Turf wars and risk aversion: China’s pro-market central bank boss ‘leaves note’ to next generation

Institutional obstacles block the country’s path to a freer market and won’t be moved in the short term, analysts say

A plea from China’s outgoing central bank governor for a freer yuan has focused attention on the institutional obstacles stopping the country from integrating into the world’s financial market, analysts said.

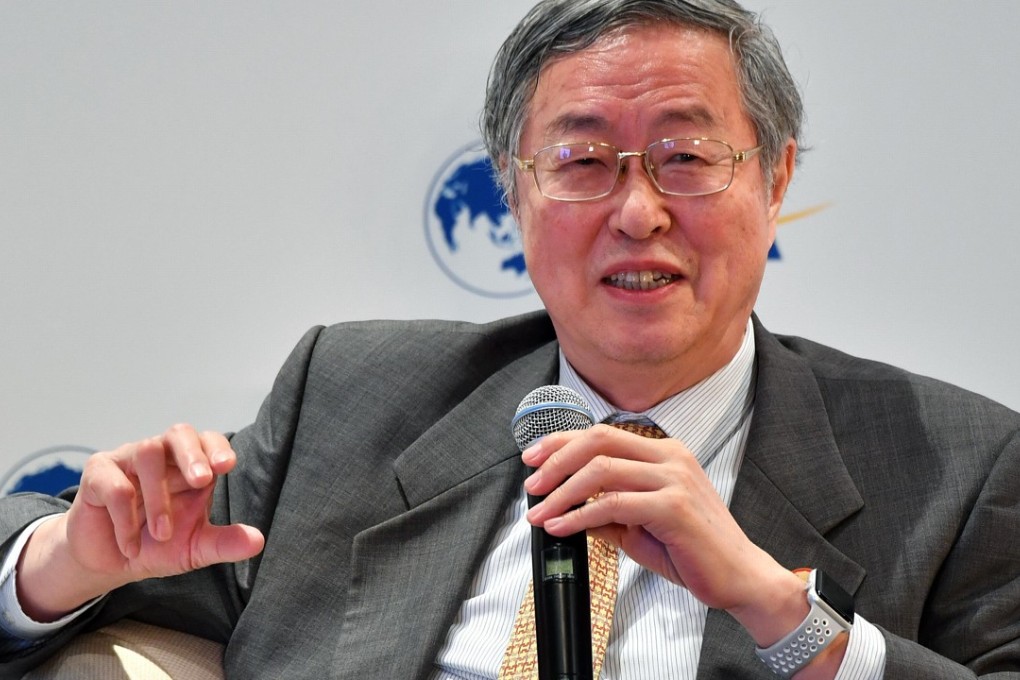

In what could be one of his last major interviews in the top job, Zhou Xiaochuan, the veteran People’s Bank of China (PBOC) governor who is expected to retire soon, told Chinese magazine Caijing that China should seize the moment to let the market decide the yuan’s value and scrap capital account controls.

Zhou’s call for reform came amid speculation that China’s leadership is veering away from liberalisation towards a more nationalistic and centralised approach to managing the world’s second-biggest economy.

The interview, published days before the Communist Party meets to decide on a new leadership line-up, underscored Zhou’s long-standing liberal monetary views.

Analysts said it was also reminder to the country’s future leaders and financial technocrats of what needs to be done to make China an open economy.