China’s finance ministry goes back to old playbook with move to spur bond sales

After disagreement with central bank, local governments told to issue new ‘special purpose’ bonds for infrastructure before the end of September

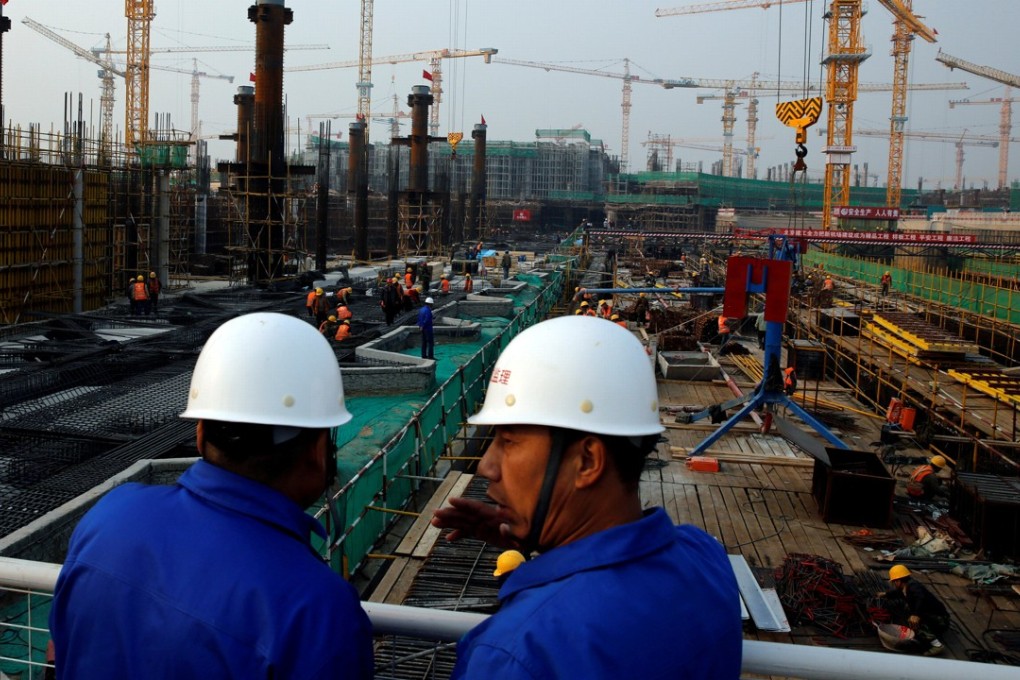

China is expected to see a bond-selling spree after the finance ministry asked local governments to issue bonds as soon as possible as it tries to boost growth, a move that will push lenders to bankroll the authorities.

The move also indicates a return to Beijing’s old playbook of relying on debt-fuelled state investment to keep economic growth on track at a time when the leadership is worried about dangers beyond its control, though it has refrained from an all-out stimulus strategy, analysts said.

The Ministry of Finance issued the order on Tuesday, after Beijing decided to prioritise maintaining growth over cutting debt due to headwinds from a trade war with Washington and decelerating investment at home.

The cabinet had already said it would allow local governments to issue 1.35 trillion yuan (US$195.12 billion) of “special purpose” bonds for infrastructure investments. But the finance ministry took it a step further, telling local governments to sell at least 80 per cent of those newly approved special purpose bonds before the end of September. Most local government bonds are sold to the country’s financial institutions and a surge in their supply will in turn put pressure on the People’s Bank of China to loosen its monetary policy.

Zhou Hao, a senior economist at Commerzbank in Singapore, said Beijing seemed to be “scrambling to solve immediate problems and putting long-term reforms on the back-burner”.

The latest order also puts an end to an unusually public disagreement between the finance ministry, in charge of fiscal policy, and the central bank, in charge of monetary policy.

China’s central bank, which is part of the cabinet, has for years tried to avoid becoming a cashier to the government, especially under former reformist governor Zhou Xiaochuan. However, it has often had no choice but to allow the state banks to facilitate government spending plans, as it did a decade ago when it backed Beijing’s massive stimulus package that has left the country saddled with debt.