The book Xi Jinping’s economic point man suggests former US treasury chief Jack Lew put on his reading list

Zhu Guangyao offers up copy of Xi Jinping’s lengthy congress report when asked about China’s future reform moves

Chinese President Xi Jinping’s tomes are required reading for China’s 90 million communist cadres and now one senior finance official is suggesting it should also be the case for a former US treasury chief.

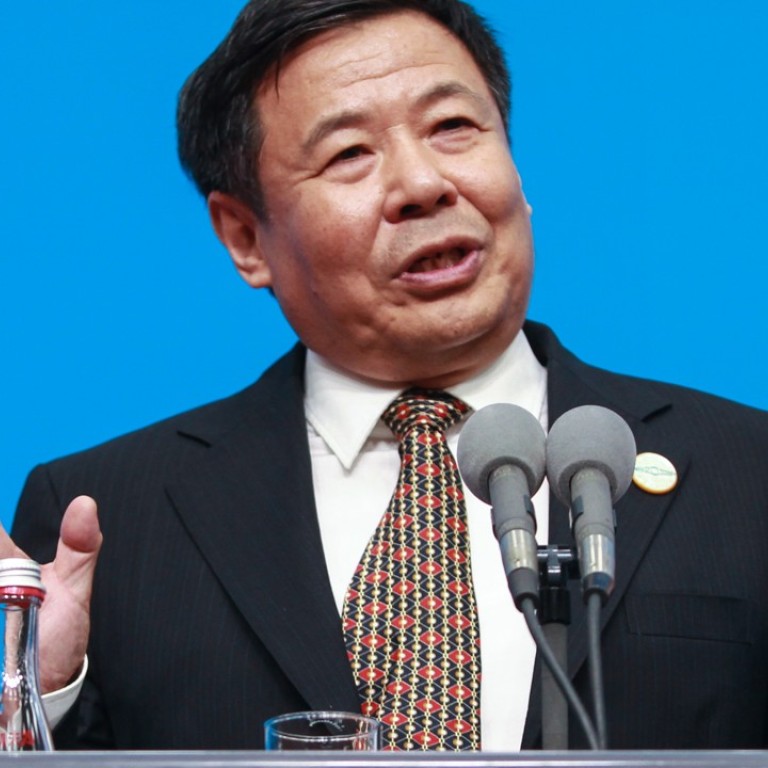

At an annual conference staged by influential financial magazine Caixin, vice-finance minister Zhu Guangyao asked former US treasury secretary Jack Lew if he had read Xi’s report to the Communist Party’s national congress last month.

Lew, who was in the United States and taking part in the conference via a video link, had raised a general question with the official about the country’s reform direction.

“Have you ever read this important document by President Xi Jinping?” Zhu said, holding up a copy of the report in front of hundreds of conference participants.

Lew replied that he had read the main points but had not made his way through the whole text now that he no longer had hundreds of staff briefing him.

Xi took more than three hours to present his marathon report to the five-yearly Communist Party congress last month. Coming in at about 32,000 characters, the report has been printed and distributed for the party’s 90 million or so members to “study”.

In it, Xi defines his vision for the country’s development, pledging that China will further open up its economy.

And there are signs that it is already doing that. Just hours after US President Donald Trump left Beijing on Friday, Zhu announced that China would remove the cap on foreign stakes in Chinese banks, insurers and asset management companies over the next three to five years.

Chinese and US companies also signed US$253 billion in trade deals during the trip.

At the conference on Wednesday, Zhu described Trump’s visit as very successful, saying Xi and Trump talked very broadly on policy and reached a lot of economic objectives.

He said more changes were to come but they would be determined by China and not as a result of external pressure.

“Certainly I can tell you, with the strong leadership of President Xi Jinping and with the policies outlined in the party document, [we] will certainly open more to foreign investors, and will deepen structural reform,” the official said.

China’s economy has beaten market expectations in the last few months and the global economy is in a better shape. China is expected to register a rise in gross domestic product this year for the first time since 2010, with the International Monetary Fund projecting GDP growth to increase to 6.8 per cent from 6.7 per cent a year earlier. The IMF forecasts global economic growth to be 3.6 per cent for 2017.

But Beijing needs to be alert to external shocks such as monetary moves by the US Federal Reserve and there are question marks over the sustainability of China’s economic expansion.

Huang Yiping, a Peking University professor advising China’s central bank, said the recovery was largely driven by the property market and the global recovery in commodities. “How far can growth driven by infrastructure and property go? There’s a huge question mark,” he said.

Huang also warned of the latent risk of a financial crisis, saying little progress had been made on overhauling the global regulatory regime, quantitative easing was having negative impacts on small economies and Trump had little interest in financial deregulation.