Siemens boss demands EU action to fend off ‘cheap’ Chinese wind power imports

- Christian Bruch says either quotas or qualitative criteria could help stop the industry going the way of solar

- Principles need to be applied to create a level playing field, he says

“If you do not act it will go [to the same direction as the solar sector]. If you only decide on price, what we all did on solar, it’s not possible to really compete because I would say you don’t have a level playing field,” Bruch said in an interview on Saturday.

“We don’t ask to fence off the European market but to install principles to create a level playing field, which today is not there with Chinese suppliers,” he told the South China Morning Post on the sidelines of the Munich Security Conference.

“That is something we would insist on if you want to have a pan-European industry. If not, if price is the only determining element, the European wind industry is going to have a challenge.”

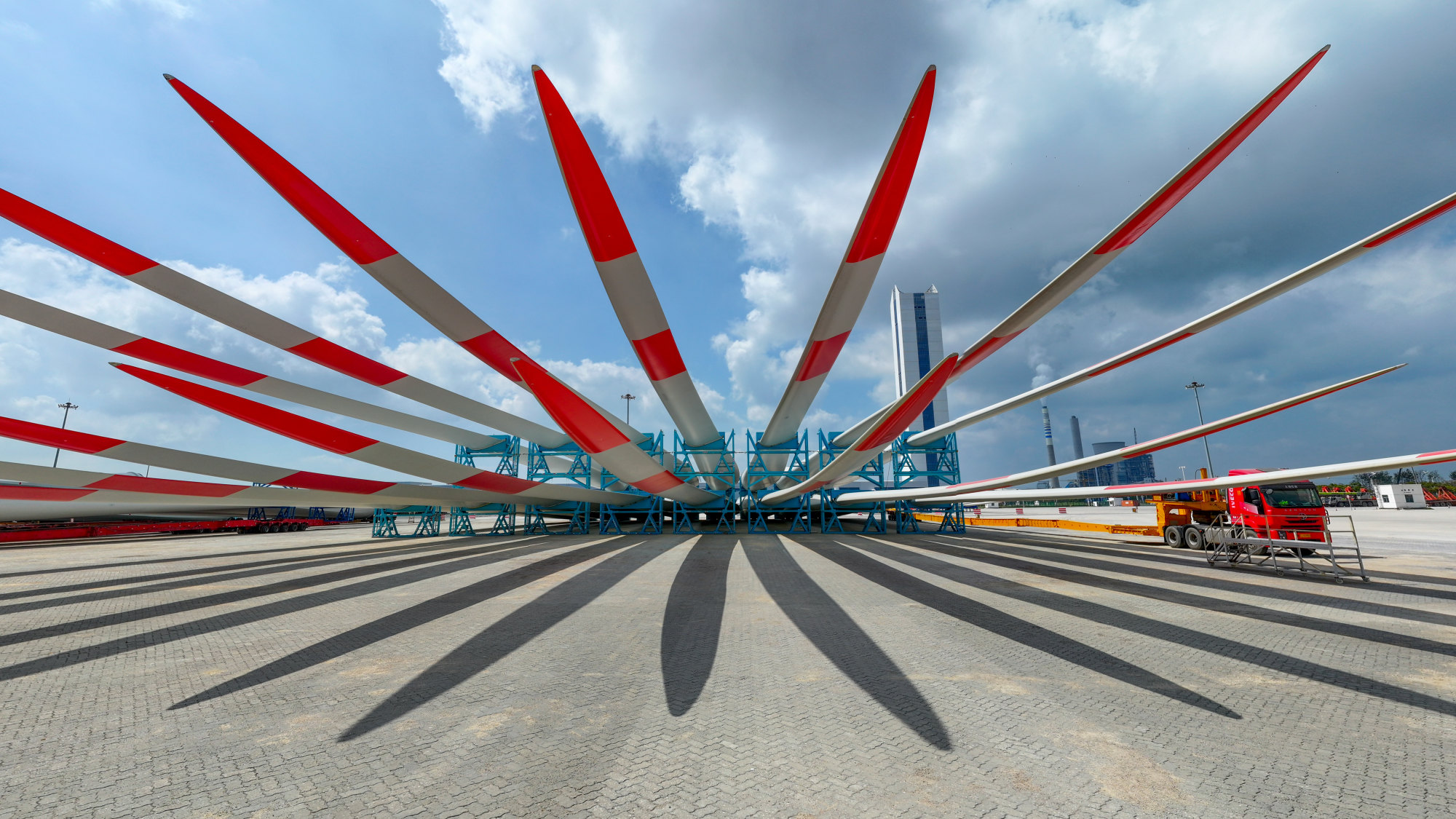

Siemens Energy, a subsidiary of Siemens Group and the parent company of Siemens Gamesa, one of the world’s top manufacturers of wind turbines, has had a troubled year.

In November, amid major losses at its wind energy subsidiary and struggles to secure commercial lending, the company tapped the German government for loan guarantees worth €7.5 billion (US$8 billion).

Bruch said Siemens would be open to quotas on imports from China, “if you do it smartly, if used properly”. “It’s not easy to do these things.”

The industry has long warned of the potential threat from Chinese competition. In a report last year, lobby group WindEurope wrote that “constraints in Europe’s wind energy supply chain mean Chinese turbine manufacturers are now starting to win orders here, not least with their cheaper turbines, looser standards and unconventional financial terms”.

“There is a very real risk that the expansion of wind energy will be made in China not in Europe,” the group said.

There has been speculation in Brussels about a possible investigation into Chinese subsidies but the European Commission said it had not received a formal complaint and did not have the evidence to launch such an inquiry.

“The legal conditions for launching an investigation are very strict, requiring sufficient evidence of a surge in low-priced and subsidised imports of wind turbines into the EU that are harming or may harm the EU’s wind turbine industry,” commission spokesman Olof Gill said.

Nonetheless, Gill said, the commission was “ready to robustly defend” the sector from “unfair imports” when conditions were right.

The case is similar to that of the solar industry.

The European Solar Manufacturing Council warned this month that photovoltaic panel makers would be put out of business without protection from cheap Chinese imports.

