The three government numbers China’s economists trust least

Take figures for investment, unemployment and personal income with a grain of salt, report says

Of the 70 or so economic indicators produced by various Chinese government agencies, three are particularly untrustworthy – the figures for the jobless rate, fixed asset investment and personal income, according to a leading investment bank.

In a research note published on Thursday by China International Capital Corporation (CICC), the bank’s economists, led by Liang Hong, wrote that the fixed-asset investment (FAI) data compiled by the National Bureau of Statistics and local governments was likely inflated. But they said the urban jobless rate – the main unemployment indicator produced by the labour ministry – and figures for personal income had underestimated the real picture.

The quality of China’s economic data has long been questioned. Bill Gross, the famous Wall Street bond investor, once called China a “mystery meat” for its lack of transparency and reliable indicators, and President Xi Jinping has urged the country to improve the quality of its economic data.

The Communist Party’s anti-graft watchdog, the Central Commission for Discipline Inspection, recently said that Inner Mongolia and Jilin had been cooking some of their figures. An earlier report from the watchdog said rust belt province Liaoning had been inflating GDP and fiscal revenue numbers.

National data has also been seen as suspect, including figures for gross domestic product, consumer price index (CPI) and housing prices. The country’s headline GDP number, for instance, has been suspiciously steady in the last couple of quarters.

But these figures are not as unreliable as the ones for investment, joblessness and income, according to the CICC.

Fixed asset investment (FAI), for example, has been one of the main drivers of China’s economic growth for decades. However, the CICC said FAI data had been abused by local government officials, who wanted to show growth to enhance their career prospects. Last year, national FAI accounted for more than 80 per cent of China’s GDP, and 11 provinces reported investment figures that were higher than the local GDP, according to the bank.

Hong Hao, chief strategist at Bocom International, said: “It’s crucial to change Chinese officials’ appraisal system, as the overemphasis on GDP is obsolete and gives incentives for local officials to distort data.”

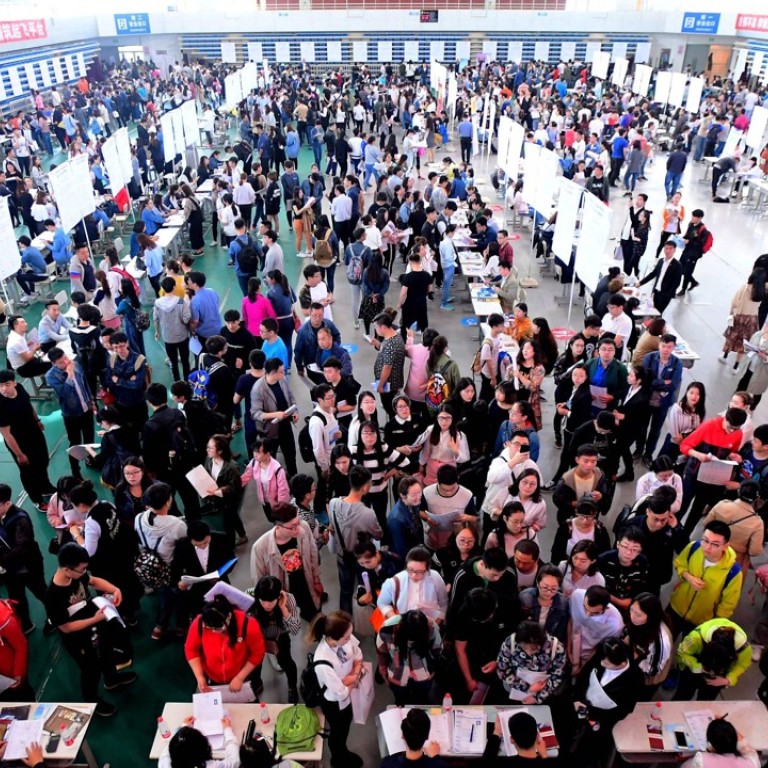

Statistics on registered urban unemployment are also flawed, underestimating the number of people out of work by only counting those registered with China’s labour authorities, according to the CICC.

It said China might also have underestimated people’s disposable income, as its survey had poor coverage of high-income earners and was unable to fairly evaluate personal housing costs.

Insufficient transparency was also problematic, as China had never announced the weighting for the components of its inflation gauge, the CPI.

The CICC economists also noted that there was no fixed schedule for some data releases, such as on bank loans and monetary supply.

“While China’s data has its quality problem, it does not mean China’s economic size is overrated,” the economists wrote. “As China undervalued people’s properties and the emerging service sector, it is likely China’s GDP is underestimated.”

Lu Zhengwei, an economist with Industrial Bank, said that with the rapid development of the service sector, there were more things not on the radar of China’s statistics authorities.

“China should utilise the new weapons, such as big data and cloud computing, to improve data quality and catch up with developed countries,” Lu said.