Live | China Markets Live - Chinese markets rally in last hour to end 5-day losing streak

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy

Welcome to the SCMP's live markets blog. The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate. We'll bring you the key levels, trading statements, price action and other developments as they happen.

Here’s a summary of market action today and overnight:

- After losing ground mid-afternoon, Shanghai rallies in last hour to end the day up 5.34 per cent

- Shenzhen, which moved into negative territory, reverses to finish the day 3.3 percent stronger

- Hang Seng Index in Hong Kong soars 758.15 points or 3.6 per cent to match robust close in Shanghai and Shenzhen

- ING says China rate cuts have not been able to provide sustainable market cheer and along with Fed uncertainty, volatility to hound markets

- US Fed's Dudley says September rate increase "less compelling" due to turmoil wracked global markets, most analysts now betting on December or even 2016 for first rate rise in a decade

4:07pm: The Hang Seng Index closes a good day at 21,838.54 points, a gain of 3.60 per cent or 758.15 points. It was even better for the H-shares index, which closed 4.62 per cent up at 9,863.61.

3:26pm: After yesterday’s US$4.9 billion turnover for dollar-yuan trading at the China Foreign Exchange Trade System, some banks in China were seen by traders to be selling their dollar holdings.

As of 3 pm, Bank of Communications is offering at 6.4057; ICBC at 6.4057; HSBC at 6.4051. Reference price provided by CFETS for the day is at 6.4085 – it has just started publishing its own this week.

The dollar-yuan is trading at 6.4061 – down 0.07 per cent for the day.

3:13pm: The Hang Seng Index is tracking the mainland markets higher and is now up 3.12 per cent at 21,737.57. The H-share Index is 4.35 per cent stronger at 9,838.31.

3:10pm: Chinese stocks leapt in the final hour of trading to close well up for the day. The Shanghai Composite Index finished at 3,083.59, up 5.34 per cent. The CSI 300 Index jumped 5.95 per cent to 3,205.64.

The Shenzhen Composite Index rose 3.33 per cent to 1,752.21 recovering strongly from a mid afternoon fall into negative territory. The ChiNext Index climbed 3.67 per cent to close at 1,959.49.

3:03pm: Rabobank says the markets are in a fragile equilibrium:

“Talking about ‘inflation dynamics and monetary policy’, the developments in August are not likely to have increased the confidence of the Fed in the inflation outlook.

The minutes of the FOMC meeting in late July revealed a lack of ‘reasonable confidence’ that inflation will move back to target over the medium term well before these events.

The slowdown of the Chinese economy, the devaluation of the yuan against the US dollar, and the worldwide decline in commodity prices could further delay the return of US inflation to its 2 per cent target.

As these events have reduced the probability of a September rate hike, they have increased the probability that the first hike will be delayed until 2016. On balance, we still think that December is the most likely date for the Fed’s policy rate lift-off.”

2:20pm: China BlueChemical, a major mainland producer of fertiliser and methanol, has no plan to add production capacity in the next few years amid a looming demand cap, over-capacity and falling product prices, according to chief executive Wang Hui.

“Considering industry oversupply and the [Ministry of Agriculture]’s target for China’s fertiliser consumption growth to approach zero by 2020, we will not consider anymore fertiliser capacity in the short term,” he told reporters on Thursday. “Instead, we will focus on upgrading the efficacy of our products.”

China BlueChemical uses mainly natural gas produced near Hainan Island by sister company CNOOC, a state-backed offshore oil and gas major, as feedstock to make urea, a nitrogenous fertiliser, and methanol which is used as a fuel and industrial chemical.

2:08pm: Shenzhen Composite Index dropped to 1,679.70, down 0.95 per cent or 16.06 points. ChiNext slid to 1860.43, down 1.57 per cent, or 29.61 points.

2:07pm: Shanghai Composite Index edged up 0.04 per cent or 1.04 points to 2,928.33. CSI300 Index rose by 0.66 per cent, or 19.92 points to 3,045.61.

2:07pm: Hang Seng Index went up by 1.98 per cent, or 418.25 points, to 21,498.64. H-shares Index also rose to 9,660.45, up by 2.47 per cent or 232.52 points.

1:50pm: Hang Seng’s red chip index, comprising major mainland Chinese companies incorporated and listed in Hong Kong, is a standout basket of stocks today, lifting 4 per cent to trim its weekly losses to about 2.5 per cent.