European solar makers seek ‘emergency’ EU steps to block Chinese ‘oversupply’

However, no EU member state lodged the formal complaint needed to trigger an investigation. France is understood to have considered doing so – until Beijing hit back at a Paris-backed probe into Chinese-made electric vehicles with an inquiry into French brandy.

Bruch said one option was to restrict access to wind power auctions based on qualitative factors that would favour European firms, such as where the research and development was done and whether the materials used were recyclable. Supply chain labour standards could also qualify as a criterion.

“We have to make a choice to say: is it important for us if a company does R&D or manufacturing in Europe, yes or no? It does play a role [for the industry] because obviously the wage costs are higher in Europe,” he said.

The commission has taken some steps in this direction.

In October, it unveiled a package designed to speed up approvals in the wind power sector and improve access to funding for European firms.

“The EU will also use the measures provided for by the Foreign Subsidies Regulation. The European wind industry is encouraged to submit further evidence,” it said.

In December, all EU countries except Hungary signed a joint declaration to protect the industry from “unfair trade practices” coming from Chinese manufacturers.

In addition, tight supply chain due diligence rules are being negotiated in Brussels to require big companies to do in-depth auditing of their suppliers for labour, and environmental and social standards.

The proposed rules would only apply to non-EU companies if they had €150 million of net turnover generated in the EU.

China’s climate envoy decries trade curbs for ‘politicising’ renewables

However, the legislation is on life support after Germany and other member states abstained or voted against it earlier this month. Pro-business parties turned against the proposal amid intense lobbying from business groups about the red tape involved.

Bruch said the threshold created unfair conditions and all Chinese entrants to the European markets should be subject to the rules, if they were passed.

Bruch said complying with the proposed rules, which would come on top of separate due diligence requirements in Germany, would be a “massive effort”, particularly in markets where there was a lack of transparency further down the supply chain.

He said that while European firms were required to fully audit their “sub-suppliers”, the same may not be required of Chinese competitors “who come [to the market] with a full product”.

“What is his or her requirement to demonstrate this in Europe? If that’s not absolutely on a level playing field, we have unfair competition,” Bruch said.