China cuts deposit reserve rate for first time in 26 months to unleash cash

Reserve requirement ratio will be cut by one percentage point from April 25, People’s Bank of China says

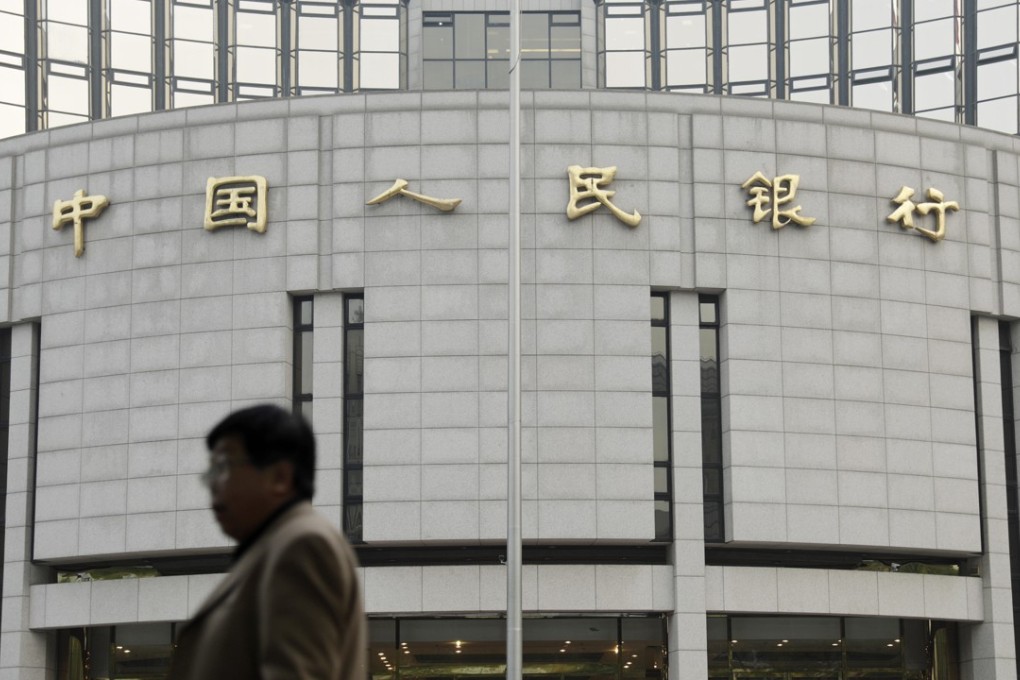

China’s central bank announced on Tuesday that it would cut the amount of cash that most banks are required to hold in reserve – the first reduction since February 2016 – to release cash into the banking system.

Although the bulk of the cash will be used to repay loans from the central bank, the use of the required reserve ratio may indicate new thinking at the People’s Bank of China under its new leadership team.

A conditional cut was announced in September if banks met certain requirements in terms of lending to small businesses and rural areas.

Tuesday’s cut tookplace at a time when a major source of liquidity in China, namely capital inflows, was drying up – partly because the US Federal Reserve is raising rates and China’s trade surplus is shrinking.

“This may start a sustained period of relative monetary easing [in China],” Yang Weixiao, an economist with Founder Securities, a local brokerage, wrote in a note after the move.

The unexpected move came after official data released earlier on Tuesday showed that China’s economy had grown at 6.8 per cent in the first quarter.