‘Unimpeded trade’: China begins to deliver on US$10 billion promise to African businesses

- African SMEs will be able to tap into the large China market as Xi Jinping makes good on his US$10 billion financing promise

- Providing money to African lenders will also help China secure new trading partners that it otherwise would not have been able to reach

Now, a growing number of SMEs want to tap into the massive Chinese market – but they lack trade finance.

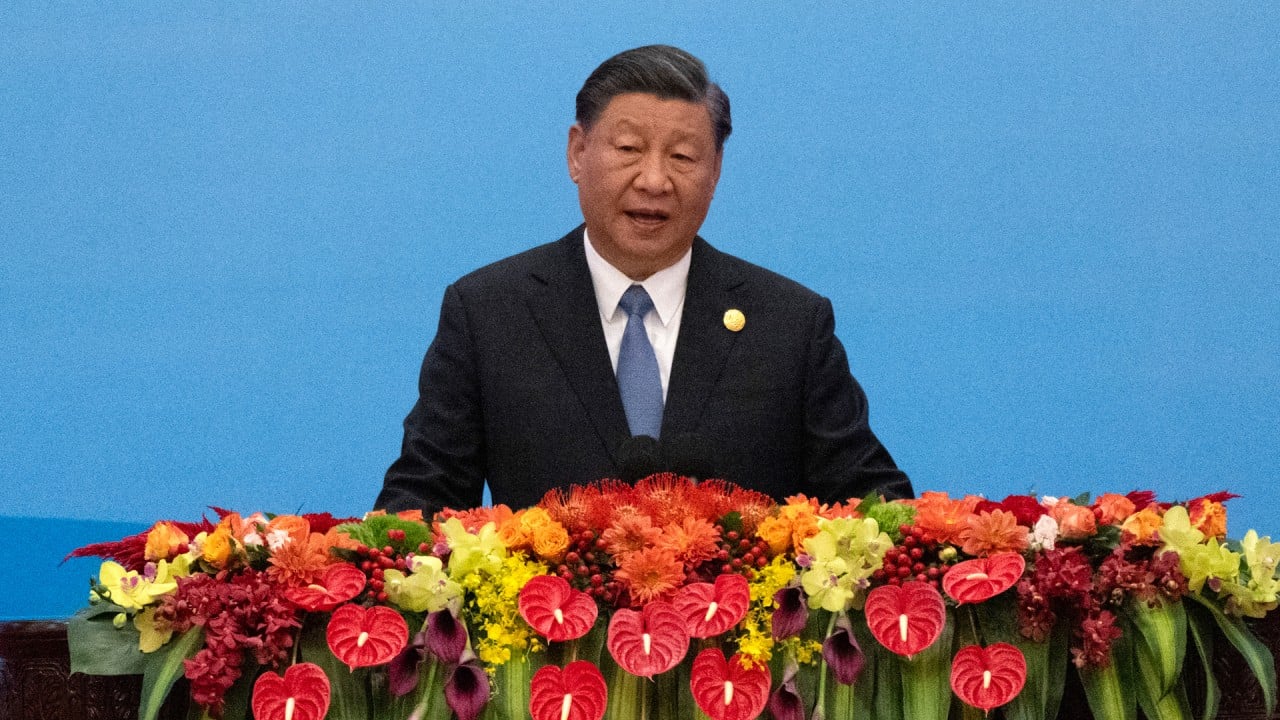

At the signing ceremony in Beijing last week, Professor Benedict Oramah, president and chairman of Afreximbank, said the agreement showed the strengthening relationship between China and Africa.

“The deal is strong evidence of the rapid growth in cooperation between China and Africa,” he said.

“As a bank we are committed to play a big role, especially in leveraging financial resources into Africa. This facility will help to catalyse trade financing between Africa and the People’s Republic of China, thereby enhancing flow of goods, capital and technology,” he said. “Working with partners like China Eximbank, we aim to attain the goals of this strategy, especially supporting China-Africa cooperation and expanding Africa’s export manufacturing capacity.”

China’s overseas development loans at lowest level in recent years, study finds

It came less than a month after the Chinese lender agreed to advance US$300 million to the Africa Finance Corporation (AFC), an African-focused multilateral financial institution – an agreement which was made in late September during the Asian Infrastructure Investment Bank annual meeting in the Egyptian resort city of Sharm el-Sheikh.

The three-year loan facility will help drive increased trade finance and investment across the African continent, fostering economic growth and development, the AFC said.

The two institutions have been collaborating since 2018, with the AFC receiving US$400 million in bilateral loans from China Eximbank to date.

“The loan will provide critical financing to support trade finance and investment in Africa, further facilitating the flow of goods and services between Africa and China,” the AFC said.

Zhang Wencai, vice-president of China Eximbank, said over the past few years, the Chinese lender has provided loans to the AFC to enhance bilateral trade and investment between China and Africa.

“This new project has elevated our bilateral cooperation to a new level and will further enhance China-Africa trade and economic cooperation through the financial support of our two institutions,” Zhang said in September.

In August, Afreximbank signed a US$400 million term loan facility from China Development Bank (CDB), another Chinese policy bank, to support the financing of SMEs across Africa.

