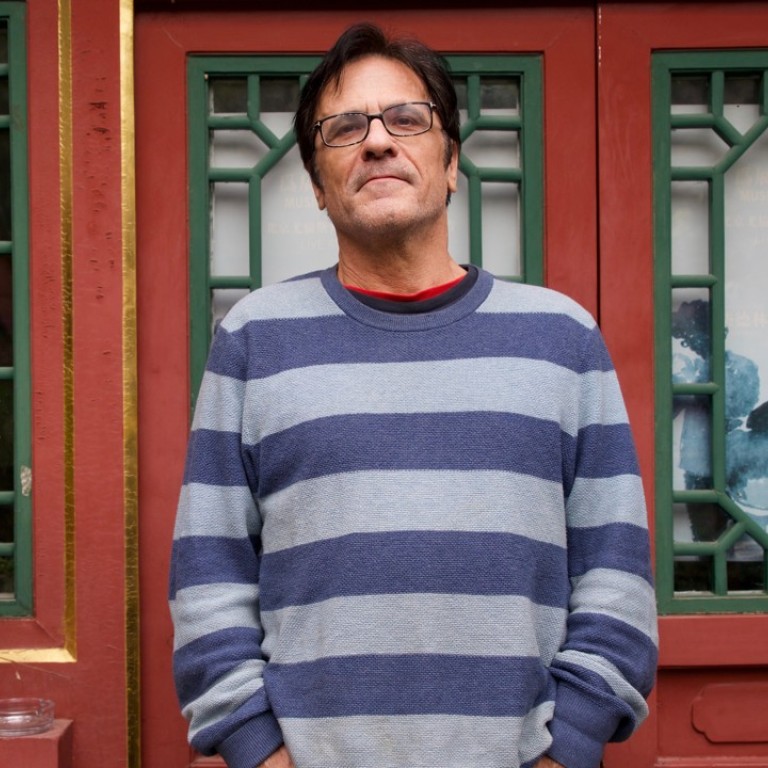

Maxed-out China needs a strong leader to fix its debt mess, economist Michael Pettis says

President Xi Jinping’s increased power will help put China’s growth plan on the right track, Peking University finance professor says

China needs a strong leader if it’s to clean up its debt mess and rebalance its economy, a long-time watcher of the Chinese economy has said.

Michael Pettis, a professor of finance at Peking University’s Guanghua School of Management, said President Xi Jinping’s consolidation of power at the Communist Party’s national congress last week was necessary to put growth on the right track.

“China does not really need a more liberalised economy, doesn’t need to eliminate capital control. It does not need a larger degree of market role in the decision-making process. What it needs is a significant transfer of wealth, and for that we need to centralise the decision-making process,” he said.

Pettis, who has spent the last decade and a half in Beijing, said the omission of a specific growth target in Xi’s report was “a good sign to start with”, sending a strong message to the country’s local cadres to stop piling up debt.

“The first signal from Beijing that it will rein in credit would be to give up GDP growth target, because the GDP growth target locks the country into surging debt,” Pettis, who also works as a senior fellow at the Carnegie Endowment for International Peace, said a day after China decided the new leadership line-up and enshrined Xi’s thought into the party constitution.

The country’s all-out efforts to accomplish annual growth targets, mostly resorting to investment stimulus, has generated a series of economic problems, including a mountain of debt.

“One of the biggest problems we have in analysing the Chinese economy is that in most countries GDP growth is an output that tells us about the performance of the economic system, but in China, GDP growth is an input into the system,” he said.

“China could grow 8 per cent if it wanted, just by allowing debt to grow by whatever amount was necessary. But it’s not a real growth. It’s growth in economic activity, not growth in wealth.”

China’s headline growth rebounded to 6.9 per cent in the first three quarters from 6.7 per cent last year, outperforming not only the United States and Japan but also India and Indonesia.

Pettis said, according his own estimates, China’s real growth is lower than 3 per cent.

He warned that if China didn’t act quickly, it risked a fate similar to Brazil’s debt crisis and Japan’s “lost decades”.

“Everybody agrees that China has a serious debt problem … This growth model has been overall reliant on an unsustainable increase of debt. So it just can’t continue,” Pettis said. “The sooner they address the debt problem, the better.”

The absolute amount of Chinese debt, about US$2.8 trillion according to the Bank for International Settlements, was not high compared to major economies. But the big concern was the rapid rise of leverage – from 143 per cent of its gross domestic product to 257 per cent.

Despite government rhetoric to slash financial leverage from this year, Pettis said no meaningful results had yet been seen. “[Debt is] growing more and more quickly every single month and every single quarter. So there’s no deleveraging at all,” he said.

DIRECT ANSWERS

The basic solution to the problem, according to Pettis, is to break the opposition of vested interest groups to liquidate local government assets.

“Local governments have benefited tremendously from the last 30 years’ growth, they must give up some of the benefits. Local governments’ must liquidate their assets and use the proceeds to pay down the debt, increase household wealth and household income.”

Competition among local governments for strong growth is an underlying factor of China’s economic success, but it has also led to neglect of environment, debt risks and data forgery.

“The key issue is to what extent the president has to centralise power that they can enforce local governments to absorb those big losses,” he said.

Pettis, a former Wall Street banker, said China could withstand a much lower headline growth rate if household income could rise, and Xi could not rely on laissez-faire policies to fix China’s problems.