Can China survive trade war by seducing US firms and fixing economy’s weak links?

Beijing will remain focused on its existing domestic strategies, while promising to open up more markets to foreign investors, analysts say

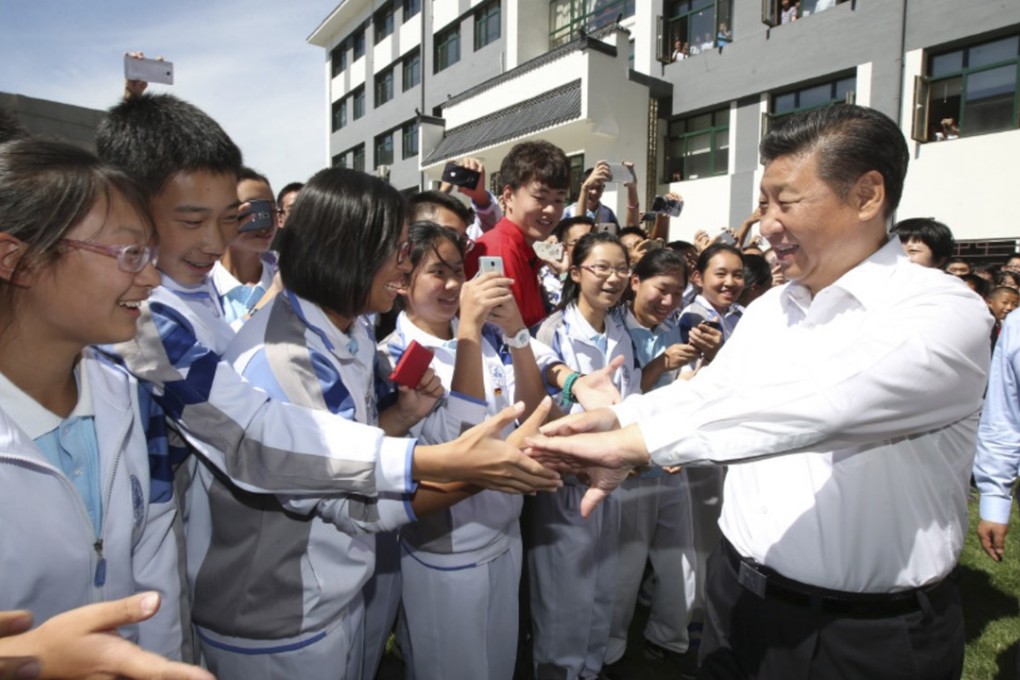

Chinese President Xi Jinping is trying to play cool and smart to win a trade war against the US by fixing domestic economic weak links, and offering a friendly face to other trading partners and American firms.

Xi and his colleagues have shelved a tit-for-tat confrontational approach and opted to deal with the protracted battle by pressing on with what Beijing believes is right for the long-term health of its economy, carefully managing the trade dispute’s impact on growth without sidelining Beijing’s strategic pursuits such as debt reduction, analysts said.

The plan is based on Xi’s trust in China’s growth model, having often asked the country’s officials to keep “strategic confidence” and “strategic focus” during the trade hostilities with US, and the threats from US President Donald Trump could press Beijing to enhance its economic resilience, they said.

Mei Xinyu, an affiliated researcher with the Ministry of Commerce, said China could use the trade dispute as a “pressure test” to spot weak links in its economy and remedy them.

“For instance, China can carry out large-scale tax cuts … not catch fish by drying up the whole pond,” he told a symposium in Beijing this week.