Debt-ridden Chinese city does U-turn on scrapping loan guarantees

Ningxiang bows to pressure and reverses sudden plan to invalidate promises to pay money owed

A city government in central China has scrapped plans to pull guarantees to pay local debts after a backlash among creditors, lawyers and financial professionals.

The U-turn by the government in Ningxiang, Hunan province, comes as the country’s leadership under President Xi Jinping tries to rein in local authorities’ massive debt problems.

The rapid roll-out and then reversal in policy also highlights the risks facing creditors who have lent to municipal authorities in China, according to analysts.

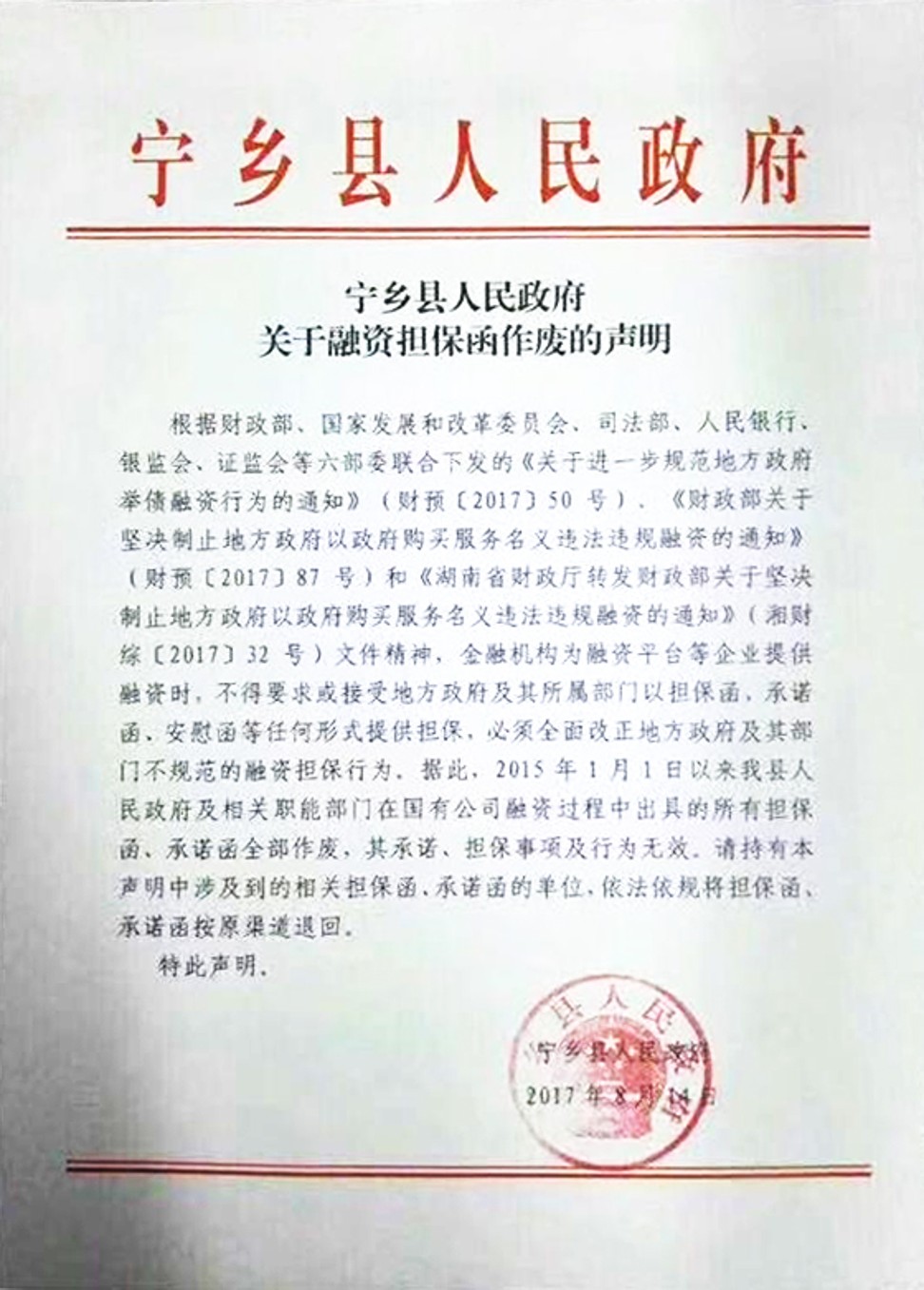

In a document dated August 14, Ningxiang’s government said its finance guarantee letters issued for state-owned institutions and businesses issued since January 2015 were invalid.

The note said the ruling had been made because the finance ministry banned local governments from making such commitments.

It said banks and other lenders should “return all received letters of credit guarantees and letters of promises” issued by Ningxiang agencies.

But a report on the announcement published on the news website NetEase.com attracted more than 30,000 comments, with most criticising the local government for not honouring its promises.

Chinese newspapers, including The Beijing News, published opinion pieces criticising Ningxiang for damaging government credibility.

Amanda Du, a vice-president at the ratings agency Moody’s, said Ningxiang’s brief announcement dropping its liabilities “was too sudden and simple” and ran counter to the spirit of the contracts it agreed.

Ningxiang’s government revenue in 2016 was 4.3 billion yuan (US$645 million), but its expenditure was 8.1 billion yuan, meaning the local authorities rely heavily on central government support and debt.

The city’s government had total outstanding debt of 16.3 billion yuan at the end of 2016, local data shows, about four times its gross revenues that year.

The administration had issued official guarantees for 742 million yuan in outstanding debt, and might have to shoulder some of the burden of 6.5 billion yuan in loans.

The government did not provide a breakdown of which companies it gave credit guarantees for.

The municipal government withdrew its document reneging on debt guarantees on Thursday morning.

It said the document invalidating the guarantees had “inappropriate elements” and had “misled public opinion”.

Liu Xuezhi, an analyst at the Bank of Communications in Shanghai, said the case reflected growing pressure from the central government to address debt problems as financial risk prevention was made a priority this year.

“As the existing debts will have to show up in local budgets and many are due for repayment, this will generate a short-term financial squeeze in some regions,” he said.

Central government figures suggest that local government debt was at an “overall controllable” level of 15.3 trillion yuan by the end of last year, but the National Audit Office has warned that some local governments and western regions face a greater burden as their outstanding debt levels have doubled in three years.

The finance ministry has named and shamed several cases of irregularities in Sichuan, Shandong and Hubei provinces plus in Chongqing so far this year. It also threatened to expose new scandals and hold local officials accountable.

Providing credit guarantees to secure loans used to be a common practice among local authorities in China, although it is coming under increasing scrutiny from Beijing as it can produce huge “hidden debts”.

China’s Budget Law, which came into effect in January 2015, forbids local governments from granting credit guarantees without prior approval.

The finance ministry and other government departments are now checking the books of local governments to see if they are following the regulations.

Ningxiang’s initial document issued earlier this month was issued as a result of “China’s tightening of local government financing”, according to Du at Moody’s.