China's Premier Li urges reluctant banks to support real economy

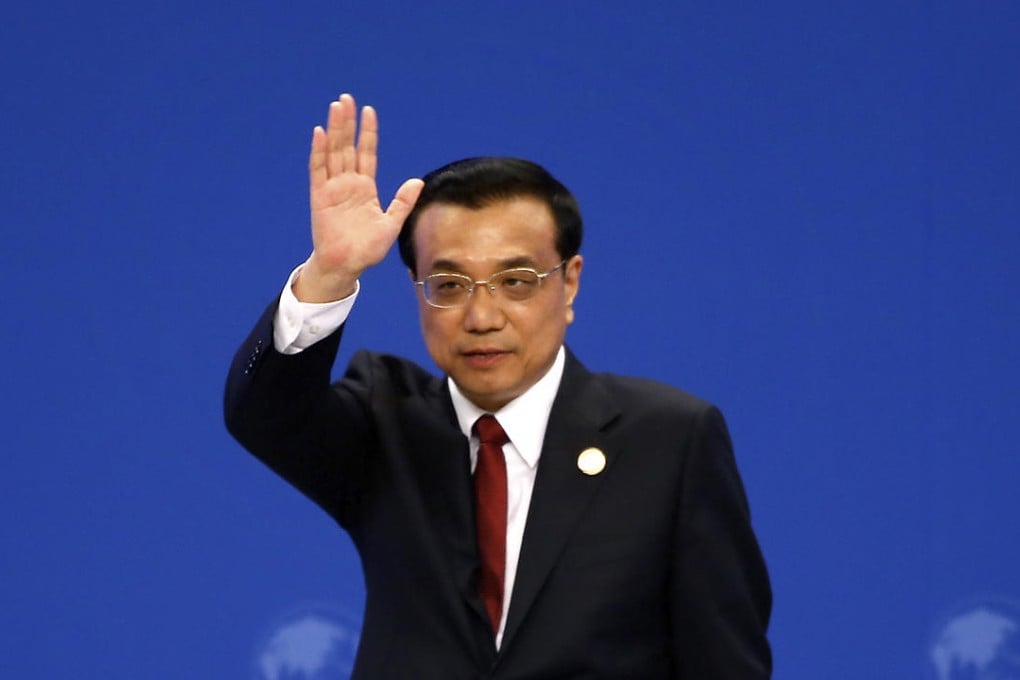

Li Keqiang's call to back smaller firms comes as frustration rises over lenders' reluctance to help

Premier Li Keqiang has urged banks to do more to support the real economy, as mainland authorities grow frustrated with their reluctance to lend for productive investment, even as they support a debt-fuelled stock market rally.

During visits to two major state-owned banks, the Industrial and Commercial Bank of China and China Development Bank, Li urged more lending to small and medium-sized enterprises, the government said on its website.

He stressed that these smaller companies played an important role in job creation.

His visits came after figures this week showed the mainland economy grew at its weakest pace in six years in the first quarter - expanding 7 per cent compared with 7.3 per cent in the previous quarter. "China's economic growth is within a reasonable range, but downward pressure [on growth] is increasing," Li was quoted as saying.

To cope with the pressure on economic growth, Beijing would set prudent and "flexible" monetary policy and increase its "targeted" policy easing, Li said.

Mainland banks made 1.18 trillion yuan (US$190 billion) of new loans in March - beating expectations as authorities ramped up efforts to support the economy, although data suggests credit has not yet flowed into key sectors. As banks become more profit-oriented, experts say they seem less interested in supporting policy goals with high risk, low returns, or both.