CNOOC is the leading index constituent at 13 per cent up, while Mengniu Dairy at negative 5.5 per cent is the only one to trade down. Ten of the 30 index stocks have improved by 4 per cent or better.

1:25pm: China and Hong Kong indices so far today. After all markets jumped in pre-opening trading, China continued to show considerable volatility while Hong Kong traded sideways. Prices are against today's opening. Click to enlarge charts.

1:14pm: Hong Kong’s Hang Seng Index is up 2.3 per cent at 21,565.83 after dipping slightly in early afternoon trading. The H-share Index is at 9,710.38, up 3 per cent for the day so far.

1:08pm: The Shanghai Composite Index ticked slightly higher in early afternoon trading, climbing to 2,975.93, up 1.66 per cent. The CSI 300 also gained and is up 2.2 per cent at 3,092.16.

1:08pm: The Shenzhen Composite Index is up 1.32 per cent at 1,718.18. The ChiNext Index is 1.42 per cent stronger at 1,916.89.

12:04pm: The Hang Seng Index finishes the morning on 21,615.69 points, up 2.54 per cent or 535.30 points. The H-shares index traded to 9,751.22, up 3.43 per cent or 323.29 points.

12:00pm: Hong Kong dollar is trading Friday at 7.7503 against the US dollar, near upper end of the currency peg. Euro/dlr strengthened by 0.29 per cent at 1.1347. Dlr/yen at 120.13, stronger by 0.18 per cent. Pound/dlr stronger by 0.22 per cent to 1.5497. Australian dollar to US dollar stronger by 0.1 per cent to 0.7129.

11:53am: Onshore yuan trades at 6.4091 to the dollar, firmer by 0.01 per cent from the previous close at 6.4095.

Offshore yuan trades at 6.4825 to the dollar, stronger by 0.08 per cent from the previous close at 6.4879.

11:45am: Columbia Threadneedle Investments’ director of global research, Robert McConnaughey, says emerging market growth is faltering and central bank largesse is not the answer:

“I would focus on the challenge of massive amounts of global production capacity seeing returns eroded by forces of globalization and technological change intersecting with a normalization of unsustainable demand from China. It is increasingly apparent that virtually every capital-intensive business that operates versus a global set of competitors is struggling with pricing their products today.

Perhaps the situation rhymes with the Japanese experience of the last 20 years where very low interest rates did little to fix a massive misallocation of capital, even probably delaying steps toward a real healing process by keeping “zombie” capacity in place.

Through the recovery, incrementally more disciplined corporate management has been able to convert modest, but fairly stable top-line growth into healthy profit and cash flow growth. Beyond basic belt tightening, “off-shoring” capital intensive/lower value added processes and technological innovation (automation, cloud computing) has delivered significant results.

Again, the US led the way in this regard, but there has been progress in the rest of the developed world as well. In turn, this has helped to heal government finances and the employment picture. Opportunities remain for greater corporate efficiencies around the world, but this is not a given. The US has already reached historically high levels overall and the cultural changes necessary to deliver sustained gains in Europe, Japan and China are not a given.”

11:37am: The Shanghai Composite Index closes the morning session at 2,972.57, up 1.55 per cent or 45.28 points. The CSI 300 went to 3,089.38, up 2.10 per cent or 63.69 points.

11:37am: The Shenzhen Composite closes at 1,713.78, up 1.06 per cent or 18.03 points. The ChiNext Price Index went to 1,908.07, up 0.95 per cent or 18.04 points.

11:35am: Hong Kong-based developer Hopewell Holdings traded 4.1 percent up in the morning after it posted strong profit growth in its interim report.

The developer, also one of Hong Kong’s biggest landlords, saw profit up 109 percent year-on-year to HK$ 2.84 billion in the first six months, thanks to redevelopment and completion gains from its Queen's Road East retail complex. Earning per share also rose by 108 percent to HK$3.08. Core profit rose 34 percent to HK$1.66 billion.

11:34am: In an overall positive morning on the Hong Kong stock exchange, many sectors have no losers at all. All companies are flat or improving among insurers, securities brokerages, infrastructure firms, electricity and gas companies, telecoms, electronics manufacturers, restaurants and green power. All banks except BOC Hong Kong and Standard Chartered are up.

11:07am: The Hang Seng Index trades to 21,600.54, up 2.47 per cent or 520.15 points. The H-shares index is at 9,721.65, up 3.12 per cent or 293.72 points.

