Advertisement

China is building a nuclear power plant in Argentina as it looks to Latin America

- New deal is the latest Chinese effort to engage with countries in the region using its cutting-edge clean energy technology

- But some projects have met opposition over environmental issues, and there is US pressure not to deepen ties with Beijing

Reading Time:3 minutes

Why you can trust SCMP

60

A recently inked deal to build a nuclear power plant in Argentina is the latest effort by China to engage with Latin American countries using its advanced clean energy technology, part of a broader push to expand its influence in the region.

The US$8 billion plant, known as Atucha III, will use China’s home-grown Hualong One design. Located near Lima – about 100km (62 miles) northwest of the capital Buenos Aires – it will be Argentina’s fourth nuclear power station and will have an installed capacity of 1.2 gigawatts and an initial life of 60 years.

Beijing and Buenos Aires agreed to cooperate on the project back in 2015, but progress had stalled until the contract was signed between state-owned China National Nuclear Corporation and Nucleoelectrica Argentina on January 31.

Advertisement

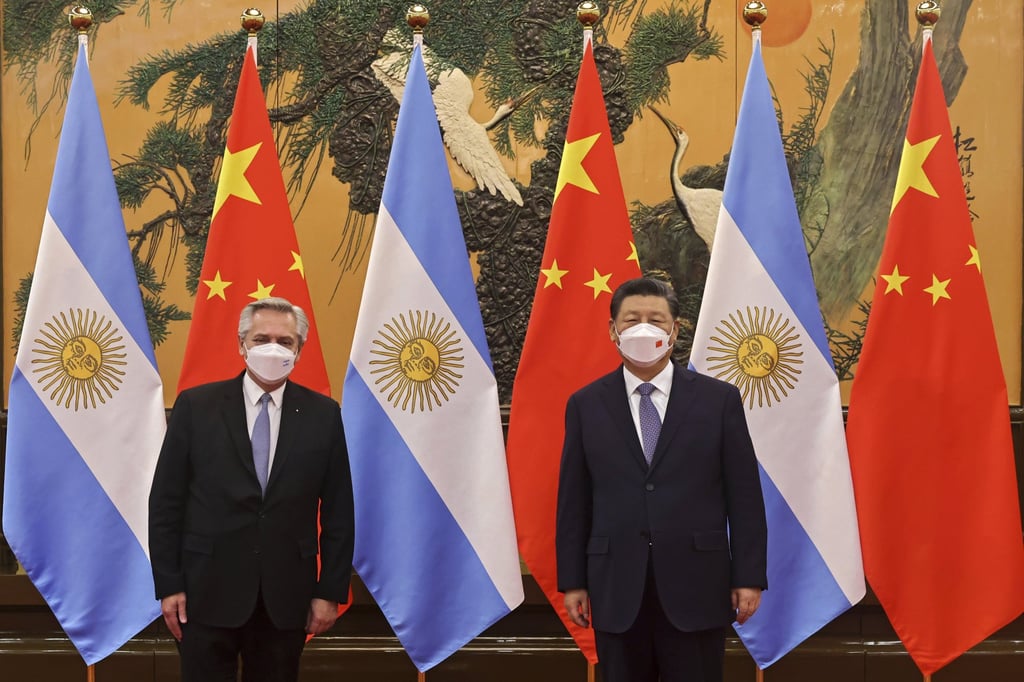

Days later, Argentina agreed to join China’s global Belt and Road Initiative – the first major Latin American country to do so – with President Alberto Fernandez signing a memorandum of understanding during a visit to Beijing.

Meeting Fernandez on Sunday, Chinese President Xi Jinping said the two nations should push forward existing hydropower and railway projects and deepen cooperation on trade, industry, infrastructure and investment, according to state news agency Xinhua.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x