Overseas deals a national security matter for China, Xi says

Leading group run by president says it will step up supervision of investment abroad

A top decision-making group headed by President Xi Jinping decided on Monday that Beijing would enhance its monitoring and supervision of overseas investment deals to safeguard China’s economic interests and national security.

The latest order from the Central Leading Group for Comprehensive Reform, one of the many groups Xi has created to centralise decision-making around him, comes at a time the government is getting tough on the country’s big dealmakers, especially private enterprises that have borrowed heavily to finance overseas acquisitions.

It is the first time the top leadership has explicitly linked outbound investment with national security.

“The safety of overseas businesses and outbound investments is an important part of [securing] China’s overseas interests,” the official Xinhua news agency reported, summarising the leading group’s decision.

“We must insist [on] the Communist Party’s leadership over the security of overseas businesses and outbound investments, and we must ... improve statistics and monitoring of such businesses and investments to strengthen supervision,” the summary read.

China’s history of aggressive overseas investment to secure energy and raw materials is chequered with failures and losses from Australia to Venezuela.

Beijing began to curb external acquisitions at the end of 2016, labelling investments in real estate, cinemas and soccer clubs as “irrational”.

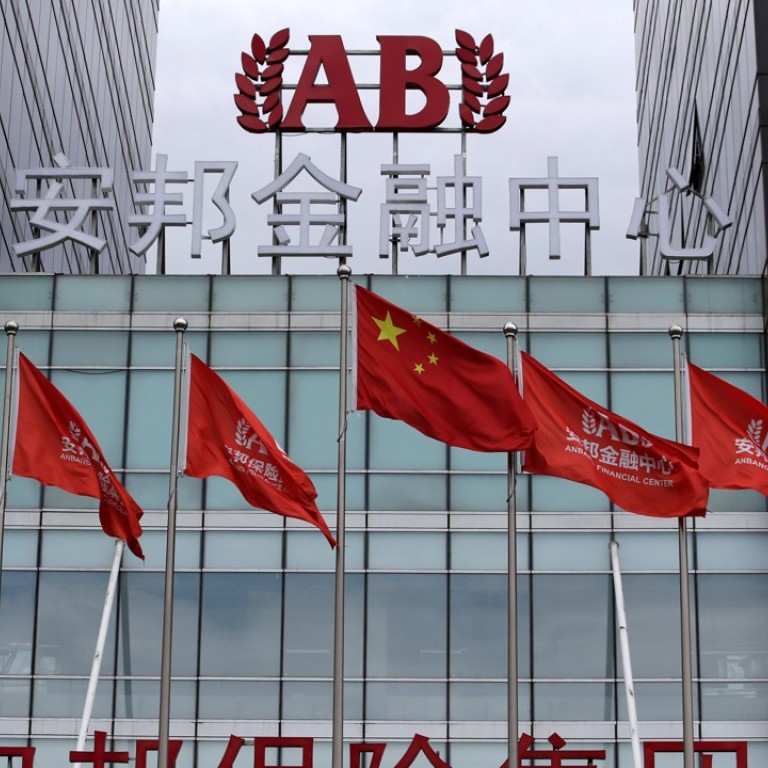

The country’s banking regulator has singled out Wanda, Fosun, Anbang, HNA Group and Zhejiang firm Rossoneri Sport Investment Lux as aggressive overseas investors, and ordered banks to check their exposure to these enterprises, according to emails seen by the South China Morning Post last week.

Anbang chairman Wu Xiaohui, who married a granddaughter of former paramount leader Deng Xiaoping, had made a series of high-profile acquisitions abroad, including the Waldorf Astoria Hotel in New York.

Wu was taken away to “assist in investigations” earlier this month.

Beijing’s bid to increase its control over overseas deals is showing results. Mainland outbound investment for the first five months of the year plunged 53 per cent from a year earlier, Ministry of Commerce data showed.

“A few companies were suspected to have transferred their capital overseas,” Huo Jianguo, a former head of the commerce ministry’s research institute, said.

However, Huo said it was technically difficult to assess whether an overseas deal was a legitimate business decision or a way to cover up the stashing of money abroad.

Lester Ross, a managing partner at the US law firm Wilmer Hale, said the Chinese leadership was showing concern over the economic security of the country’s overseas businesses.

“The real concern here is some of the investments made are not adequately supported by assets and not financially viable, which could ... constitute a systemic risk to the Chinese economy,” he said.

Some deals by companies such as Anbang involved a mismatch between their long-term liabilities and their short-term assets, Ross said. “That’s a problem which could affect the economic system,” he said.