Are the EU and China hurtling towards a trade war?

- In Brussels, Beijing’s promises to individual EU states are seen through the lens of a combative and defensive China unwilling to yield on major issues

- For some members the potential return of Trump to the White House hastens the need for a stronger European approach

They see Beijing’s dangling of market access for its individual member states as attempts to dilute support for tougher measures on Beijing being cooked up by the European Commission. A series of working groups that the Chinese government has requested to discuss EU trade concerns, meanwhile, is also seen by some as a way for China to kick the can down the road.

“We see them in the year ahead being in ‘drag-it-out mode’,” said a senior official. “After we were pretty explicit about the problems, they can expect one or two more actions if they don’t deliver.”

Last month, the bloc’s top leaders laid out swathes of economic grievances, from a gaping bilateral trade deficit, which they said was artificially turbo-boosted by Beijing, to manufacturing overcapacity in China, which they blamed on industrial subsidies and said would see cheaper Chinese products flooding the European market.

On individual sectors, they challenged China to change course, otherwise Brussels would be forced to take more defensive trade actions to rebalance the relationship.

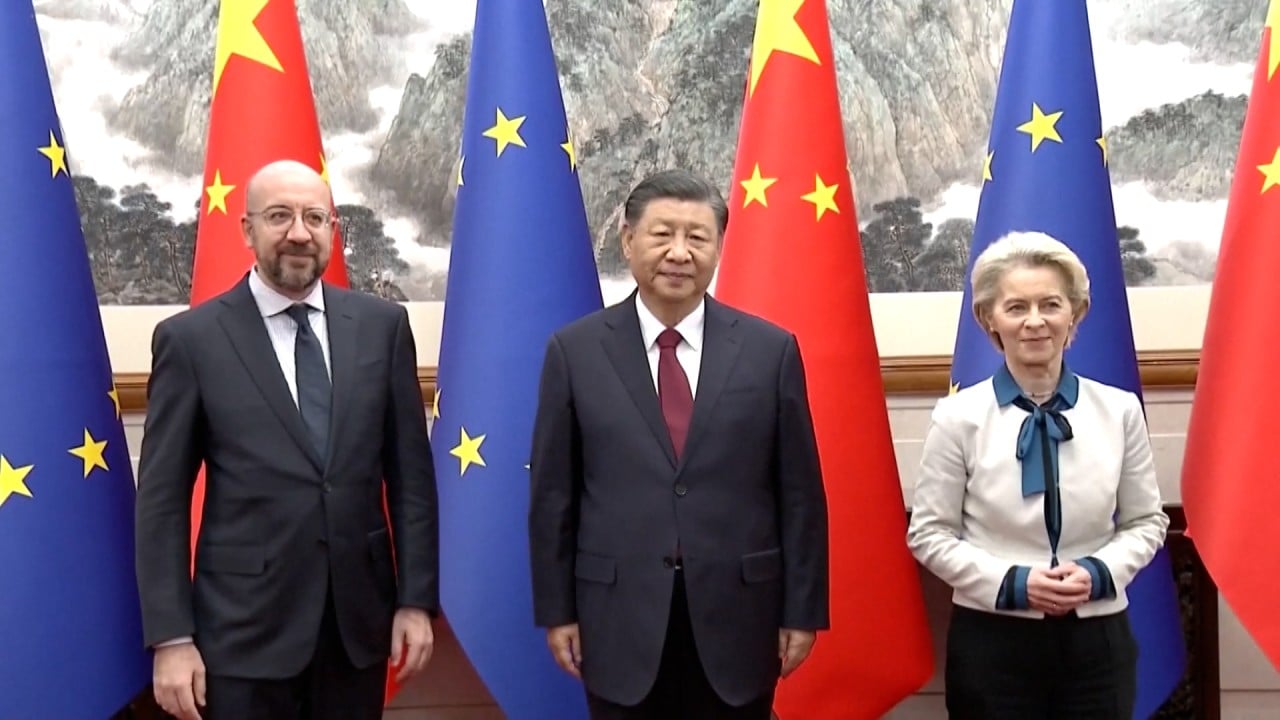

European Commission President Ursula von der Leyen told Chinese President Xi Jinping and Premier Li that the EU was prepared to “use its toolkit” of trade weapons and that Brussels was “ready to go” with action against Chinese access to Europe’s medical device sector, which was not reciprocated – EU companies do not have access to the Chinese market.

