China-Africa relations: IMF report says Chinese loans are not main debt burden in sub-Saharan region

- Beijing the largest bilateral official lender to countries in Africa but share in sub-Saharan overall sovereign debt still relatively small, according to report

- IMF is distancing itself from US ‘debt trap diplomacy’ theory along with new American narrative China’s economy is on brink of collapse, says analyst

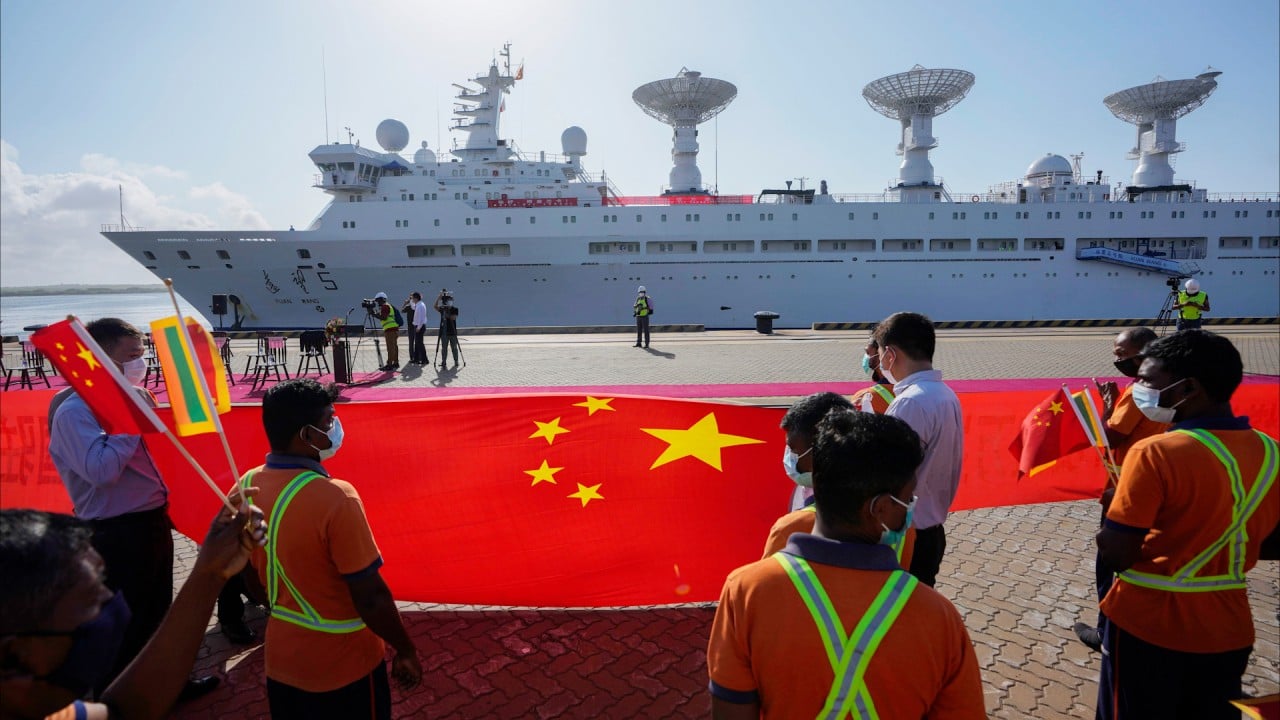

China’s share of the total sub-Saharan Africa external public debt rose from less than 2 per cent before 2005 to about 17 per cent – or US$134 billion – in 2021, according to the IMF. The World Bank’s International Debt Report said sub-Saharan Africa’s total external debt stood at US$790 billion in 2021, a figure that more than doubled in about a decade.

But China’s share in sub-Saharan Africa’s overall sovereign debt, or public debt, was still relatively small – about 6 per cent of the total – the IMF said.

“It is noteworthy that the debt owed to China has not been the principal contributor to the region’s public debt surge in the past 15 years,” the IMF said in a side report about sub-Saharan Africa’s economic relations with China that it released early this month.

Some 60.9 per cent of the region’s public debt is now domestic commercial borrowing with higher interest rates and shorter maturity, while multilateral lenders hold 13.7 per cent of the debt.

China has denied the debt trap allegations. Instead, it has pointed the finger at multilateral financial institutions and commercial creditors which account for more than 80 per cent of sovereign debt for developing countries.

The IMF does not wade into political arguments to avoid hindering its mission of helping member countries overcome balance-of-payments issues.

The US holds an effective veto power over the IMF with 16.5 per cent of the fund’s voting power, followed by Japan at 6.14 per cent, China at 6.08 per cent and Germany at 5.31 per cent. But there has been a push from developing countries for the IMF and other multilateral institutions to be reformed.

Mark Bohlund, a senior credit research analyst at REDD Intelligence, said the solvency issues of many lower middle-income countries was mainly due to domestic debt because it accounted for the majority of interest costs for most of these countries.

On the other hand, Bohlund said, interest payments to commercial external creditors weighed on the current accounts of many countries while the relatively short repayment periods on Chinese-financed infrastructure projects was adding to low-income countries’ financial problems.

“There is a strong worry that many countries will not regain market access when US rates come down,” Bohlund said, adding that many governments had had too much market access, “both domestic and external, over the past decade”.

‘Freewheeling days’ are over? China’s belt and road plan makes financing pivot

According to the Chinese Loans to Africa Database at Boston University’s Global Development Policy Centre, China advanced US$170 billion between 2000 and 2022.

But sub-Saharan Africa has seen a retrenchment of Chinese investment and lending since 2017.

According to the IMF, Chinese official total loan disbursements to sub-Saharan Africa have fallen precipitously, now representing about one-eighth of their peak value of 1.2 per cent of the region’s GDP in 2016.

Nevertheless, China has been a key player in recent debt restructuring and negotiations. It also contributed to the Debt Service Suspension Initiative, providing 63 per cent of suspensions in 2020 and 2021, though owning just 30 per cent of the claims.

Four countries – Zambia, Ethiopia, Chad and Ghana – applied for debt restructuring under the G20’s common framework. Zambia, which was the first country to default on its foreign debt in 2020 during the Covid-19 era, received debt relief from its bilateral lenders that agreed to restructure US$6.3 billion debt, of which US$4.1 billion is owed to China.

Aly-Khan Satchu, a sub-Saharan Africa geoeconomic analyst, said the West advanced the “debt trap” diplomacy story along with a new narrative that China’s economy was on the brink of collapse.

“I think the IMF is stating the obvious and distancing itself from this long-embedded and erroneous narrative,” Satchu said.

However, he said the emphasis on local borrowing was correct. The IMF and the World Bank promoted the theory that domestic borrowing was a silver bullet because it would deepen in-country financial and capital markets and reduce reliance on the often capricious international markets, Satchu said.

4 lost years: How the EU fumbled its response to China’s belt and road

“We have now seen this creates a negative feedback loop (in a deteriorating circumstance) where local final institutions are hugely affected, like in Ghana, in any debt workout and restructuring,” Satchu said.

“Also in terms of scale, we should not discount the Eurobond markets which have turned out to be a fair-weather friend – dumping money in countries [when] the living is easy and not to be found when money becomes expensive.”