11:07am: The Shanghai Composite Index retreats to 2,969.20, up 1.43 per cent or 41.91 points. The CSI 300 has gone to 3,083.31, up 1.90 per cent or 57.62 points.

11:07am: The Shenzhen Composite trades at 1,719.99, up 1.43 per cent or 24.23 points. The ChiNext Price Index slips to 1,922.70, up 1.73 per cent or 32.66 points.

11:00am: Shuang Ding, Head of Greater China Economic Research Standard Chartered Bank (HK):

“The government’s missteps in the stock market have caused collateral damage to public confidence in its ability to stabilise growth. We argued earlier that the government had intervened in the market at too early a stage, and that its unconventional approach undermined market rules and increased ‘moral hazard’.

The government picked an unnecessary fight that was difficult to win, in our view. When it eventually ceded, the market started to doubt its ability to deal with other economic challenges, including its ability to boost economic growth.

We see the policy rate and reserve requirement ratio (RRR) cuts announced on 25 August as a concrete step to support growth and restore confidence, and expect more policy easing in H2.

Given larger-than-expected capital outflows, we now expect another 100bps RRR cut by year-end (previous forecast: 50 basis points). We now also forecast another 25 basis points policy rate cut by end-2015 (previous: no further cuts this year), as the People’s Bank of China (PBOC) now appears less concerned about CPI inflation.”

Click to enlarge chart.

10:51am: In Shanghai, the industrial sector has turned around to go 4.3 per cent up after being the main drag on the index earlier this week.

China Railway Rolling Stock Corp (CRRC) hit its daily upside limit of 10 per cent, adding more than 3 index points, while China Shipbuilding Industry Co (CSICL) is also trading strongly.

The financials sector is also up, but has made the most modest gains after serving as a safe haven yesterday, with Ping An Insurance the top sector contributor. SAIC Motor Corporation is leading the charge in consumer products sector, while Sinopec is the top performer on the energy counter.

10:33am: Chinese carmaker BYD Co Ltd, backed by Warren Buffett's Berkshire Hathaway, rose 7.7 per cent to HK$31.65 in Hong Kong during the first hour of the morning session.

The company just posted a 29 per cent year-on-year rise in first-half net profit to 466.7 million yuan (HK$ 564.2 million), on rising sales of its hybrid and electric vehicles. Turnover climbed 20.7 per cent yearly to 30.435 billion yuan.

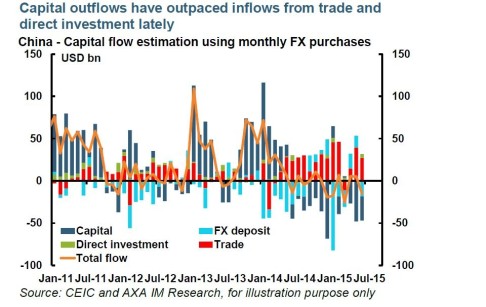

10:31am: AXA Investment Managers say China needs to carefully manage any currency depreciation to prevent sudden outflows:

“Such outflows would tighten domestic monetary conditions and give rise to financial risks. Acknowledging this helps to understand why the PBOC intervened in the market most recently and lowered the RRR by 50bps and interest rates by 25bps shortly.

We think capital outflows pose a key risk to China’s macro condition in the coming months, as expectations of yuan depreciation deepen. The authorities need to carefully manage market expectations and proactively operate monetary policy, in order to minimise the risk of a liquidity shock to the economy.

We think the pattern of capital outflows over the past few quarters will likely persist in the near future. Expectations of yuan depreciation will likely drive further shifts towards USD deposits by local residents.

As capital outflows reduce domestic liquidity, the PBOC will need to adjust its policy to keep monetary conditions intact. We expect two more RRR cuts, targeted liquidity injections and proactive open market operations to prevent a liquidity shock to the economy.

The RRR reductions can be seen as part of a great rebalancing in China’s monetary policy. Now, as currency appreciation turns to depreciation and capital inflows become outflows, the liquidity that was previously locked up in excess reserves needs be released back to the system. This will allow the RRR to return to more normal levels and monetary policy to respond to domestic economic conditions.”

Click on chart below to enlarge.

