Stalling of economic reform could hamper Donald Trump’s Beijing strategy, study suggests

Measured against Beijing’s 2013 goals, an analysis by the Rhodium Group and the Asia Society Policy Institute shows the reform effort has largely fizzled

China’s economic reforms may have hit a dead end, according to a new study.

When measured against reform goals Beijing set five years ago – at the Third Plenum meeting of the country’s leadership in November 2013 – an analysis of data available in China by the Rhodium Group and the Asia Society Policy Institute shows the effort has largely stalled.

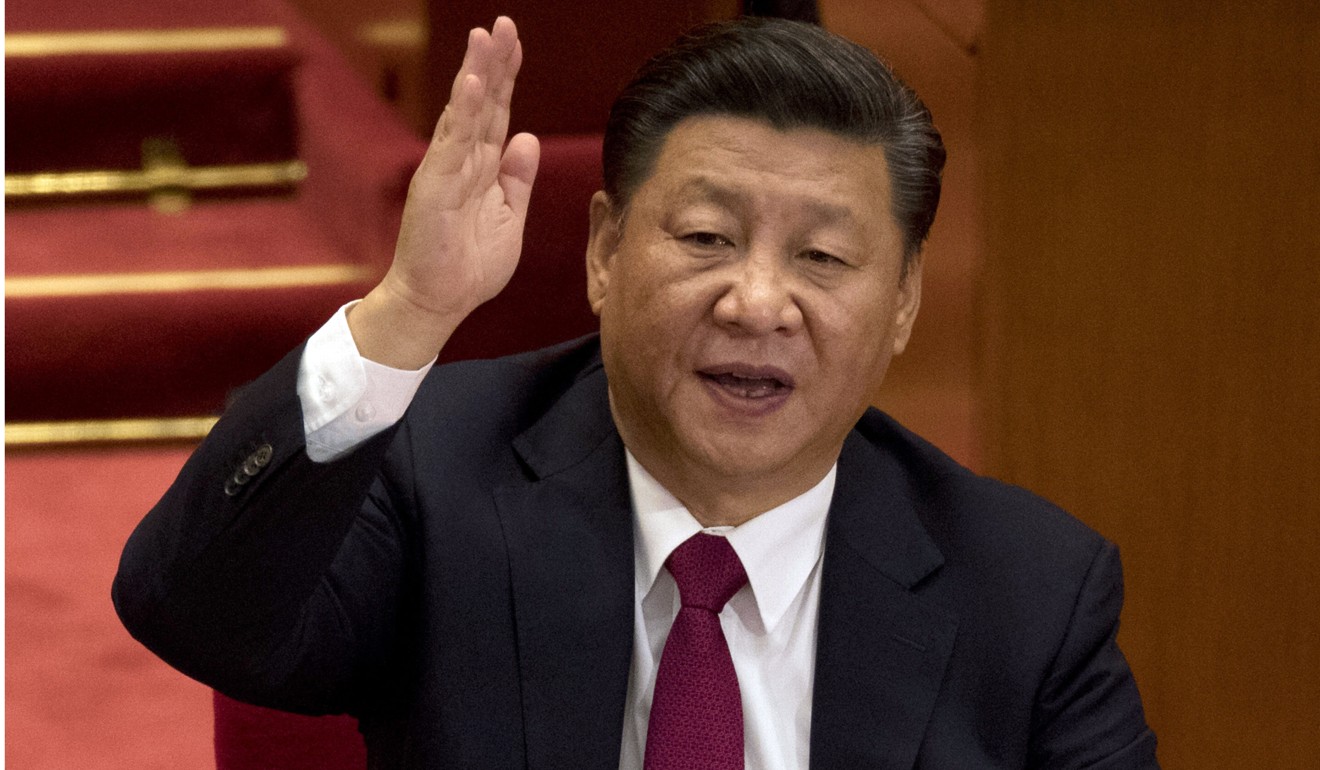

Paired with rising concern about the Chinese government’s efforts to acquire technology for military purposes, languishing market reforms in China may hamper efforts by US President Donald Trump to show his approach to Beijing will provide opportunities for the US. Trump is expected to arrive in Beijing on November 8 for two days of ceremonies, a state banquet and bilateral talks with President Xi Jinping.

“The Trump administration would be better served by policies rooted in an understanding of where China is heading,” Rhodium founder Dan Rosen said in an interview with the South China Morning Post. “China’s leaders have put off many economic reforms in hopes of finding an approach that avoids sacrificing political control, but unfortunately that solution probably does not exist.”

The China Dashboard, an online, interactive tool just launched by the policy institute and Rhodium, shows either backsliding or very little progress in nine out of 10 areas targeted by the government for reform, based on domestic data. These areas include trade, competition, cross-border investment and fiscal policy.

“Indications do not show stepped-up progress in opening trade for China’s highly protected goods and services – the place where it counts,” according to the Dashboard’s assessment of China’s trade situation. “Halfway through 2017, China’s global surpluses and bilateral surplus with the United States are turning up, not down. Furthermore, exports of Chinese overcapacity goods through 2017 will cause further international reaction.”

