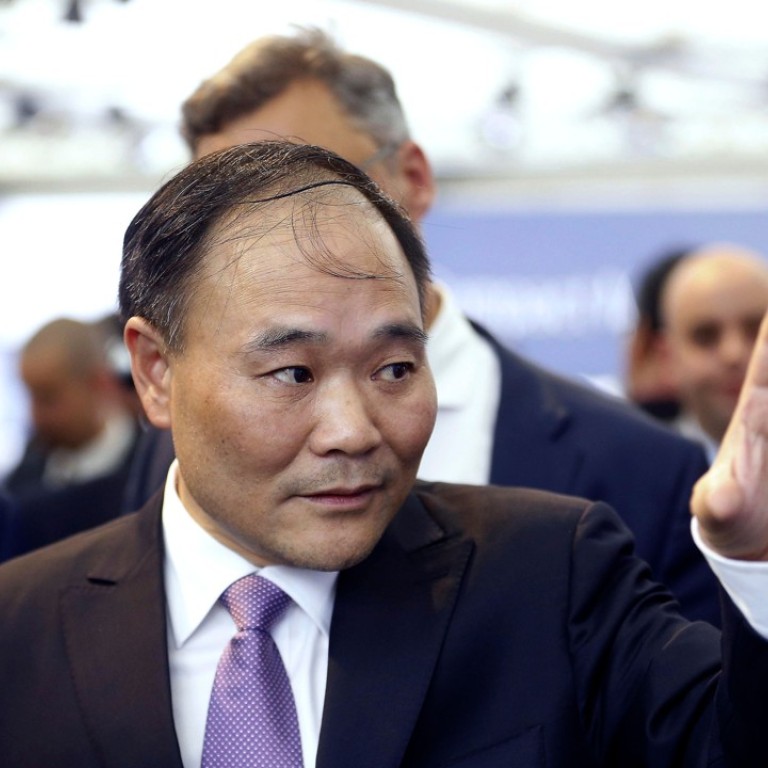

Chinese billionaire Li Shufu is now biggest single stakeholder in Daimler

Geely chairman buys near 10 per cent share in Mercedes-Benz maker

Chinese billionaire Li Shufu has bought a near 10 per cent stake in Mercedes-Benz maker Daimler, making him the German group’s largest single shareholder, a stock market filing showed on Friday.

Li, who chairs auto giant Geely Automobile Holdings, bought a 9.69 per cent stake in the carmaker, worth around €7.2 billion (US$8.9 billion), according to the filing.

The size of the investment leapfrogs a 6.8 per cent stake in the Stuttgart-based group held by Kuwait and Renault-Nissan’s 3.1 per cent holding.

“Daimler is pleased to announced that with Li Shufu it could win another long-term orientated shareholder,” a spokesman for the Stuttgart-based group said.

Li had been “convinced by Daimler’s innovation strength, strategy and future potential”, he added.

German business media have for weeks reported Li and Geely’s interest in Daimler.

But Friday is the first time Li’s stake has crossed the threshold of 3 per cent of stock, requiring a public notification.

Two sources familiar with the thinking of Li Shufu told Reuters that his move to accumulate the stake, which has a market value of US$9 billion, was motivated by the “dramatic transformation” under way in the automotive industry.

His strategic goal was an alliance with Daimler, which is developing electric and self-driving vehicles, to respond to the challenge from US players Tesla, Google and Uber, who are all working on their own driverless cars.

“This is what chairman Li has envisioned. He thinks maybe one or two or three manufacturers that exist today will survive in this new competition,” one of the sources said, requesting anonymity because of the sensitivity of the matter.

“He thinks existing manufacturers should unite and invest in the future and become one of the two or three companies that will survive.”

Geely itself is no stranger to the European car business, having bought Sweden’s Volvo in 2010.

It also owns British sports car manufacturer Lotus and the firm which makes London’s world-famous black cabs.

And in December it advanced further onto Daimler’s turf, investing in AB Volvo, the world’s number two truck manufacturer after the Stuttgarters.

But in a speech to the CAR Institute automotive conference in Bochum, Germany earlier this month, Li skirted around the speculation, saying simply that Europe had “a very important role for the development of automotive brands under our leadership”.

The stake purchase followed an initial approach last November, when Li sought to buy a Daimler stake as a way to access Mercedes-Benz technology for electric cars and trucks, including battery technology, to help Geely comply with a Chinese crackdown on pollution.

Geely sees potential in Daimler because it is developing high-speed internet connections for autonomous cars at a time when Li believes satellite-based internet connections could become more important for the auto industry, according to Reuters.

Li, 54, is ranked at 10 on Forbes magazine’s China Rich List and 209th on its global billionaires ranking, with an estimated net worth of US$16.6 billion.

His interest in Germany is the latest in a string of acquisitions by wealthy Chinese firms and individuals, including conglomerate HNA which owns an 8.8 per cent stake in the country’s biggest lender Deutsche Bank.

China’s avid search for footholds in Europe has raised hackles among some politicians in Berlin, Paris and Brussels.

Daimler overtook home-grown rival BMW to become the world’s largest luxury carmaker by unit sales in 2016, helped by a broad refresh of its model range and powerful sales growth in China.

It reported a 24 per cent leap in net profits last year, to €10.9 billion, when it presented its annual earnings earlier this month.

Geely’s investment arrives as Daimler begins moving away from a classic German conglomerate model that shareholders complain is too rigid.

It will become a holding company combining three divisions: financial services, cars and small commercial vehicles and trucks and buses.

The Stuttgart firm is unusual among its German peers in lacking a single controlling shareholder, whereas Volkswagen is dominated by the Porsche-Piech clan and BMW by the Quandt-Klatten family.

Executives hope the reform will make Daimler more flexible as it adapts to a changing environment for the industry, electrifying a growing share of its range and offering new digital services like ride- or car-sharing.

Electric vehicles are especially critical to the massive Chinese market, where Beijing is preparing to impose quotas for emissions-free vehicles on manufacturers.

Daimler is making Mercedes-Benz cars for the Chinese market locally via a joint venture with partner BAIC motors.

The company told business daily Handelsblatt on Friday that its relationship with BAIC remained solid.

.png?itok=arIb17P0)