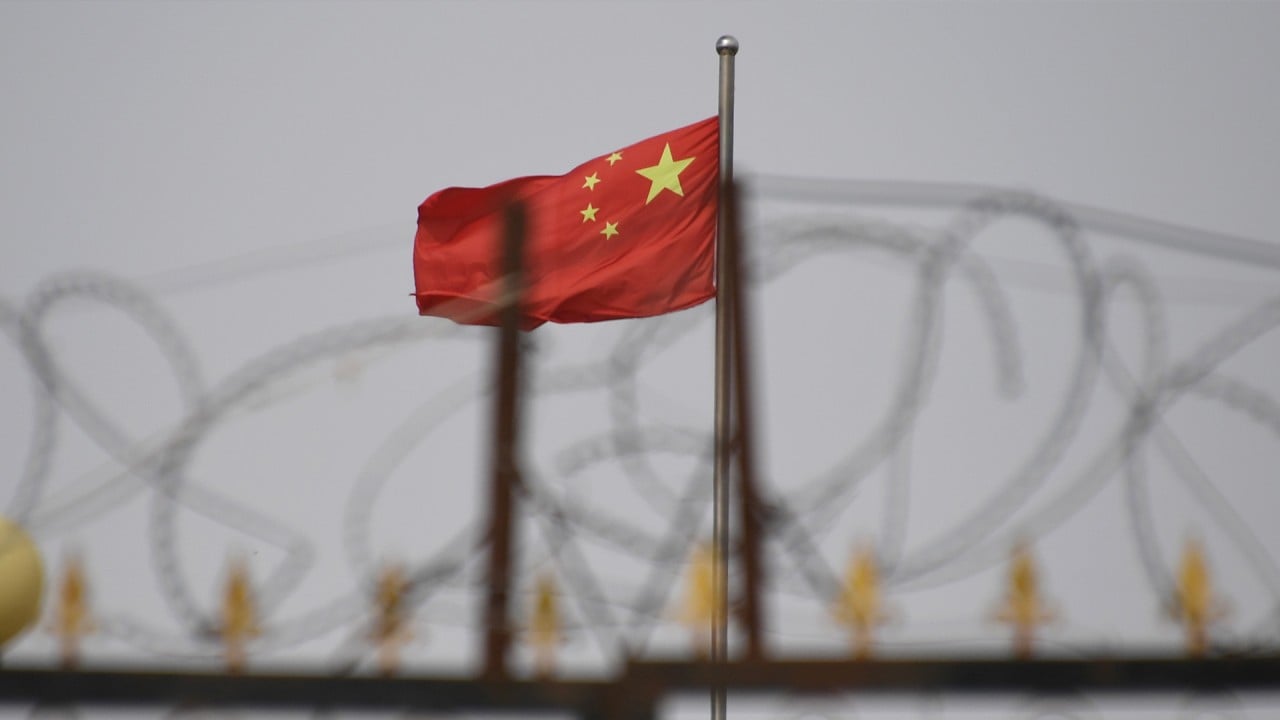

China’s European investments in downward trend, 10-year low amid coronavirus pandemic, political tensions: report

- Covid-19 and rising political tensions blamed for 10-year low in Chinese investments in EU countries and Britain

- Fears Chinese investors would use pandemic to snap up distressed assets prove unfounded, as total global spend drops

EU, US launch trade, technology council to outcompete China

OECD statistics showed global FDI volumes plunged by 38 per cent in 2020, compared to the previous year – their lowest level since 2005 – against a backdrop of international disruption to cross-border mergers and acquisitions (M&As) as a result of the pandemic.

Fears that Chinese investors might use the pandemic as an opportunity to buy distressed foreign assets hit by recession proved unfounded. China’s total global outbound investment also dropped to a 13-year low, with completed M&A transactions of just €25 billion (US$30.3 billion), down 45 per cent from 2019, the report said.

There were multiple reasons for the decline, according to the report, in addition to the uncertainty caused by Covid-19. These included persistent outbound capital controls in China, heightened regulatory scrutiny of Chinese investments in Europe, and deteriorating public sentiment towards China.

Germany remained the top recipient of Chinese capital, with 30 per cent of the total, while Poland rose to second place with a record €815 million (US$988 million) in Chinese investment. The big loser was Britain, which saw a 77 per cent year on year plunge, although it remained at number three with 12 per cent of China’s European investments.

Joe Biden’s European diplomatic blitz will have China woven ‘throughout every meeting’

China’s private sector investors were the most affected, with their share of FDI dropping by a huge 49 per cent year on year, to €5.3 billion (US$6.4 billion). Despite facing increased scrutiny, investments by state-owned enterprises maintained steady at €1.2 billion (US$1.4 billion) – an 18 per cent share, compared to 11 per cent in 2019.

According to the report, Chinese investment in Europe was more diversely distributed among different sectors in 2020, after the previous year’s focus on infrastructure, because of the smaller average size of individual outlays. However, transport, construction, infrastructure and ICT were still the top targets for Chinese buyers.

The report predicted Chinese FDI was unlikely to pick up in the coming year, despite the economic recovery. “As EU-China relations enter a new phase, the greatest risk to China’s FDI into Europe is the souring political relationship,” it said.

China’s activities around the South China Sea and Taiwan, as well as human rights issues, could exacerbate the souring political tensions and affect economic ties, the report said. “The CAI’s adoption by 2022 is now highly unlikely. Whatever the CAI’s shortcomings, the failure to conclude it could lead to slower progress on true reciprocity and erode public tolerance towards Chinese FDI.”