10:27am: BNP Chief China Economist, Chen Xingdong, said:

“We estimate the Reserve Requirement Ratio (RRR) cut may release RMB 700 billion additional liquidity into the financial system. But this is unlikely to be sufficient. If we estimate that the central bank spent USD 150-200 billion in August for exchange rate intervention, that translates into RMB 0.95-1.28 trillion liquidity drain. Other liquidity injection operations, such as reverse repo, SLF and MLF, may continue to be utilized.

For the stock market, the cuts in interest rates and RRR are positive catalysts, given they benefit the real economy and lower the risk-free rates. But the move itself is unlikely to turn around the trend. After the government exit from intervention into the stock market, investors now are refocusing on the anaemic economic fundamentals and tardy progress in reforms.

For the exchange rate, lower interest rate will exert more intensive depreciation pressure. While the odds of interest rate cut decline, RRR cuts are likely. We anticipate another two times RRR cut in the remainder of 2015, and the timing will primarily hinge on capital flow and the liquidity condition.”

Click to enlarge the charts below.

10:25am: China Mengniu Dairy Company is now the only Hang Seng stock trading down, having slid 5.3 per cent to HK$28.15. Mengniu's interim revenue slid 1.1 per cent to 25.56 billion yuan, it announced after yesterday's closing, although profits were up 27.7 per cent to 1.34 billion yuan on reduced operating costs.

10:20am: The Hang Seng Index moves to 21,628.82, up 2.60 per cent or 548.43 points. The H-shares index is trading at 9,750.90, up 3.43 per cent or 322.97 points.

10:20am: The Shanghai Composite Index breaks the glass ceiling trading to 3,008.59, up 2.78 per cent or 81.30 points. The CSI 300 has moved to 3,121.37, up 3.16 per cent or 95.68 points.

10:20am: The Shenzhen Composite trades at 1,741.44, up 2.69 per cent or 45.68 points. The ChiNext Price Index goes to 1,951.18, up 3.24 per cent or 61.15 points.

10:17am: The People’s Bank of China injected 150 billion yuan of liquidity into the system via seven-day reverse repurchase agreements, the official Shanghai Securities News reports citing traders.

10:12am: ING morning call:

“The PBOC easing failed to cheer stocks. The Shanghai Composite ended trading 1.27 per cent lower yesterday. Good news is that it wasn’t a stampede like previous few sessions.

A reason for the failure of monetary easing to stimulate the market could be delayed implementation of the RRR cut; unlike previous two RRR cuts which took effect immediately on the next day of the announcement the latest cut will be effective from September 6.

Another reason could be doubts about latest easing being aimed at supporting markets (rather than the economy) amid reports of authorities reducing intervention following failure of recent market support measures.

Bottom line: The PBOC easing may have halted the panic stock market selling but we think it’s too early to expect a lasting relief from the global market volatility which is now elevated by the Fed policy uncertainty.

We reiterate our forecast of one more 25bp PBOC policy rate cut and 50bp RRR cut this year.”

10:03am: China’s biggest life insurer China Life saw its share price surge 5.1 per cent to HK$ 25.8 in the first 30 minutes of trading in Hong Kong, after it posted a 71.1 per cent profit growth in its interim report last night.

Net profit attributed to equity holders of China Life climbed 71.1 per cent year-on-year, to 31.49 billion yuan (HK$38.07 billion), according to the company’s interim report.

Total revenue increased by 37.5 per cent year-on-year to 331.32 billion yuan. The company’s market share in the first half of 2015 was approximately 24.8 per cent, maintaining a leading position in the life insurance market, according to its interim report.

10:02am: CNOOC, the China National Offshore Oil Corporation, is an early winner in Hong Kong trading, lifting 7.8 per cent to HK$8.69 to be the Hang Seng’s top gainer so far.

CNOOC reported a 13.5 per cent increase in net oil and gas production in its interim results, posted after yesterday’s close, but sales dropped 34.2 per cent and consolidated profit was down 56.1 per cent to 14.73 billion yuan as oil prices lurked in the basement amid a slow global economy.

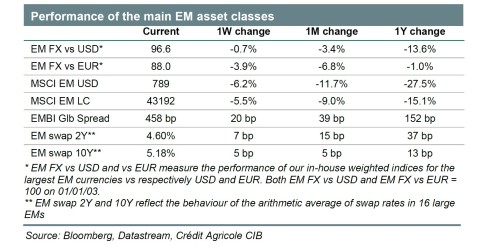

10:00am: Sébastien Barbé, Head of Emerging Market Research & Strategy of Credit Agricole,

“The People’s Bank of China’s (PBOC) decision to ease monetary policy has offered some respite to emerging markets. However, this respite should be short-lived.

