EU-China relations: European firms are reluctant to speak up on China as Brussels seeks to de-risk

- Fear of threats, raids and other retaliatory measures hamper efforts to find evidence to support Ursula von der Leyen’s economic security strategy

- Report finds many German multinationals plan to ‘friendshore’ production out of China to other Asian countries: ‘We are de-risking without too much noise’

“These joint risk assessments on technology security and leakage are currently ongoing and should be concluded by early next year,” the Latvian said.

The bloc’s department of trade is “halfway” to where it wants to be in terms of analytics, sources said. They have held two working groups with member states, with another planned for Thursday, and believe they are winning some sceptics over to their cause.

But the precarious information environment is making it tricky to flesh out a case that will ultimately have to convince the bloc’s 27 member states that such a suite of tools is necessary.

As it stands, the commission does not have enough data to transmit the full extent of risks to member states and, with an extended holiday period looming, the clock is ticking.

But in the space of a couple of years, the business environment in China has worsened further still.

Executives see huge risks in speaking out for fear of falling foul of opaque new anti-espionage and foreign relations laws in Beijing. Reports abound of Western companies being raided in China for flouting laws that Western business groups believe are vague and ill-explained.

Nor do businesses want to put their heads above the parapet when discussing their own de-risking plans – shorthand for not having all your production and sourcing eggs in a single Chinese basket – lest it endanger their operations in China.

“While both laws contain references to the broader concept of ‘national security’, neither provide guidelines on what constitutes a national secret, raising the likelihood of both inconsistent implementation and compliance issues for businesses. In the absence of clear language and well-defined boundaries, businesses tend to err on the side of caution,” said one EU business source.

Some firms that continue to bank big profits in China simply do not see the point in complying with Brussels’ efforts. As the world becomes increasingly bifurcated and supply chain risks proliferate, a common refrain among some corporate executives is: “What’s in it for us?”

The chilling effect makes building legislation difficult – but not impossible. Plenty of other companies see what is coming down the road in terms of Chinese industrial overcapacity and are willing to cooperate – but often under certain circumstances.

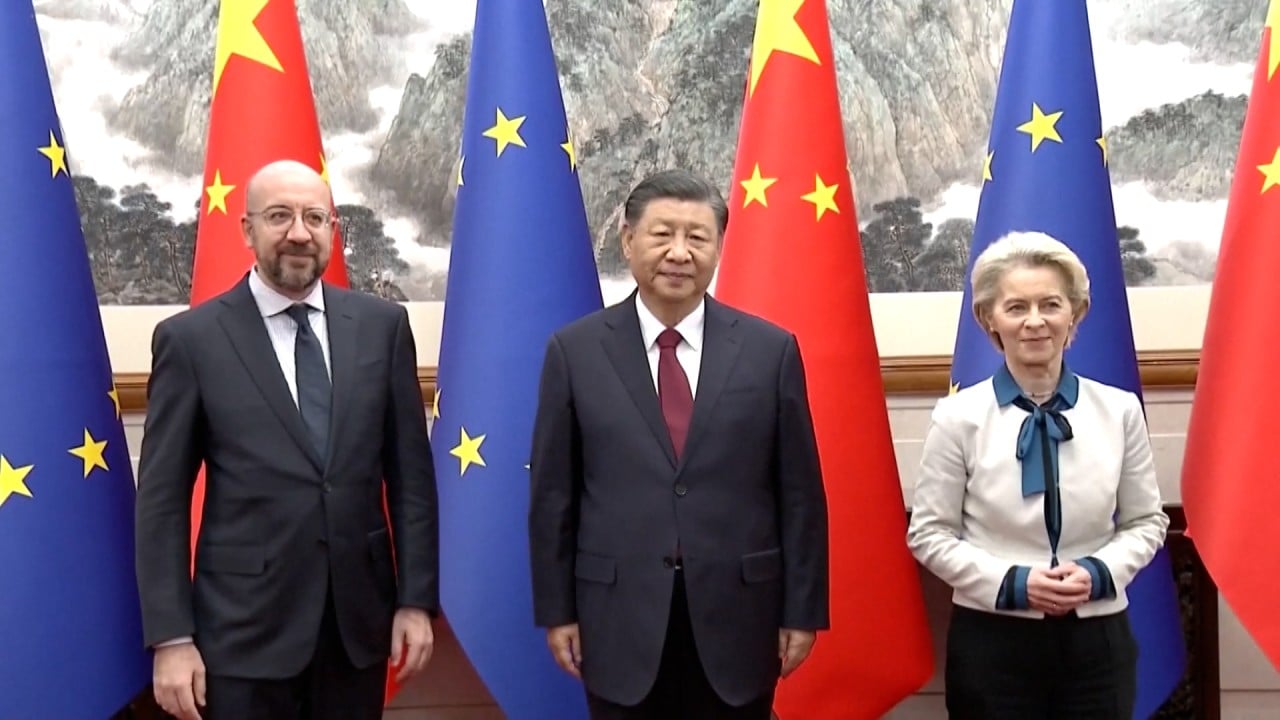

Europe is no one’s vassal, ‘relaxed’ Xi tells EU leaders in Beijing

Some companies have asked for confidentiality when speaking to the authorities. It is generally easier to get them to share in smaller groups with firms from separate sectors. For example, business groups have started pairing non-competitors such as carmakers and pharmaceutical companies to build a holistic view of the risks facing EU businesses in China today.

Survey data suggests that some businesses – perhaps sensing the rocky road ahead – are not waiting around for EU legislation and are autonomously de-risking their own operations. According to a report by Deloitte and the Federation of German Industries this month, around one-fifth of 100 German multinationals plan to “friendshore” their production lines out of China and into other Asian countries.

In the words of one major company’s chief executive: “We are de-risking without too much noise”.

But with persistent inflation, recessionary winds and stiff competition from American and Chinese state support, the survey also showed that few of those firms were likely to come back to Europe.

“Almost half of responding companies expect the attractiveness of Germany, compared with other industrial locations, to decline from slightly to significantly over the next three years,” read the report.

When Brussels officials started raising de-risking with member states in June, they got a frosty response. Some have since been converted through what sources described as “therapy sessions” – discussing their vulnerabilities with Berlaymont bureaucrats to help admit and accept there are risks that must be managed.

European firms in China will be ‘squeezed out’, EU leader says in de-risking bid

But others remain unconvinced, according to diplomatic sources. In some parts of the German government, for example, the commission is seen to have acted too hastily with an investigation into subsidies in China’s electric vehicle sector.

The probe was launched “ex officio”, or under the commission’s own volition. While it was under the influence of the French government, it angered some in Berlin, home to Europe’s biggest car producers. Handing Brussels expansive powers on private investments in China, then, is considered a risk.