Fitter, leaner, faster: China sets hard targets in ‘weight loss’ plan for bloated state firms

Goals include specific cuts to capacity and layers of management

Beijing on Wednesday unveiled hard targets as part of a “weight loss” plan to downsize the bloated state sector.

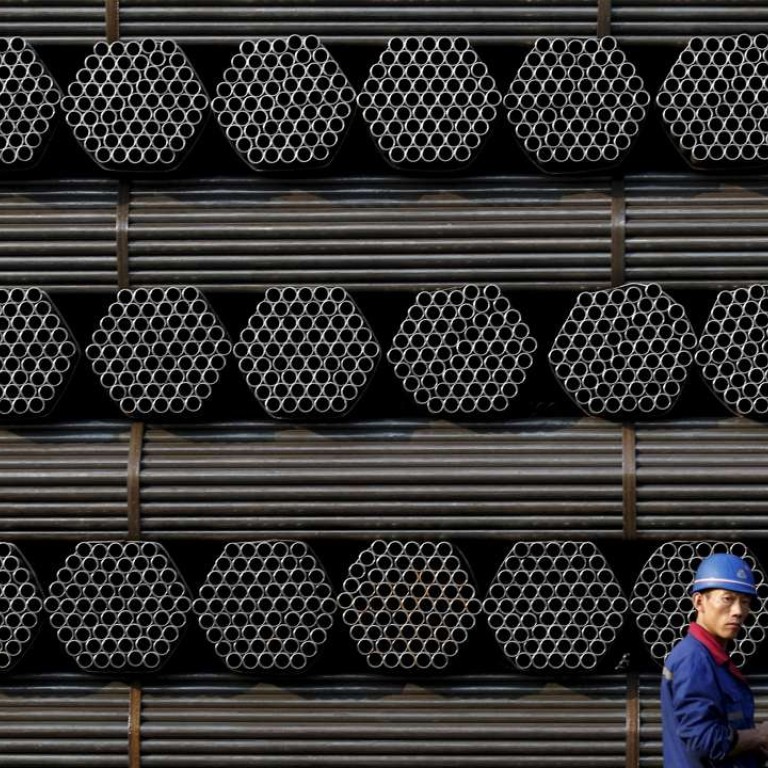

Coal and steel capacity would be cut by 10 per cent this year and in 2017, according to a statement released after a regular State Council meeting chaired by Premier Li Keqiang.

The government also aims to reduce the number of offshoots of the country’s biggest state enterprises by 20 per cent, as well as cut costs and boost profitability at the firms by a combined 100 billion yuan (HK$119 billion) over the next two years, it said.

The decision came after People’s Daily last week published an interview questioning the sustainability of debt-fuelled growth and a speech by President Xi Jinping urging government agencies to accelerate “supply-side structural reforms”, the centrepiece of Xiconomics.

The State Council said some of the problem state enterprises had “weak core businesses, redundant workers, inefficiencies, excessive layers of management, and too many subsidiaries”. The government would promote a “weight loss and fitness” plan for such businesses to trim costs and boost profits, according to the statement.

‘Don’t wait, waver, hide or hesitate’: Xi Jinping on ‘supply-side’ reform

It said internal reporting layers at the biggest firms under the central government’s control should shrink to three or four, from the existing five to nine, to flatten the overly hierarchal structure at most state businesses. The structure of state firms often mirrors the 13-layer bureaucracy of the Communist Party.

The State Council did not say what the consequences would be if the targets were missed.

While Beijing has been working to make the nation’s biggest state-owned industrial enterprises more efficient and compliant over the last few decades, the performance of the top 100 under the direct leadership of the central government continues to be a major headache for the country’s decisionmakers.

China heading for big economic policy shift, says mystery ‘authoritative’ source in People’s Daily

Along with increasing profitability and efficiency, the leadership under Xi wants the Communist Party to play a bigger role at the businesses, according to a reform blueprint on state firms.

Most state coal and steel companies are under provincial or municipal control and among the central state-owned enterprises, only a few are steelmakers. These include Anshan Iron and Steel Group and Wuhan Iron and Steel Group, which are under huge pressure to cut their workforce.

China National Coal Group and China Shenhua Group are among the coal firms on the central government’s list.

But other conglomerates might have expanded into coal or steel production during the commodity boom. Sinosteel Corp, for example, made huge losses from its investments in steelmaking, and the company has missed payments on its bonds.

According to the Ministry of Finance, central state-owned firms made a combined net profit of 1.18 trillion yuan in 2015 from total assets of 64.2 trillion yuan, with a return on asset ratio below 2 per cent.