Beijing to take action to tackle P2P lending, stock market leverage risks amid trade war

Regulator focuses on deleveraging campaign risks to stabilise economy

Beijing will take urgent action to contain two of the most acute financial risks facing the country, as the top leadership seeks to stabilise the domestic economy amid the ongoing trade war with Washington.

Following a special conference of officials in Beijing, the Financial Stability and Development Commission (FSDC), the country’s top financial regulator, called for urgent steps to clean up inadequately capitalised internet-based lending platforms as well as prevent a potential massive sell-off of listed company shares due to the government crackdown on excessive lending-based risks in the financial system, state-run Xinhua reported on Monday.

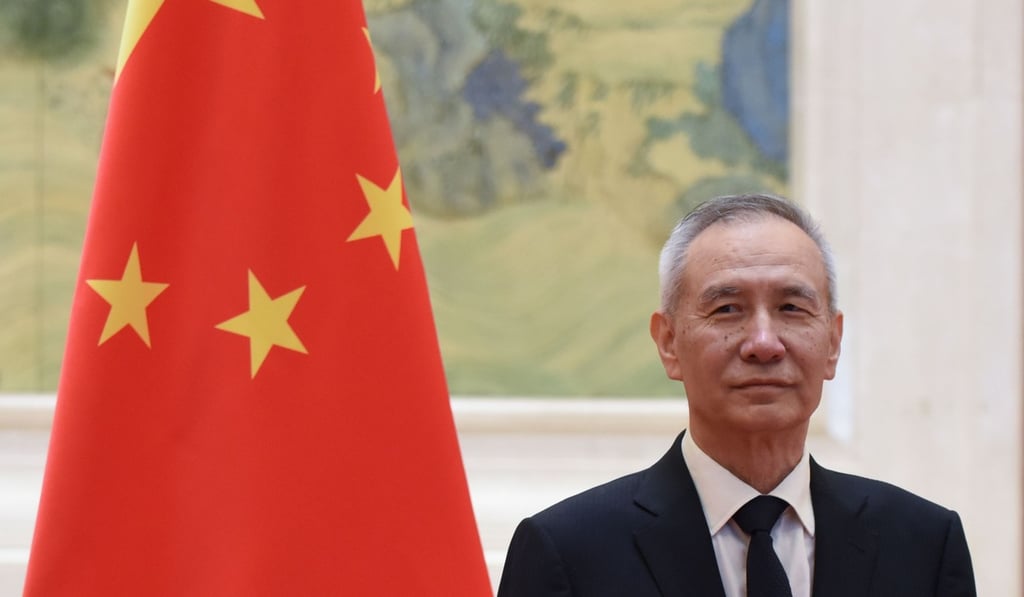

All levels of government must help create a full inventory of the thousands of peer-to-peer (P2P) internet lending platforms in the country and their respective risks, according to the commission, which is headed by Vice-Premier Liu He, the top economic adviser to President Xi Jinping.

Solutions for cleaning up the P2P lending platforms can differ based on local conditions as long as the problems are tackled effectively, the commission said. New standards governing internet-based lending will be drafted as part of a long-term regulatory mechanism, it added.

In late July, the Politburo, the top decision-making body, called for the government to take steps to stabilise the economy, investment, finance and employment.

Monday’s statement from the financial regulatory body focuses more on the effects of the government’s deleveraging campaign rather than its causes. In its previous statement on August 3, it ordered a “continuing crackdown on illegal financial activities and financial institutions to protect the interests of investors and safeguard financial and social stability”.