It is not yet time to boldly re-enter the market frenzy. We expect further depreciation in the short term, though at a more moderate pace. Indeed, the PBOC easing will not in itself bring about a stabilisation in GDP growth and is unlikely to be enough to fix China’s growth.

Moreover, the global and idiosyncratic risks that have prevailed across emerging markets over recent weeks are still in place, not to mention the uncertainty regarding the Fed rate hike. To this extent, we would remain on the sidelines and favour Central European assets. We expect further emerging markets local rate curve flattening.”

Click on chart to enlarge.

9:45am: DBS daily report:

“The bout of market volatility has persisted since the onshore yuan (CNY) devaluation two weeks ago. Over the time period, the market has been pushing back Fed hike expectations. Notably, the implied Fed funds rate for end-2015 stands at 0.24 per cent, just 1 basis point shy of the all-time low.

The pace of rate normalization priced into the market (taking the difference in implied rates for 2016 to 2015) is roughly two 25 basis points hikes per year. USD rates look low, but with market volatility still elevated, triggers for higher rates are scarce.”

Click to enlarge the chart.

9:31am: Hong Kong’s flagship Hang Seng Index jumps to open at 21,758.62 points, up 3.22 per cent or 678.23 points. The China Enterprises Index of major H-share companies opens at 9,785.24, up 3.79 per cent or 357.31 points.

9:31am: The Shanghai Composite Index opens at 2,978.03 points, up 1.73 per cent or 50.74 points. The CSI 300 of Shanghai-Shenzhen large-cap stocks starts at 3,092.81, up 2.22 per cent or 67.12 points.

9:31am: The Shenzhen Composite Index opens at 1,723.54 points, up 1.64 per cent or 27.78 points. The emerging tech-focused ChiNext Price Index starts at 1,924.78, up 1.84 per cent or 34.74 points.

9:25am: People’s Bank of China set the yuan's mid-price at 6.4085 to the dollar, weaker by 42 basis points from the mid-price the previous day at 6.4043. This marks the third day in a row the PBOC fixed the yuan at a weaker level.

9:14am: The chairman of Tianjin Port, Zheng Qinyue, was put under investigation by the authorities for dereliction of duty, according to a statement posted on the Shanghai Stock Exchange website.

Tianjin Port Development has suspended its Hong Kong shares from trading, according to an exchange filing posted this morning.

9:10am: The CFFE issued a notice to all of its member institutions urging them to strengthen their supervision over clients, as “certain individuals or companies have engaged in malpractices that have distorted the prices and post huge risks to the market.

The institutions were ordered to crack down on margin financing, double confirm the identities of their clients and check irregular futures trading activities, the official Shanghai Securities News reports citing the futures exchange.

9:05am: Three Shanghai listed A-share companies resume trading today while 10 companies applied for voluntary suspension of their shares. The number of suspended companies in Shanghai is 127 on Thursday, representing 11.86 per cent of the total.

Two Shenzhen listed A-share companies resume trading today while eight companies joined trading suspension. The number of suspended companies in Shenzhen is 249 on Thursday, representing 14.4 per cent of the total.

9:04am: Hang Seng August futures contracts are currently trading at 21,673 points, up 2.65 per cent or 560 points.

9:03am: China Financial Futures Exchange froze 164 trading accounts for one month in order to clamp down on “over-speculation,” control risks, and ensure sound operations of the futures market, according to a statement posted Wednesday evening on the futures exchange website.

9:02am: China Railway Signal & Communication Corporation, China’s dominant provider of railway and urban transit control systems, reports a 54.6 per cent jump in first half revenue to 3.46 billion yuan and 34.8 per cent profit growth to 1.13 billion yuan.

CRSC listed in Hong Kong three weeks ago having raised HK$10.8 billion in its IPO at a valuation of almost 22 times earnings. The stock last traded at HK$6.06.

9:00am: SG Morning Call:

China - “Restrictions were imposed yesterday on trading in stock index futures in an effort to curb speculations according to a statement from the China Financial Futures Exchange. The People’s Bank of China fired a double-barreled easing shot late Tuesday by lowering interest rates by 25 basis points and the Reserve Requirement Ratio (RRR) by 50 basis points but it failed to counter downward pressure on the stock market."