SMEs involved in trade both within and outside Africa as well as businesses engaged in the productive sectors of Afreximbank member states will be able to access the funds. The seven-year facility will either be deployed directly to eligible SMEs or indirectly through local intermediaries.

“This facility further strengthens the strategic partnership we have developed with the China Development Bank over the last six years, which has seen CDB make three previous interventions in support of our work at Afreximbank,” Oramah said.

Oyintarelado Moses, a data analyst and database manager from the Global China Initiative at Boston University’s Global Development Policy Centre, said the practice of channelling financing to African regional institutions has been around for some time.

IMF report says Chinese loans not main debt burden in sub-Saharan Africa

And data from the Chinese loans to Africa database at Boston University’s Global Development Policy Centre shows that from 2000-22, China signed 21 loan commitments worth US$2.94 billion to African regional banks and institutions such as Afreximbank, Trade and Development Bank, West African Development Bank, Development Bank of the Central African States and AFC.

“This finance has largely been on-lending for small and medium enterprises and discretionary purposes,” Moses said.

She said the funding to African institutions is largely a follow-up to the FOCAC commitment, but also a way that China will diversify its lending to the continent in years to come.

Lauren Johnston, a China-Africa researcher at the South African Institute of International Affairs in Johannesburg, said local African development banks have a lot of capacity in managing such finance and in picking local entrepreneurs who can benefit most.

“A good share of this finance is directed more at local SMEs – which are much harder to target from Beijing,” Johnston said.

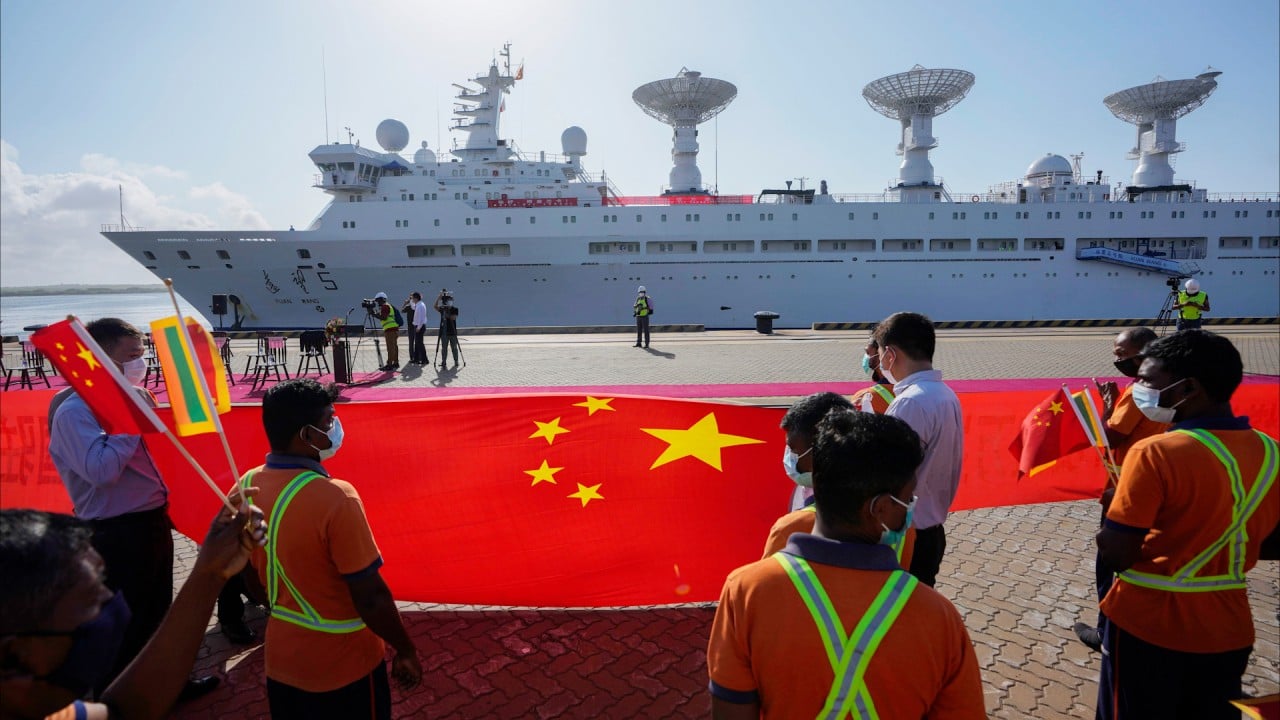

Targeting SMEs is part of China’s agenda to foster “unimpeded trade” under the Belt and Road Initiative, she said, as well as a means of supporting rising incomes of households.

It is also a means of directing investment in Africa’s development under the African Continental Free Trade Area (AfCFTA). It fosters institutions with the capacity to encourage local entrepreneurs to increase trade within Africa and to China.

Johnston added that China’s belt and road promise to open some digital commerce pilot zones could be a target for these funds “as digital commerce can also unlock such SME-based trade”.

One platform for e-commerce is Alibaba’s electronic World Trade Platform (eWTP), which enables SMEs to participate in cross-border electronic trade with China. Rwanda and Ethiopia are the first countries in Africa to sign up to the platform, which serves as a gateway for products to China and new markets. Alibaba is the owner of the South China Morning Post.