Chinese law company set to become first to open branch in North Korea

- Law firm Jingsh, headquartered in Beijing, will also be expanding into South Korea and Japan

- North Korean office will focus on investment services as Pyongyang attempts to revive its struggling economy

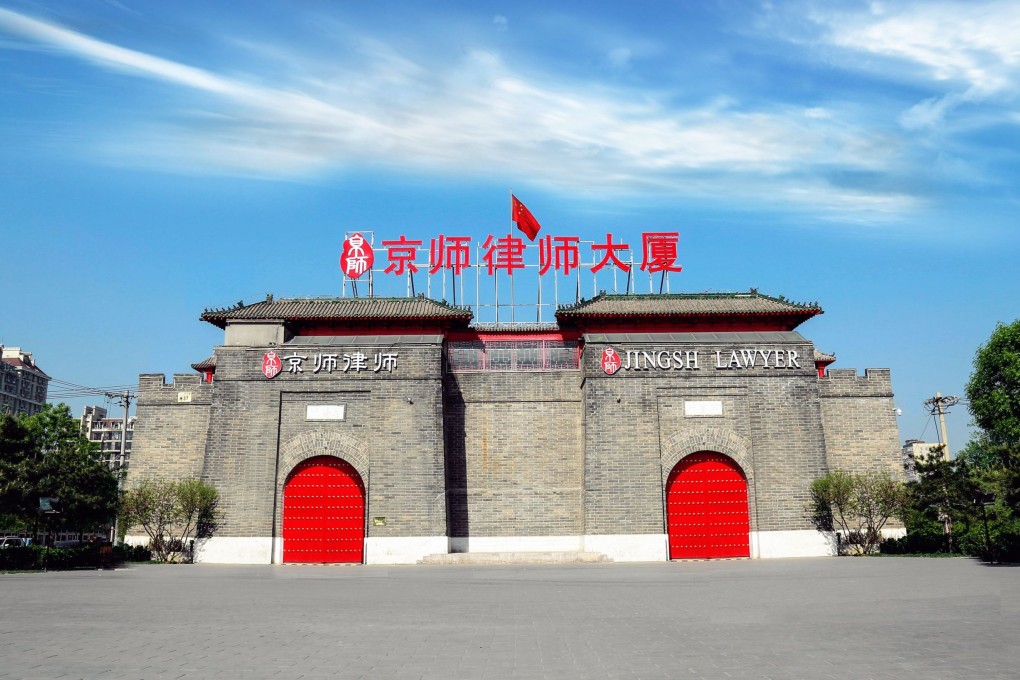

As one of the first and biggest partnership law firms in China, Jingsh announced last week that it would expand its law services to North Korea, as well as locations in South Korea and Japan, with openings planned for next year.

The expansion is based on “China’s unique advantages of geographical proximity and cultural exchanges” to boost cooperation in different fields with its three Asian neighbours, Jingsh said in a press release.

The announcement came as North Korea has resumed rail freight and flight services with China in a sign that its border is reopening after it was shut due to the Covid-19 pandemic.

China is North Korea’s main trade partner and its largest source of investment. Most Chinese investments have been directed to mining and infrastructure, according to a report by the Korea Development Initiative in 2021.