8:48am: China Cinda Asset Management said its wholly-owned Cinda Financial Holdings was the only firm that has made an application by the August 25 deadline to bid for Nanyang Commercial Bank, which is being sold by Bank of China (Hong Kong), citing an announcement by BOCHK on Wednesday.

In a filing to the Hong Kong Stock Exchange Thursday, Cinda Financial said it has submitted an application to the Beijing Financial Assets Exchange as part of the bidding qualification process.

China Cinda noted it has not received any formal notification from the exchange on the number of applicants participating in the bidding process. Cinda Financial has not yet been determined by the exchange as a qualified bidder.

If Nanyang is sold for the HK$68 billion asking price, it would be the largest bank deal in Hong Kong. China Cinda's share price dropped 9.3 per cent to HK$2.62 in the first half hour of Hong Kong trading.

8:37am: Hong Kong's Hang Seng Index (orange) and China Enterprises Index (purple) faded late in trading yesterday after experiencing a post-lunch surge. Closing percentages are against Wednesday's opening price, not Tuesday's close. Click to enlarge.

8:34am: Rusal, the world’s biggest aluminium producer, posted a recurring net profit of US$830 million for the year’s first six months, compared to a loss of US$40 million in the year-earlier period, it said in a filing to Hong Kong’s stock exchange.

Revenue rose 8.3 per cent year-on-year to US$4.75 billion on the back of a 4.4 per cent rise in aluminium sales volume and a 1.8 per cent rise in its price as quoted on the London Metals Exchange.

Cash-based production cost fell 15.3 per cent to US$1,484 a tonne. Net debt was cut to US$8 billion, 41 per cent lower than in 2008. The firm has cut its global demand forecast for aluminium to 6 per cent from an earlier forecast of 6.5 per cent, citing weaker than expected demand in Russia, Brazil and Asia. It expected China’s consumption growth to reach 9 per cent this year.

8:18am: China Everbright Bank will release interim results today. Executives of the company will meet the media at 4:30 pm. The company closed 2.63 per cent down on Wednesday at HK$ 3.3. Its share (yellow) outperformed the benchmark Hang Seng Index (purple) in early June and then underperformed the benchmark the next two months. Click to enlarge chart.

8:17am: China’s biggest oil company PetroChina will release interim results today. Executives of the company will meet the media at 4:15 pm. The company closed 0.8 per cent up on Wednesday at HK$ 6.29. Its share (yellow) underperformed the benchmark Hang Seng Index (purple) the past three months. Click to enlarge chart.

8:15am: Industrial and Commercial Bank of China, the world’s largest bank by market capitalization, will release interim results today. The company closed 0.86 per cent down on Wednesday at HK$ 4.59. Its share (yellow) slightly underperformed the benchmark Hang Seng Index (purple) the past three months. Click to enlarge chart.

8:12am: Greenland Hong Kong Holdings, the offshore arm of the Shanghai based Greenland Holdings, will release interim results today. The company closed 5.16 per cent down on Wednesday at HK$ 3.31. Its share (yellow) underperformed the benchmark Hang Seng Index (purple) in the past three months. Click to enlarge chart.

8:12am: China COSCO Holdings, the nation’s shipping and container conglomerate, will release interim results today. Its share price (yellow) underperformed the benchmark Hang Seng Index (purple) the past three months. Click to enlarge chart.

8:10am: Bank of Communications, China’s fifth largest lender, will release interim results today. Its share (yellow) outperformed the benchmark Hang Seng Index (purple) the past three months. Click to enlarge chart.

8:06am: Air China, one of the nation’s biggest carriers, will release interim results today. The company closed up 5.92 per cent on Wednesday at HK$5.55. Its share price (yellow) underperformed the benchmark Hang Seng Index (purple) in the past three months. Click on chart to enlarge.

8:00am: China’s state-owned Agriculture Bank of China (yellow) will release interim results today. The company closed up 0.32 per cent on Wednesday at HK$3.12. Its share was trading in line with the benchmark Hang Seng Index (purple) since May but underperformed it since early July. Click to enlarge chart.

7:58am: Onshore yuan closed Wednesday at 6.4095 to the dollar, stronger from the previous close at 6.4114. Offshore yuan finished at 6.4857 to the dollar Wednesday, firmer from the previous close at 6.4886.