US Census Bureau data pegged the US trade deficit with China at US$239 billion for the first eight months of this year, putting it on track to match or exceed the $347 billion gap in 2016.

Continued government financing of unprofitable state-owned enterprises as a means to provide economic stability has led to overcapacity in the production of steel and other commodities. That overproduction has undercut global steel prices and fuelled imports of Chinese steel products by the US.

In response, the US Commerce Department has been conducting a months-long investigation into the impact on national security of imports of steel and aluminium. US Commerce Secretary Wilbur Ross is expected to give Trump options for restricting steel imports based on the investigation’s findings.

Some Chinese officials acknowledge a lack of progress in reforming parts of the economy.

“The direction of the reform is to give the market a decisive role in resource allocation and at the same time we also encourage [having] more efficient government,” Zhu Hong, minister of economic and commercial affairs at China’s embassy in Washington, said in an Asia Society discussion earlier this month.

“This is a very difficult balance. There’s a long way to go. We haven’t finished that task. The most difficult issue is how to reform the [state-owned enterprises].”

Rhodium’s Rosen said some China watchers “suspect that [China’s] leaders already know that reform without political liberalisation is not an option and they’re stalling for time. Others think Beijing believes it can find a way to avoid the political compromises other transition economies had to make.”

Innovation emerged as the only area where China has made progress in reform, according to the China Dashboard. Ironically, this area also happens to be one of increasing tension between the US and Beijing.

“Beijing’s commitment to implement its Made in China 2025 industrial policy plan with benchmarks for reducing imports and taking larger global market shares in numerous high-value sectors is clear, and it will continue to fuel trade tensions if more trade openings do not follow,” the dashboard said.

Made in China 2025 refers to a state-sponsored programme that directs hundreds of billions of yuan towards development of domestic technologies needed for advanced manufacturing in automotive, aerospace, telecommunications and other high value-added industries.

The US Chamber of Commerce has criticised the programme by pointing out how it benefits Chinese companies such as smartphone maker Xiaomi Corp.

By comparing the value-added output of sectors targeted by Made In China 2025 against aggregate value-added growth across all industries, the Dashboard concludes that “most industries that make up our aggregative innovation index are growing value-added faster than the headline [industrial value added] growth rate” of 7.9 per cent in the second quarter of 2017.

“I don’t think [Trump] is going to get satisfaction out of the summit in the full range of issues that he’s raised in trade and investment,” including forced transfers of technology, subsidies to state-owned enterprises and access to financial markets, Elizabeth Economy, director for Asia studies at the New York-based Council on Foreign Relations, said in a conference call with reporters and analysts.

“He’s put a lot of things in motion already that will not come to fruition by the time he sits down with Xi Jinping. He’ll make his points forcefully, and certainly there will be some deals announced. There will be some deals. Will there be some slight market opening in one sector? Perhaps,” Economy said. “But the types of issues that he’s raised are not going to be resolved at this summit, and will play out further down the line.”

While Made in China 2025 seeks to limit the participation of foreign high tech, the US is gearing up to block Chinese acquisitions of US companies developing artificial intelligence and other advanced technology that can have military applications, also known as “dual use” technology.

The China Dashboard flags comments by Xi this year where the president emphasised “the importance of ‘utilising existing resources and optimising the allocation of new resources’ so that ‘the maximum benefits of deep military-civilian integration can be achieved’”.

“This emphasis on the interplay of military and commercial innovation is a new theme, at least as an explicit direction,” Xi said. “Innovation with Chinese characteristics therefore means directing resources into security priorities such as military applications of artificial intelligence, nuclear energy and space technology.”

This emphasis on acquiring dual-use technology has set off alarm bells among some US lawmakers and government officials. The US defence department warned in a recently declassified document that “not only may we lose our technological superiority but we may even be easing China’s technological superiority”.

The 49-page DOD document, titled “China’s Technology Transfer Strategy: How Chinese Investments in Emerging Technology Enable A Strategic Competitor to Access the Crown Jewels of US Innovation”, highlights transfers done not only via cyber theft and espionage, but also through VC investments and research centres such as Baidu’s Silicon Valley-based Institute for Deep Learning.

The ambiguity surrounding some Chinese investments in the US sets up obstacles to the kind of investments China is most keen to make.

“Government encouragement for civil-military cooperation has been normal in OECD countries the past 70 years,” Rosen said. “What is different, and troubling in capitals such as Washington, is that the Chinese government is so omnipresent in the civilian economy that it’s difficult to see where commercial forces end and strategic objectives begin.”

Trump will be accompanied by an American CEO delegation led by Commerce Secretary Ross when he arrives in Beijing.

Speaking to reporters in Washington this week, a senior White House official said the visit will send a “clear message that, for bilateral economic relations to be sustainable over the long term, China must provide fair and reciprocal treatment to US firms and cease predatory trade and investment practices.”