There was some surprise when Xi and Li engaged with each of the EU’s complaints in detail. However, the nature of the responses did not inspire hope in those present that matters would improve.

On the trade deficit, Xi told the EU to learn from former US president Donald Trump, who also tried to rebalance bilateral trade with China and failed. Should Europe choose to fight the same fight it would face the same fate, Xi warned von der Leyen and European Council President Charles Michel.

When the EU leadership relayed a series of data-based complaints about China’s manufacturing overcapacity, they were presented with an alternative set of facts and figures that argued the contrary. China’s manufacturing success was not built on subsidies, but on Chinese efficiency and competitiveness, Xi said.

And when they warned him that a failure to act would result in new trade measures from Brussels against China, the Europeans were told in no uncertain terms that Beijing would retaliate in kind.

“This is a recipe for a trade war,” said a second senior EU official familiar with the discussions, pointing to the frustration in Europe over China’s unwillingness to budge on substantive issues.

China’s first responses have already been observed. An anti-dumping probe into French brandy launched on January 5 is seen as retaliation against the EU’s investigation into subsidies in China’s electric vehicle sector.

New data released by China’s customs authority over the weekend, meanwhile, shows China tightening shipments of critical minerals to the West. In 2023, exports of gallium plunged by two-thirds while germanium exports were down 8 per cent. In December, only one export of unwrought gallium – totalling US$19,828 to Germany – was recorded.

Beijing introduced new licensing rules for the two minerals, which are vital to making semiconductors, last summer following US efforts to choke China off from accessing advanced chips and the equipment for making them.

Meanwhile, China’s scramble to shore up its own chipmaking base continued in December, with a 950 per cent surge in equipment from the Netherlands, the home of market leader ASML, the data shows.

Amid this spiralling tussle, senior EU figures observe that rather than opening up its economy, China is asserting more control.

“We thought that opening up and lifting the controls of the pandemic would allow for less control and people would feel freer. Well, it has not come,” said the EU’s ambassador in Beijing, Jorge Toledo, during an online event last week.

“The increased obsession with national security can be seen everywhere, cameras everywhere with facial recognition. The need, and this is quite recent, for state and party cadres, officials, to get clearance for meeting foreign diplomats – that was not happening a few years ago,” he added.

Asked how much time the EU would give Beijing to make some concessions following the summit, Eva Valle Lagares, the EU’s top trade official for China, said they needed to “manage expectations”.

“We have had a flurry of engagement last year, but in each and every point of time our leaders have passed the message that engagement for the sake of engagement actually backfires,” she said.

“We would like China to be more responsive and we have a fair deal of frustration seeing that our asks are not immediately acted upon … it takes two to build trust to take steps that help and rebalance the relationship … but the ball is in China’s hands.”

On Wednesday, the commission will unveil more detail on its economic security strategy, the cornerstone of von der Leyen’s efforts to de-risk trade ties with China.

Across four papers, it will make recommendations on screening outbound investments in hi-tech sectors and push for a “Europeanisation” of export controls amid fears that more individual member states could be forced to comply with long-arm US controls.

Trade chief Valdis Dombrovskis told the Financial Times on Sunday that the bloc must prevent sensitive technologies and assets from “ending up in the wrong hands”.

But the package will not propose any legally binding changes to EU rules, a reflection of the reluctance of some member states to hand more powers to Brussels and open new fronts with China with the spectre of Trump’s return looming large.

Businesses, too, would be pleased to see a coordinated European approach to export controls, but argue that if these tools are functioning properly, there should be no need to screen private companies’ investments into China.

“We do not really understand the need for this. If we have a functioning export controls regime, that should be enough to stop the transfer of technology for military purposes. Why then would we need outbound screening on top of that? In any case as this is national security you would need first to have a legal framework at member state level,” said Luisa Santos, deputy director general at Business Europe, a lobby group.

For some capitals, however, the potential return of Trump to the White House hastens the need for a stronger European approach, a point made by French President Emmanuel Macron twice last week.

A day earlier, he told reporters in Paris that only a geopolitical EU “capable of defending itself” could handle another Trump term “without depending on it” for its sovereignty.

“The United States is an important ally … it’s a democracy that’s going through a crisis in which it itself is the first priority and the second priority is China’s power. All of us Europeans need to be lucid about that,” Macron said.